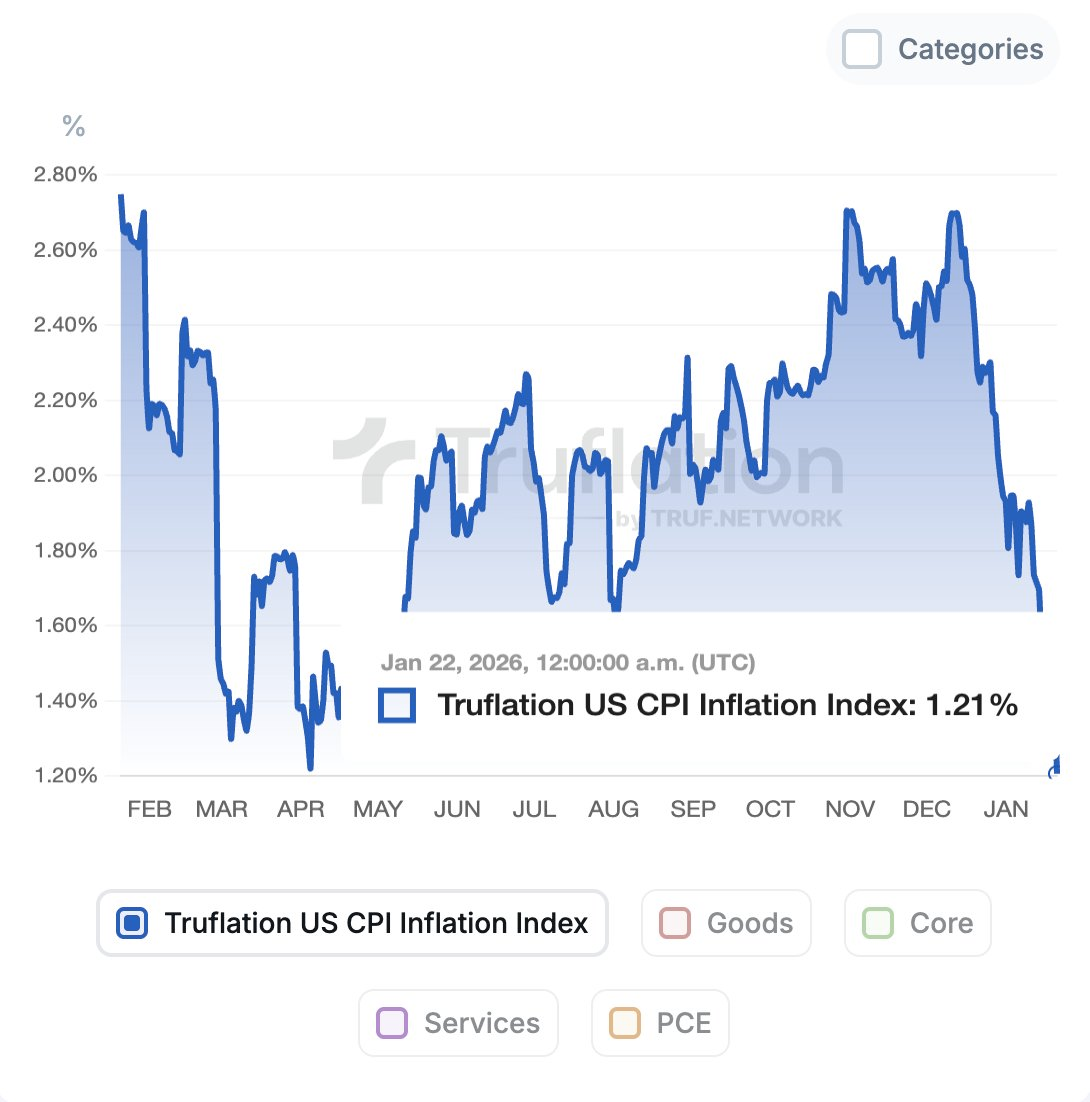

U.S. inflation declined to 1.21% as of Jan. 22, 2026, according to the Truflation U.S. CPI Inflation Index, marking a drop in price growth heading into early 2026. The real-time index tracked volatile inflation trends throughout 2025, with multiple spikes and pullbacks before the latest decline.

The reading comes as U.S. equities rebounded amid a reversal of tariffs tied to tensions over Greenland, reversing a recent market sell-off and easing pressure across equities, bonds, and currencies.

The Truflation index showed inflation above 2.6% at the beginning of the tracked period before falling below 1.5% around March and April. Mid-year data reflected a rebound, with inflation fluctuating between roughly 1.6% and 2.3%.

Source:

Source:

Toward the end of 2025, inflation pressures rose, peaking near 2.7% in November and December. The latest drop in January signals a cooling in price momentum as we enter 2026, with the index collecting real-time price data across multiple goods and services categories.

U.S. equities rose after President said he would not impose tariffs scheduled for Feb. 1 following what he described as a structure for a future deal involving Greenland and the Arctic region.

The Dow Jones Industrial Average rose by 588.64 points (1.21%) to 49,007.23, the S&P 500 gained 1.16% to 6,875.62, and the Nasdaq Composite advanced 1.18% to 23,224.82. Despite the rally, all three indexes remained lower for the week, with the Dow down 0.6%, the S&P 500 down 0.9%, and the Nasdaq down 1.2%.

Following the tariff reversal, the recent “sell America” trade unwound. U.S. Treasury prices rose, and yields declined. Technology stocks, including Nvidia and AMD, led gains as investors returned to growth stocks.

(adsbygoogle = window.adsbygoogle || []).push({});Earlier in the week, markets declined after rising tariff threats and uncertainty over possible military actions tied to Greenland.

Separately, U.S. Supreme Court justices questioned whether the president has the authority to remove Federal Reserve Governor Lisa Cook, with Justice Brett Kavanaugh noting that such authority could weaken the Fed’s independence.

Related: