BOJ money market figures indicate that Japan likely refrained from intervening in the currency market last Friday

Bank of Japan Data Suggests No Recent Currency Intervention

On Monday, figures from the Bank of Japan's money market revealed that Friday's sharp rise in the yen against the US dollar was unlikely caused by direct government action. The central bank's forecast for Tuesday pointed to a net withdrawal of 630 billion yen (approximately $4.09 billion) from the money market. This amount surpassed analysts' expectations, which ranged from an inflow of 100 billion yen to an outflow of 300 billion yen, but remained significantly lower than the sums typically associated with official intervention.

Experts noted that both the scale of treasury-related transactions and the overall shift in current account balances were far smaller than the multi-trillion-yen movements seen during previous intervention episodes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

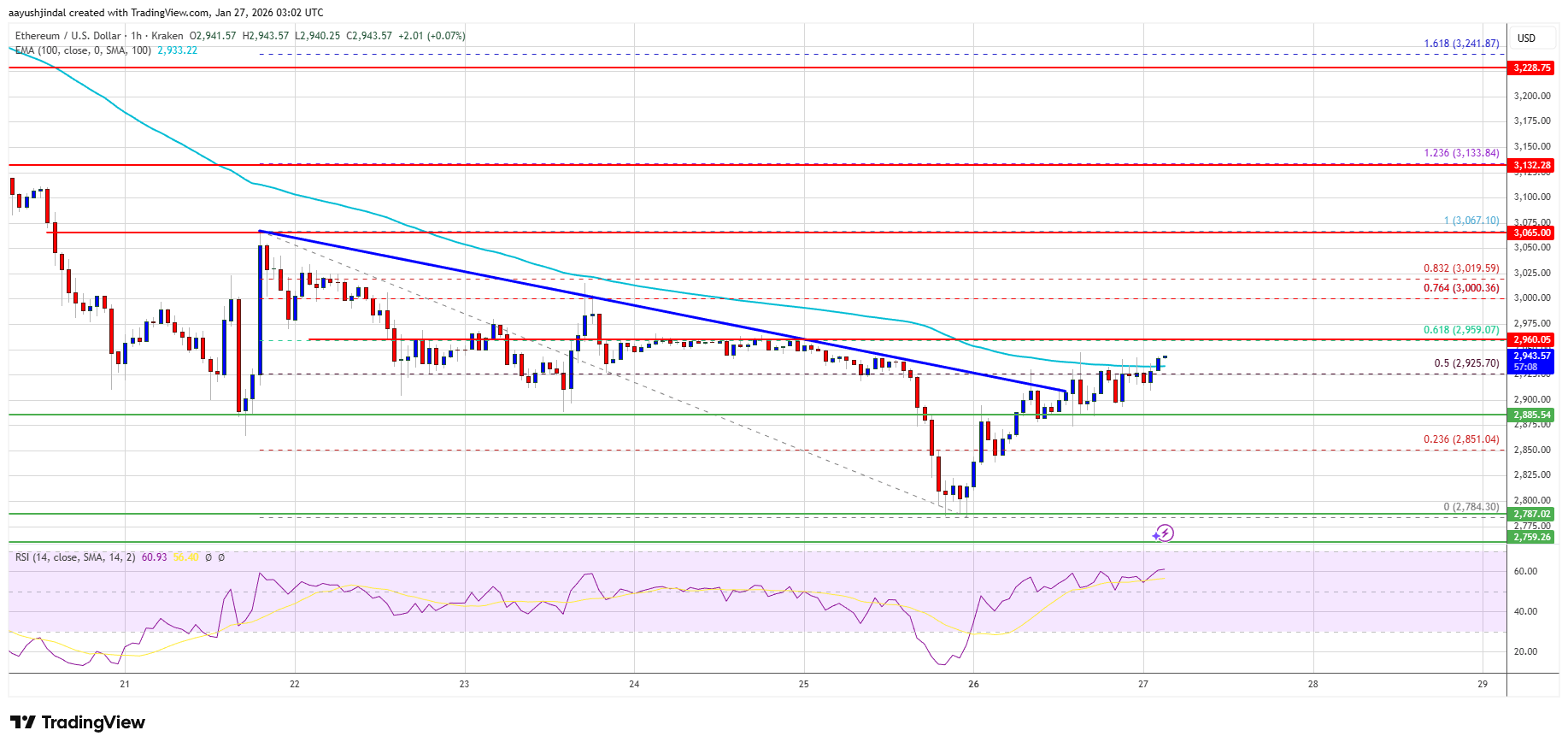

Ethereum Price Rebounds, Yet $3K Remains A Brutal Resistance Test

Stablecoin Withdrawals Indicate Capital Leaving While Bitcoin Remains Steady

North Korea–Linked Hackers Use Deepfake Video Calls to Target Crypto Workers

Navient Earnings: Key Points to Watch for NAVI