Investor conviction is being tested once again.

Over the past ten days, a sizable group of holders has slipped underwater as major top-cap assets failed to hold key resistance levels. As a result, many traders who bought near the local top are now feeling the pressure.

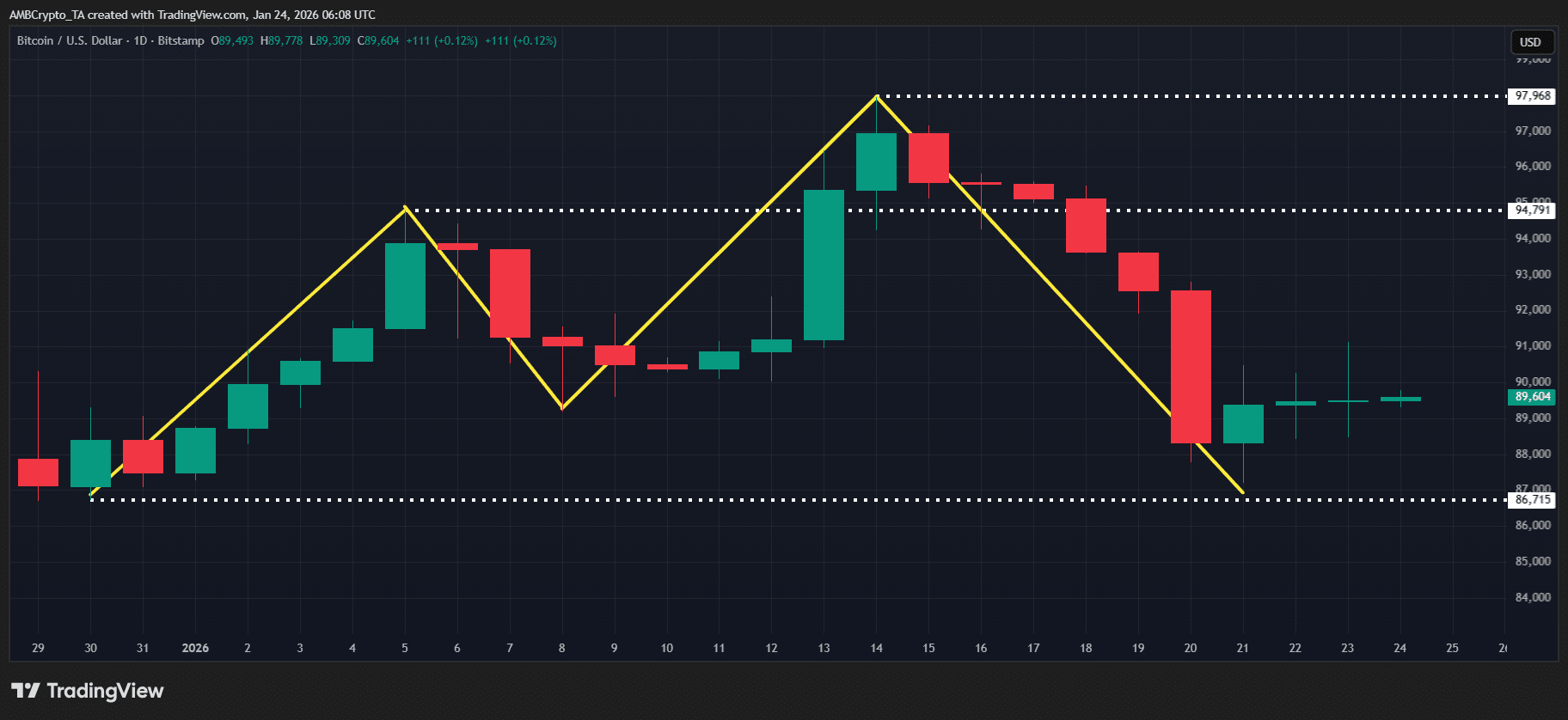

Bitcoin [BTC] is no exception. Just ten days ago, BTC printed its second-highest high, clearing the $95k level. However, the rally quickly faded, with the price topping near $97k, pushing several cohorts into unrealized losses.

Naturally, attention now turns to what could reignite HODLing.

Macro FUD and institutional selling test BTC’s resilience

The curent macro setup isn’t offering much support. Volatility is already rotating capital into safe havens, while Bitcoin’s institutional bid continues to soften, evidenced by nearly $1.8 billion in ETF outflows in under a week.

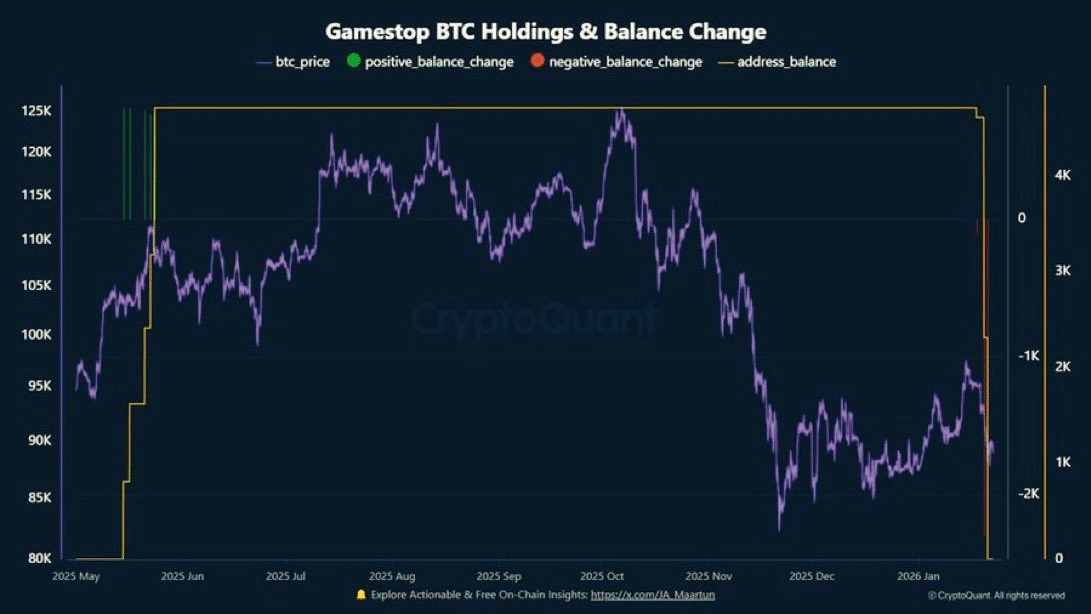

Meanwhile, GameStop doesn’t seem convinced either. Its on-chain wallets recently moved 100% of Bitcoin holdings to Coinbase Prime. Moreover, looking at its BTC balance sheet, the move likely suggests potential selling.

Back in mid-May 2025, the firm accumulated 4,710 BTC at an average price of $107k, deploying $504 million. With BTC now hovering around $90k, that position suggests potential realized losses of about $76 million.

All things considered, getting investors to HODL looks like a tough ask.

Bitcoin’s institutional bid is weak, and overall sentiment is low. And yet, the big players are talking up a Bitcoin “supercycle.” Are they seeing something the market hasn’t priced in yet, or is this just another setup for a shakeout?

CZ signals Bitcoin “supercycle,” defying weak sentiment

Defying macro FUD, heavyweights are still bullish on a BTC supercycle.

For 2026, the chart from RR2Capital highlights three bold predictions, averaging $215k as the year-end target for Bitcoin. Meanwhile, Binance founder CZ echoed a similar outlook in a recent video interview.

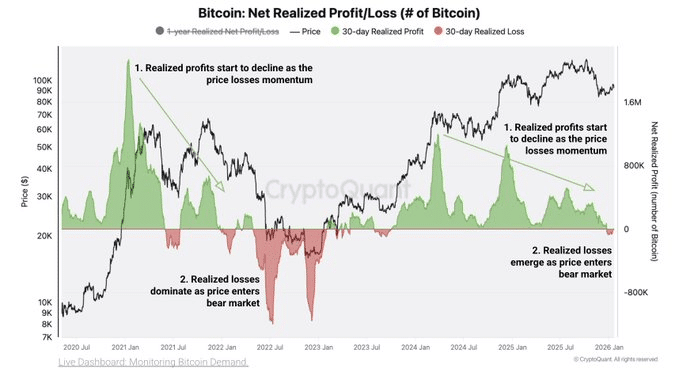

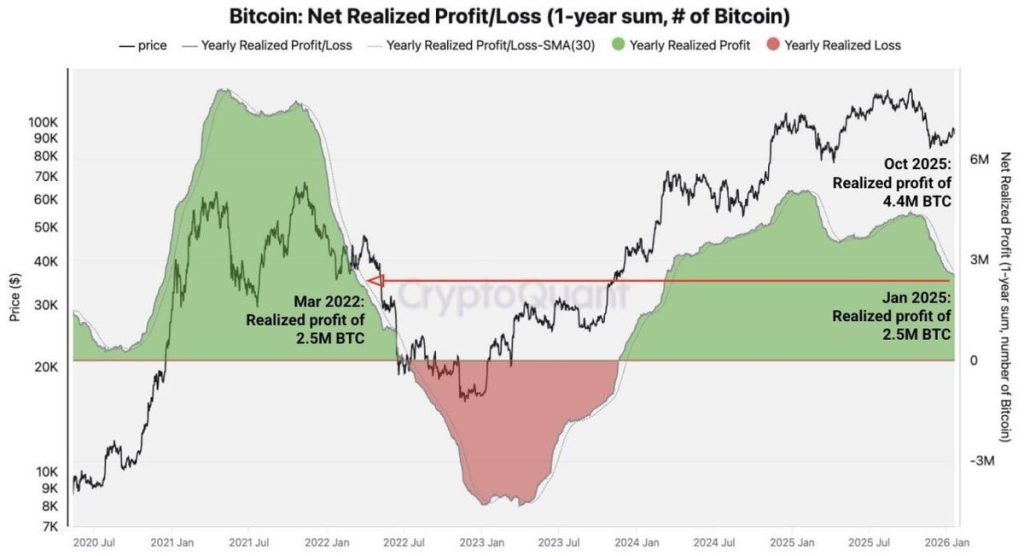

Naturally, the question remains: What are they betting on? On-chain metrics paint a cautious picture. Bitcoin’s bear momentum is building, with Net Realized Profit/Loss turning red as investors begin realizing losses.

Historically, moves like this have lined up with deeper corrections.

That puts Bitcoin’s $85k support under pressure, driven by institutional selling, ETF outflows, and fading conviction from heavyweights like GameStop. As a result, the motivation for investors to HODL is weakening.

In this context, bullish Bitcoin forecasts appear less data‑driven and more influenced by external factors such as volatility surrounding the crypto bill, an overheated metals market, and the recent U.S. withdrawal of E.U. tariffs.

Hence, this divergence highlights the gap between market fundamentals and optimistic forecasts, pulling in speculative capital and potentially setting Bitcoin up for a liquidation trap, as BTC leverage ramps back up.

Final Thoughts

- Bitcoin slipped from $97k to $90k amid institutional selling, ETF outflows, and major holders like GameStop potentially selling.

- Despite cautious on-chain metrics, heavyweights like CZ forecast a BTC “supercycle,” creating a divergence that could trigger a liquidation trap.