Why Shares of Wix (WIX) Are Rising Today

Recent Developments at Wix

Wix (NASDAQ:WIX), a leading platform for website creation, saw its stock price rise by 4.4% during morning trading following the introduction of Wix Harmony, which the company touts as the first AI-powered website builder of its kind.

This innovative tool integrates Wix’s existing web development features with artificial intelligence, aiming to deliver a quicker and more robust website creation experience. CEO Avishai Abrahami shared a bold vision, expressing hopes that within five to seven years, half of all new websites will be built using Wix.

After the initial surge, Wix shares settled at $88.47, representing a 4.6% increase compared to the previous closing price.

Curious about whether Wix is a good investment right now?

Market Response and Broader Trends

Wix’s stock is known for its volatility, with 26 instances of price swings exceeding 5% over the past year. Today’s uptick suggests investors view the news as significant, though not transformative for the company’s overall outlook.

Just 22 hours earlier, Wix experienced a 6.9% jump after reports of reduced geopolitical tensions in Greenland lifted investor confidence. This optimism led to a rally across major indices, including the S&P 500 and the tech-focused Nasdaq Composite, as investors returned to higher-risk sectors. The positive momentum extended to the entire Magnificent Seven group of tech companies, all of which saw their shares rise. Reduced global uncertainty often benefits technology stocks, and this broader market rally saw the Dow Jones Industrial Average climb by 500 points, signaling renewed faith among investors.

Despite these recent gains, Wix’s share price has declined 12.4% since the start of the year. Currently trading at $88.47, the stock is down 64.1% from its 52-week peak of $246.76 reached in January 2025. For perspective, a $1,000 investment in Wix five years ago would now be valued at just $347.18.

While much attention is focused on Nvidia’s record highs, another lesser-known semiconductor company is quietly leading in a crucial AI technology that industry giants depend on.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

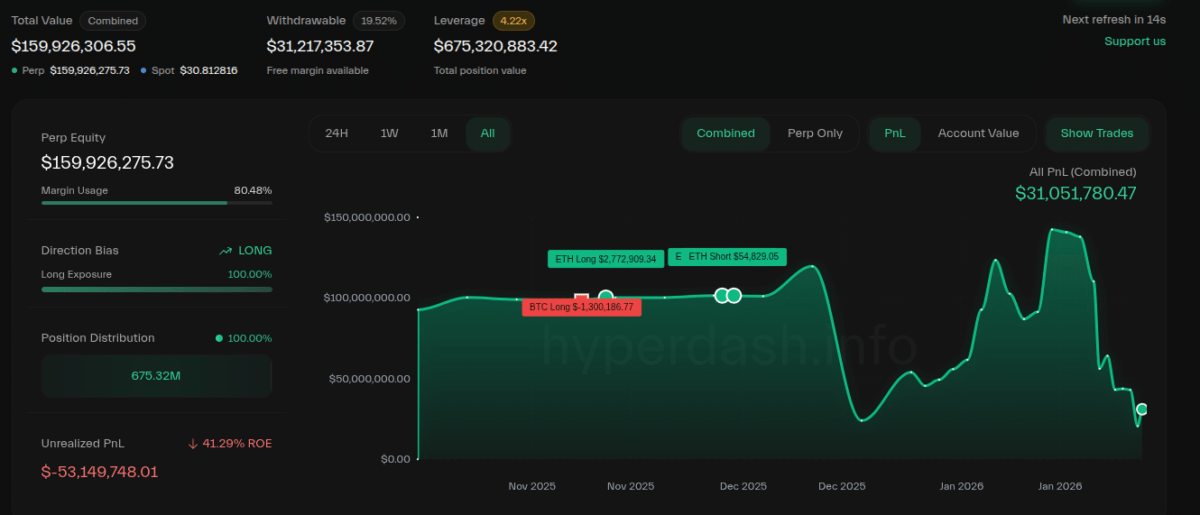

“Trump Insider Whale” Turns Bearish, Closes BTC, ETH Long Positions at $10M Losses

Nvidia unveils AI models for faster, cheaper weather forecasts

What passengers should anticipate as Southwest Airlines rolls out assigned seating

Lockheed Martin, PG&E, Salesforce, and Wells Fargo join forces to combat wildfires