Brompton Bicycle delays £100m factory plans, citing sluggish economic conditions according to executives

Brompton Bicycles Delays £100 Million Factory Amid Economic Uncertainty

Brompton Bicycles has decided to postpone its plans for a new £100 million manufacturing facility, citing ongoing economic difficulties.

The British company, renowned for its folding bikes favored by commuters, announced that it will only move forward with the project once there is a significant improvement in market conditions.

Approval for the new site in Ashford, Kent, was granted in January of last year, with Brompton initially pledging to create 2,500 new jobs in the area.

The proposed factory, first unveiled in February 2022 following a surge in demand during the pandemic, was designed to be elevated on stilts due to the site’s flood risk.

However, Chief Executive Will Butler-Adams explained that the project has been put on hold indefinitely after several challenging years for the cycling industry.

“The project is still very much under consideration, but we need to see a real recovery in the market before proceeding,” Butler-Adams told KentOnline.

He further emphasized, “Given the size and long-term nature of the Ashford investment, it’s crucial to wait for a more favorable business climate before committing.”

Sales Decline and Industry Challenges

Brompton, which began operations in London in 1976, reported in its latest financial statements that sales dropped to their lowest since 2021 for the year ending March 2025.

The company sold 78,530 bicycles during this period, representing a 7.5% decrease from the previous year. Management attributed this decline to ongoing global economic instability and persistent difficulties within the cycling sector.

Tariffs imposed by Donald Trump have posed particular challenges for Brompton, as the company sources components from countries such as Taiwan, China, Belgium, and Germany.

Butler-Adams has previously criticized the US President’s trade policies, arguing that requiring British firms to manufacture in America is misguided.

Currently, all Brompton bikes are produced at the company’s headquarters in Greenford, West London.

“Building a factory and purchasing equipment is possible,” Butler-Adams remarked last year. “But the expertise, engineering skills, and experience required would necessitate changes to immigration policies, which are not a priority for any political party at the moment.”

He also noted that “increasing labor and overhead expenses continue to squeeze profit margins,” following recent hikes in both employer National Insurance contributions and the minimum wage last April.

He cautioned the UK government against introducing further costs for businesses, revealing to the Financial Times that recent policy changes under Labour resulted in £2 million in additional expenses and the loss of 40 jobs at Brompton.

Financial Performance and Future Outlook

Despite the dip in sales, Brompton’s total revenue only fell by 0.9% to £121.5 million last year, aided by the launch of its first large-wheel model, the G line, in the UK and Europe.

Pre-tax profits rose to £130,500, up from £4,602 the previous year.

The company was compelled to reduce prices to address surplus inventory after overestimating post-pandemic demand.

Looking ahead, Butler-Adams expressed optimism in the company’s latest accounts: “The outlook is positive, with the cycling industry stabilizing after several tough years, the upcoming introduction of the G line in new markets, and ongoing investment in innovative products that Brompton is eager to unveil soon.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

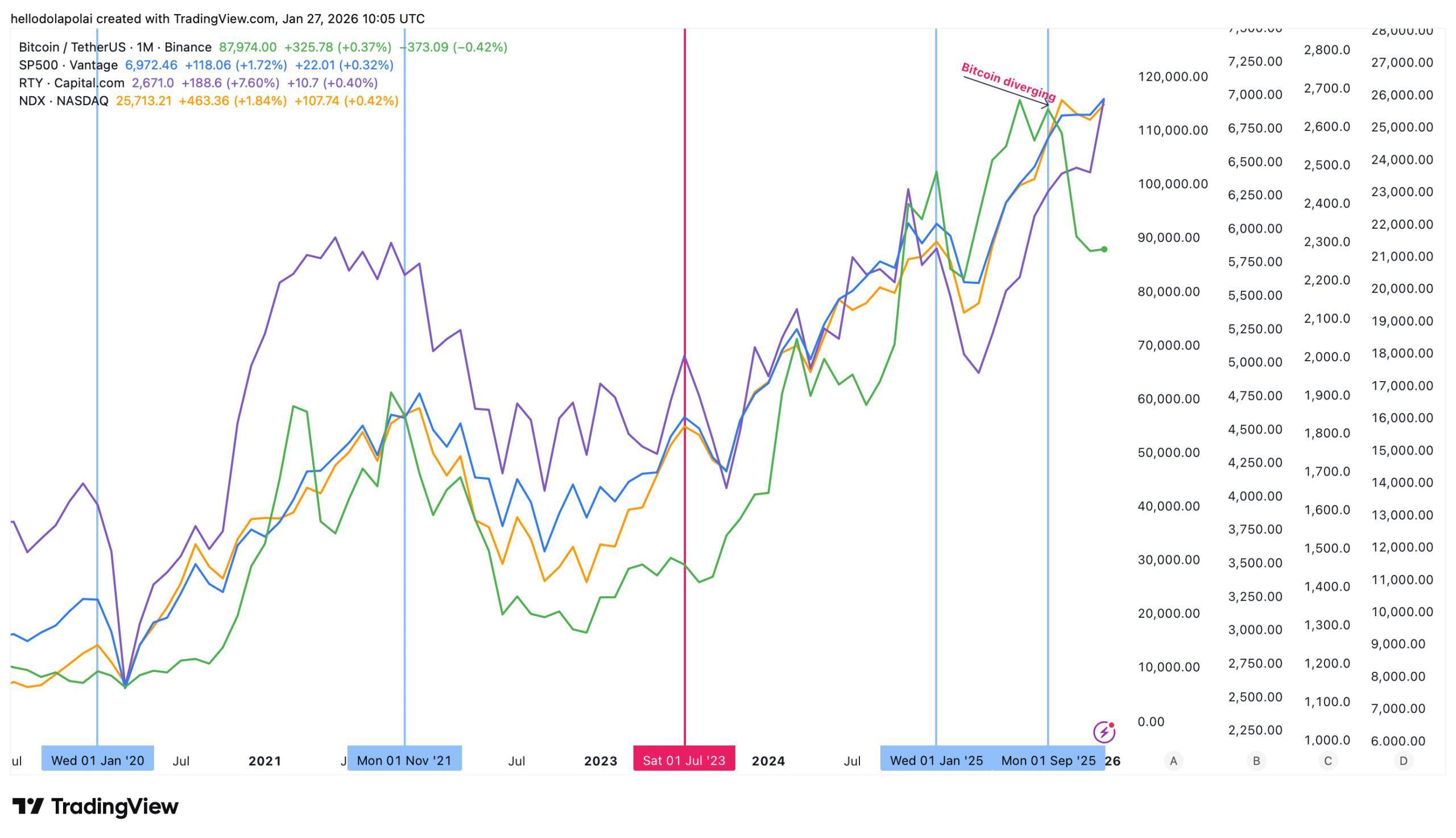

Is Bitcoin’s top still ahead? Decoding impact of equity divergence

Union Pacific announces its highest-ever financial performance

Bitcoin Tests Critical $88.5K Support Level as Precious Metals Rally Steals Market Spotlight

Trade disputes are causing significant fluctuations in US mortgage rates. What could be the outcome?