GE Q4 In-Depth Analysis: Aftermarket Performance and Supply Chain Initiatives Influence 2026 Projections

GE Aerospace Surpasses Q4 2025 Expectations

GE Aerospace (NYSE:GE), a leading industrial conglomerate, delivered fourth-quarter 2025 results that exceeded market forecasts. The company reported revenue of $12.72 billion, marking a 17.6% increase compared to the previous year. Adjusted earnings per share reached $1.57, coming in 9.5% higher than analysts had anticipated.

Q4 2025 Performance Overview

- Total Revenue: $12.72 billion, outpacing analyst projections of $11.18 billion (17.6% year-over-year growth, 13.8% above expectations)

- Adjusted Earnings Per Share: $1.57, surpassing the $1.43 consensus (9.5% beat)

- Adjusted EBITDA: $2.58 billion, exceeding the $2.46 billion estimate (20.3% margin, 5% above forecast)

- 2026 Adjusted EPS Guidance: Midpoint set at $7.25, 1.8% higher than analyst expectations

- Operating Margin: 17.9%, consistent with the same period last year

- Market Value: $309.4 billion

StockStory’s Perspective

Despite outperforming Wall Street’s estimates, GE Aerospace’s shares declined as investors weighed the company’s operational execution against potential future challenges. Leadership attributed the strong revenue to heightened demand for commercial services and improved performance in both commercial and defense divisions. CEO Larry Culp highlighted significant progress across all major metrics, fueled by increased shop visits, growth in aftermarket services, and efficiency gains from streamlined operations. CFO Rahul Ghai pointed to better material availability and improved shop floor execution, which notably enhanced turnaround times for LEAP and CFM56 engines.

Looking forward, GE Aerospace’s outlook signals ongoing strength in commercial aftermarket demand and continued investments in technology and manufacturing. Management anticipates mid-teens growth in service revenue, supported by an expanding installed base and product upgrades like the LEAP 1A durability kit. CEO Culp emphasized that further integration of flight deck technology will unlock more value for customers and shareholders. CFO Ghai expects ongoing productivity improvements and expanded third-party maintenance partnerships to help maintain margins, even as equipment mix and R&D spending present challenges.

Management’s Key Takeaways

Company leaders identified several factors behind the quarter’s strong performance:

- Commercial Aftermarket Growth: Shop visit volumes and spare parts sales surged, driven by robust demand for LEAP and CFM56 engine maintenance. Internal shop visit revenue climbed 24%, with LEAP shop visits up 27% and spare parts sales rising over 25%.

- Supply Chain Efficiency: Turnaround times across the maintenance network improved by more than 10% year over year, thanks to stronger supplier relationships and process enhancements. The Wales site achieved a 20% faster turnaround for CFM56 engines, while Selma maintained turnaround times under 80 days.

- Scaling the LEAP Program: GE delivered a record number of LEAP engines—over 1,800 units—and expanded its maintenance, repair, and overhaul (MRO) network with new partners and facilities, including MTU Dallas and a Dubai on-wing support center. The company is investing $500 million to double LEAP’s internal MRO capacity.

- Lower CFM56 Retirements: Fewer CFM56 engines were retired than expected, sustaining demand for aftermarket services. Management projects stable CFM56 shop visits through 2028, reflecting the engine’s prolonged use in active fleets.

- Organizational Changes: The company restructured by merging technology and operations into the commercial engine segment and announced leadership changes, with Mohammad Ali heading the new team and Russell Stokes retiring after nearly three decades. These adjustments aim to enhance cross-functional collaboration and customer service.

What’s Driving Future Growth?

GE Aerospace expects that expanding commercial services and further supply chain improvements will support revenue and earnings, though equipment mix and R&D investments may pressure margins.

- Aftermarket Services Expansion: The company forecasts mid-teens growth in commercial services revenue, fueled by a growing installed base, more shop visits, and ongoing durability enhancements, especially for LEAP engines. Management also anticipates continued growth in third-party maintenance partnerships.

- Supply Chain and Productivity Initiatives: GE is investing over $1 billion to boost its global MRO network and secure more materials from key suppliers, aiming to further reduce turnaround times and increase output.

- Margin Challenges: While services remain a major profit contributor, higher shipments of original equipment, a lower ratio of spare engines, and increased R&D—particularly for next-generation propulsion—are expected to offset some service margin gains in 2026. Losses from the GE9X program are projected to double year over year, impacting overall profitability.

Upcoming Catalysts to Watch

In the coming quarters, StockStory will track:

- Progress in growing aftermarket shop visits and ensuring spare parts availability

- Advancements in reducing maintenance turnaround times and expanding LEAP MRO capacity

- The effect of increased GE9X and original equipment shipments on segment margins

- Allocation of R&D investments and customer adoption of new durability kits

GE Aerospace shares are currently trading at $297.15, down from $318.50 before the earnings release. Considering these results, is now the right time to buy or sell?

Explore High-Potential Stocks Now

Relying on just a handful of stocks can leave your portfolio vulnerable. Take advantage of the current market window to secure top-quality investments before prices move higher.

Don’t wait for the next market swing. Our list features well-known names like Nvidia, which soared 1,326% from June 2020 to June 2025, as well as lesser-known success stories such as Kadant, which achieved a 351% five-year return.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hims drops intention to offer compounded GLP-1 capsules following FDA criticism

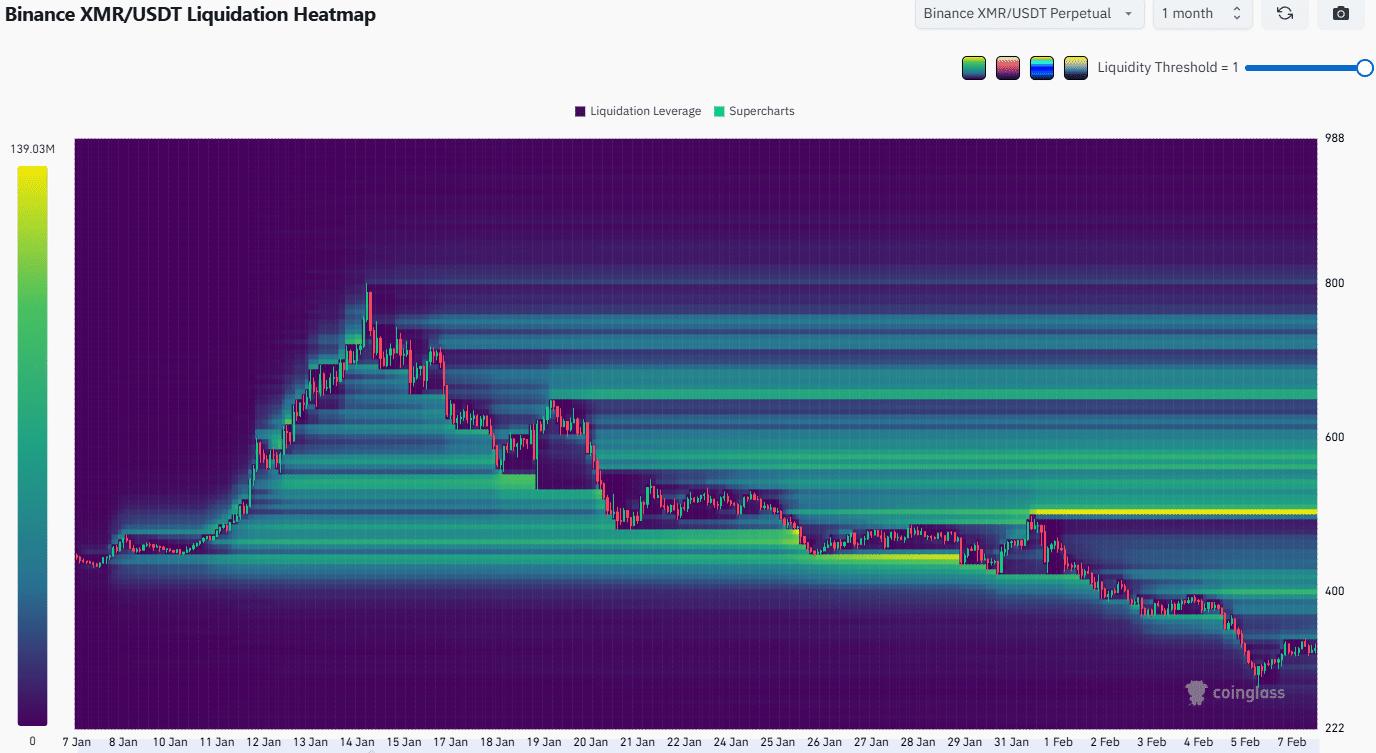

Monero falls from FOMO to 63% freefall – What’s next for XMR?

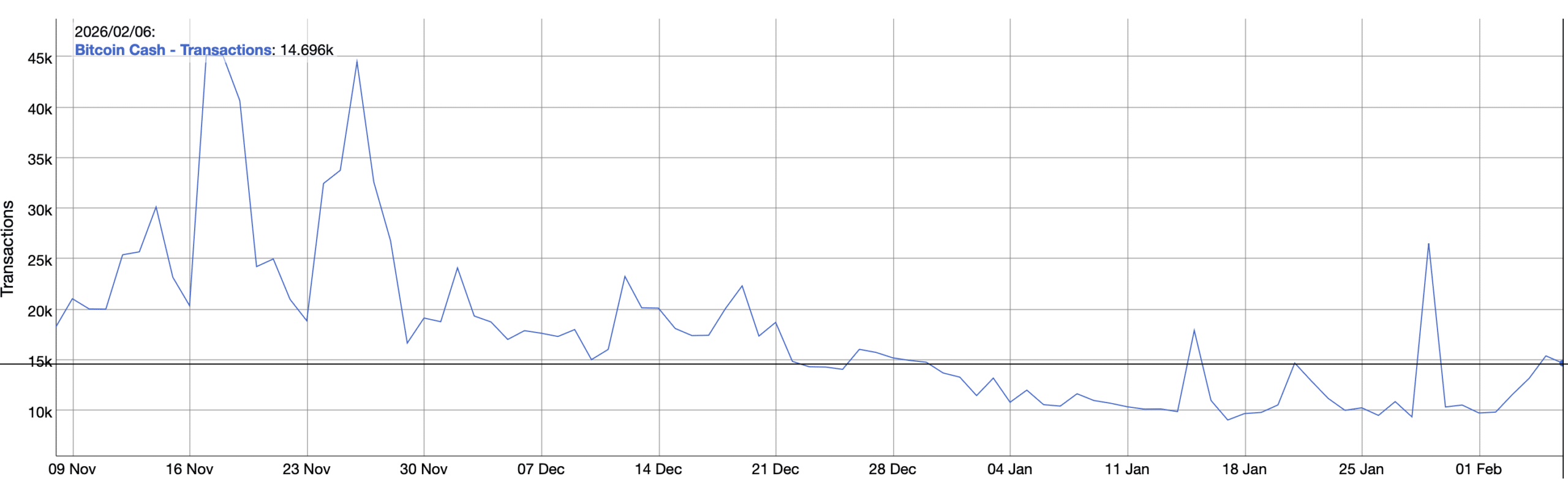

Bitcoin Cash’s rally faces KEY test – Can BCH hold above $500?