Global investment management firm ARK Invest has unveiled a bold projection for the cryptocurrency market in its Big Ideas 2026 report. The analysis suggests that Bitcoin alone could comprise approximately 70% of the total crypto market value by 2030, reaching a staggering $16 trillion. This scenario indicates that cryptocurrencies are transitioning from merely speculative tools to playing a central role in the global financial system. ARK’s analysis reveals that Bitcoin is undergoing a long-term transformation shaped by institutional adoption, its risk profile, and supply dynamics.

Bitcoin Takes the Lead: ARK Invest Reveals Astonishing 2030 Projection

Bitcoin’s 2030 Roadmap: The $16 Trillion Scenario

ARK Invest forecasts that the total market value of smart contract networks and “pure digital currency” assets could reach $28 trillion by 2030. Cryptocurrencies used as a store of value, medium of exchange, and unit of account on public blockchains are expected to achieve an annual compounded growth rate of approximately 61% by the decade’s end. Bitcoin is anticipated to represent about 70% of this total market alone.

The projections specific to Bitcoin paint an even more noteworthy picture. According to ARK, Bitcoin’s market value could soar from $2 trillion to $16 trillion by exhibiting an annual compounded growth rate of approximately 63% over the coming years. This scenario is supported by Bitcoin’s limited supply structure, increasing institutional demand, and the strengthening perception of it as a “digital safe haven.”

The report also highlights that by 2025, U.S.-based Bitcoin ETFs and publicly traded companies are expected to hold 12% of the total Bitcoin supply. ETF balances have seen a 19.7% increase within the year, rising from approximately 1.12 million BTC to 1.3 million BTC, while publicly traded companies’ Bitcoin holdings surged by 73% to reach 1.09 million BTC. These figures indicate a rapidly growing impact of institutional players on Bitcoin.

Smart Contracts, Risk Returns, and the “Few Winners” Thesis

ARK Invest paints a more selective picture for cryptocurrencies other than Bitcoin. The report predicts that the market value of smart contract platforms could rise to approximately $6 trillion by 2030 with an annual growth rate of 54%. This growth is expected to be supported by generating an annual revenue of $192 billion at an average income rate of 0.75%. However, ARK argues that a large portion of this market will be dominated by only two or three Layer 1 networks.

In terms of risk-adjusted returns, Bitcoin demonstrates pronounced superiority. According to ARK’s analysis, Bitcoin’s average annual Sharpe Ratio has remained above that of Ethereum, Solana, and other major assets in the CoinDesk 10 Index for much of 2025. When considering the last cycle’s lowest point in November 2022, the start of 2024, and the beginning of 2025, Bitcoin has shown a more stable performance. Furthermore, decreasing volatility strengthens the view that Bitcoin has matured into an asset class.

Significant divergence is also observed in the valuation structure of Layer 1 networks. When a high multiplier of 50 is applied to Ethereum’s network revenue, ARK calculates that over 90% of the market value relies on its monetary role. For Solana, it’s noted that $1.4 billion in revenue underpins approximately 90% of its valuation based on network usage. Through these analyses, ARK concludes that only a limited number of digital assets will maintain their monetary characteristics long-term, serving as liquid stores of value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

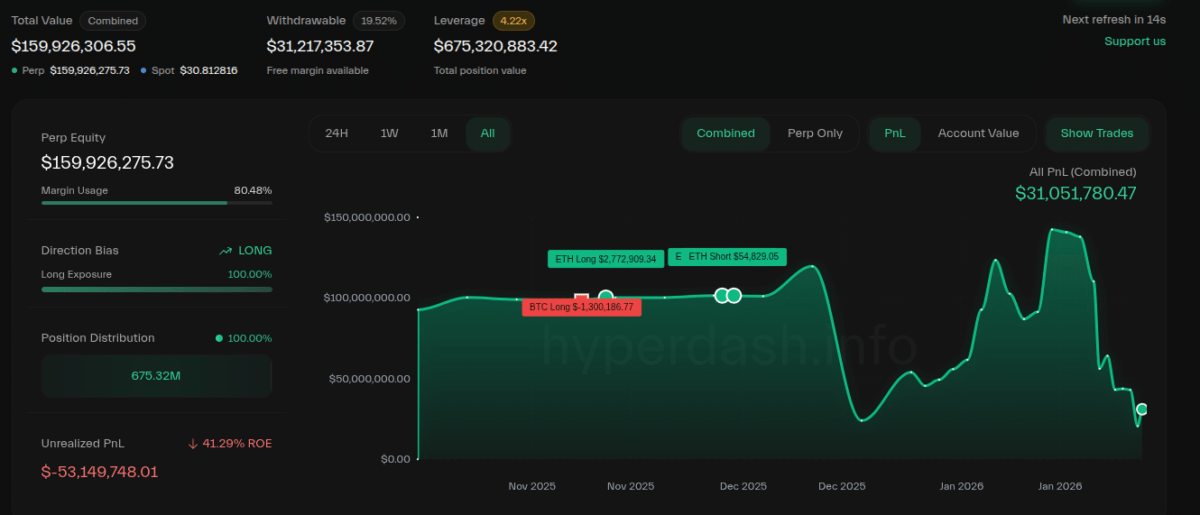

“Trump Insider Whale” Turns Bearish, Closes BTC, ETH Long Positions at $10M Losses

Nvidia unveils AI models for faster, cheaper weather forecasts

What passengers should anticipate as Southwest Airlines rolls out assigned seating

Lockheed Martin, PG&E, Salesforce, and Wells Fargo join forces to combat wildfires