Crypto treasuries are evolving from passive balance sheets into active protocol participants, and Sui illustrates the shift.

Historically, firms such as Strategy (formerly MicroStrategy) and Metaplanet treated crypto as static reserves. In today’s day and age, deployment matters.

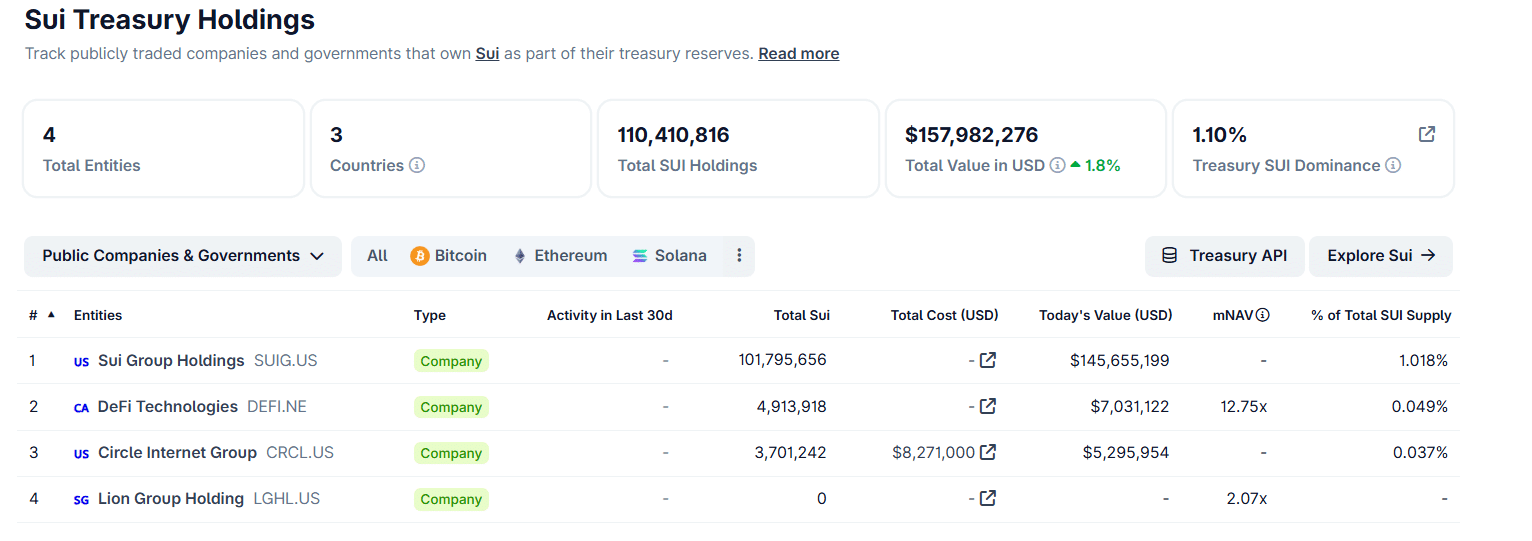

On Sui, foundation-controlled wallets remain the largest holders, while treasury wallets tracked on Explorer show a concentrated 108 million SUI position, roughly 3% of the circulating supply.

On-chain analytics also reveal rising holder concentration among top wallets.

As a result, this situation goes beyond just affecting prices and providing liquidity.

It also involves participating in governance and earning returns, indicating that treasuries are starting to run the protocols instead of just holding assets.

Sui token circulation remains stable despite ongoing unlocks

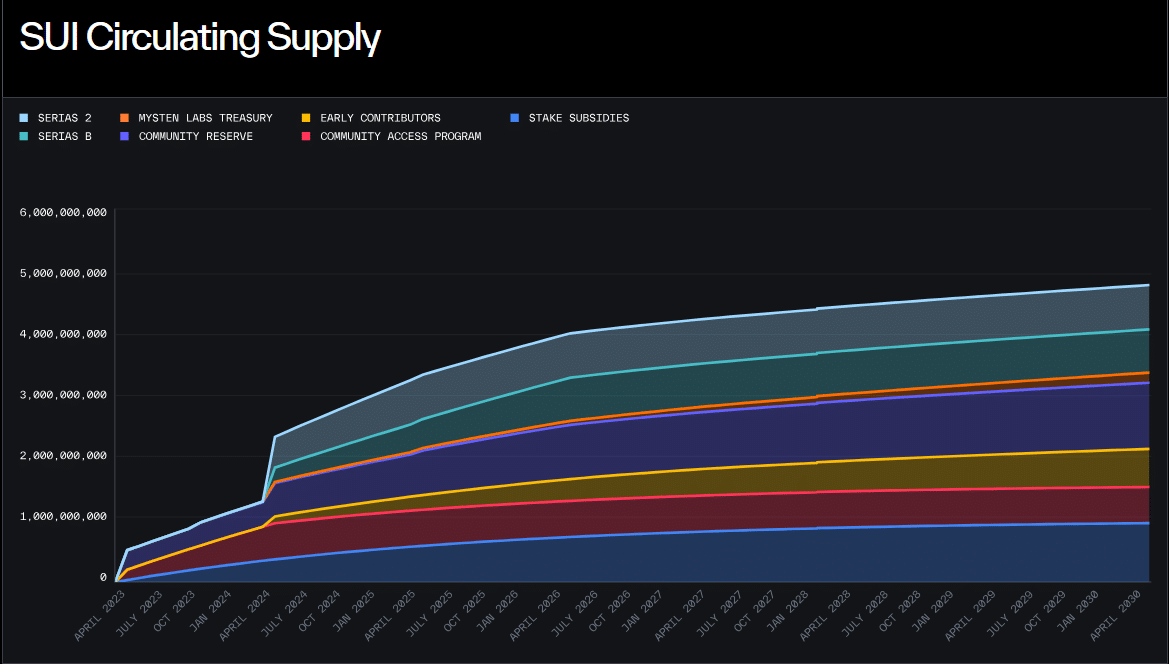

Sui’s [SUI] circulating supply reflects controlled expansion rather than shock-driven distribution.

As of late January 2026, circulation reached approximately 3.79 billion SUI.

This translates to 38% of the 10 billion max supply, with unlocks following a predefined vesting curve and no abnormal spike events.

Consequently, supply growth has remained absorbed where holdings matter.

Moreover, according to the token and schedule data, the Sui Foundation and Mysten Labs still control sizable allocations.

However, long-term development, staking incentives, and ecosystem funding largely lock in the supply.

In comparison, Sui’s treasury retention mirrors Solana [SOL]-style ecosystem bootstrapping rather than Bitcoin [BTC]-style scarcity.

According to CoinGecko data, the institution now holds over 110 million SUI, reinforcing growth-focused, yield-enabled token usage over speculative turnover.

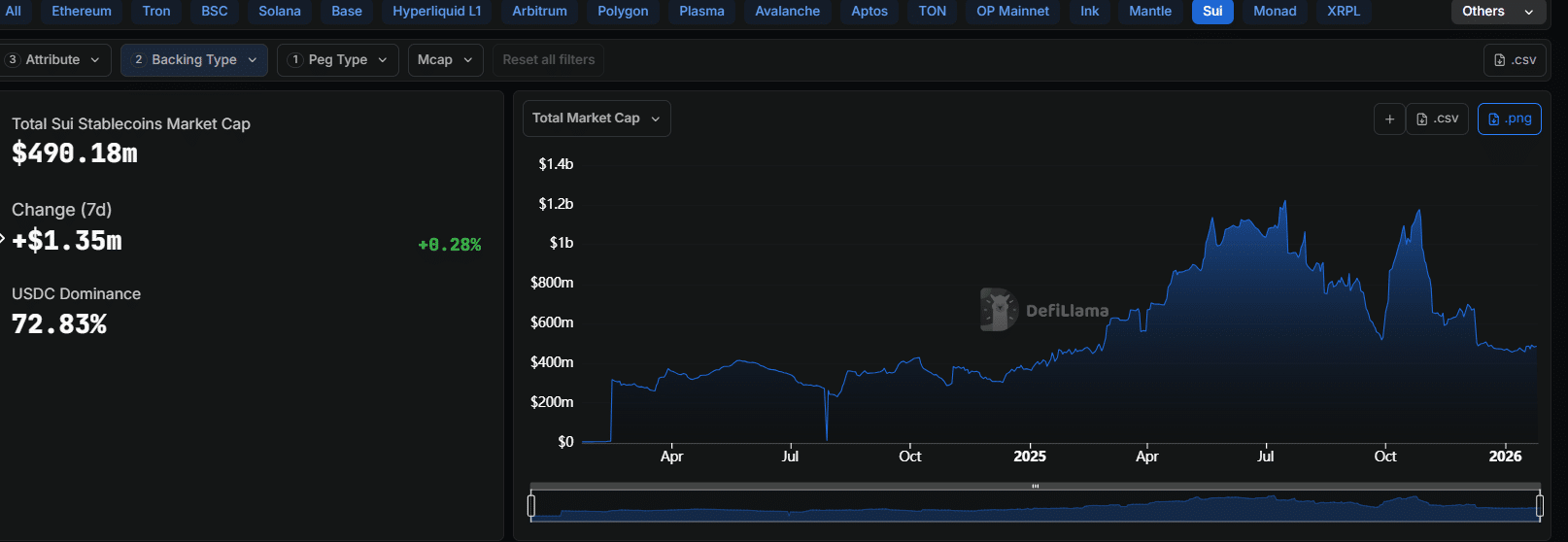

Stablecoin growth on Sui mirrors rise of active treasuries

Stablecoin adoption on Sui and the rise of active crypto treasuries reinforce the same structural shift.

As Sui’s stablecoin market cap reached roughly $500 million by late January 2026, with USDC controlling over 70%, liquidity increasingly powered lending, trading, and yield across DeFi protocols.

At the same time, treasury-linked entities moved beyond passive SUI holdings.

By deploying capital through stablecoins, they deepened liquidity, generated fees, and influenced protocol usage without triggering spot sell pressure.

As a result, treasuries began operating within the Sui economy. This convergence signals a transition from asset custody toward protocol-level execution and control.

Yield breakdown and why it matters

Yield dynamics on Sui DeFi have strengthened steadily, reflecting deeper liquidity and rising capital efficiency.

In late January 2026, yields range from 3–10% on low-risk strategies to 50%+ on incentive-heavy pools, supported by $500M+ in stablecoin liquidity and expanding TVL.

Lending protocols such as NAVI Protocol and Suilend have delivered between 5% and 7% APY on USDC, while DEXs like Cetus push for over 70% APY through fees.

Therefore, yield growth attracts capital, improves liquidity depth, and reinforces Sui’s role as an active, yield-driven DeFi ecosystem.

Final Thoughts

- Sui’s treasury behavior signals a transition from balance-sheet optionality to protocol control, where ownership increasingly translates into economic and governance influence.

- Stablecoin expansion and yield dispersion have absorbed new supply internally, allowing treasuries to monetize participation without relying on spot market exits.