Is Wall Street Optimistic or Pessimistic About AT&T Shares?

AT&T Inc.: Company Overview and Recent Performance

AT&T Inc. (T), with a market capitalization of $167.2 billion, stands as a leading global provider of telecommunications and technology solutions. The company delivers wireless, broadband, fiber, and managed services to a diverse clientele, including consumers, businesses, and government agencies, under prominent brands like AT&T, Cricket, and AT&T Fiber. Through its Communications and Latin America divisions, AT&T offers mobile and internet connectivity throughout the United States and Mexico.

Stock Performance Compared to the Market

Over the past year, AT&T’s stock has lagged behind the broader market. While the S&P 500 Index ($SPX) advanced 13.9% in the last 52 weeks, AT&T shares gained only 3.2%. Year-to-date, the stock has declined by 5.6%, whereas the S&P 500 has posted a 1.5% increase. Additionally, AT&T’s performance has trailed the State Street Communication Services Select Sector SPDR ETF (XLC), which surged 17.3% during the same period.

Recent Earnings and Financial Challenges

Following the release of its Q3 2025 results on October 22, AT&T’s stock dropped 1.9%. Despite robust subscriber growth, the company reported flat adjusted earnings per share of $0.54, which disappointed investors. Ongoing challenges include a 7.8% decrease in Business Wireline revenue and higher operating expenses, driven by increased equipment sales, legal settlements totaling approximately $0.4 billion, and greater depreciation costs from network improvements.

Analyst Expectations and Ratings

For the fiscal year ending December 2025, analysts project AT&T’s adjusted earnings per share will fall by 8.9% year-over-year to $2.06. The company’s recent earnings track record has been mixed, with two quarters exceeding expectations and two falling short out of the last four.

Among 28 analysts covering AT&T, the consensus is a “Moderate Buy.” This includes 15 “Strong Buy” recommendations, three “Moderate Buys,” nine “Holds,” and one “Strong Sell.”

Price Targets and Analyst Updates

On January 26, Wells Fargo lowered its price target for AT&T to $27 but maintained an “Overweight” rating. The average price target stands at $29.85, which is 27.3% above the current share price. The highest target on Wall Street is $34, implying a potential upside of nearly 45%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

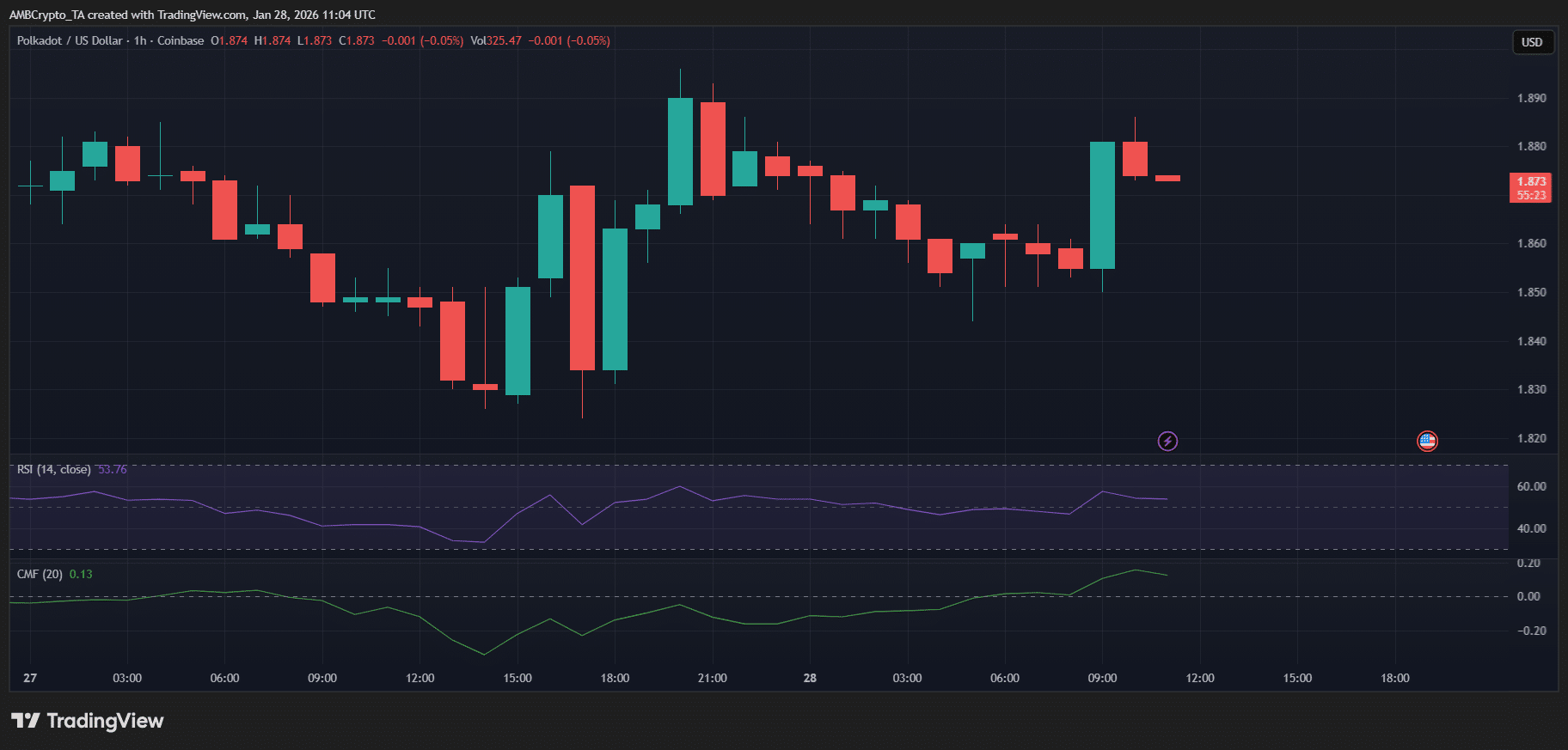

Polkadot’s smart contracts hub is live, but DOT remains stuck – Why?

Senators file key amendments ahead of crypto market structure bill markup

Meta spent $19 billion on virtual reality in the past year, and things aren’t expected to improve in 2026