- PEPE was stuck in the range between immediate key levels indicating planned, low-volatility instead of directional growth.

- Technical Indicators supported a neutral set up, with an equal amount of buying and selling pressure with no definitive conviction of the trend.

- Although it fell in dollar terms, small increases over Pairs were signs of selective rotation, and not general accumulation or withdrawal.

PEPE still traded under pressure on the latest session with short-term price action showing the market hesitation. PEPE was being traded at the period of reporting, at $0.054967 which was a 1.6% decrease over the period. This movement succeeded another daily volatility that had restricted the price action to a tight band.

It is important to note that this area was followed closely by traders as the momentum decreased. Nevertheless, the stability of the prices at the critical points continued to keep the high level of attention on the market.

PEPE Price Holds Near Immediate Support

Price action remained anchored near the $0.054939 support level, which acted as a short-term floor during the session. Notably, buyers repeatedly defended this area as downward pressure increased. However, each rebound showed limited strength.

This behavior kept PEPE constrained within its 24-hour range, reinforcing a tightly controlled structure. Meanwhile, price continued to trade below the immediate resistance at $0.055061, preventing upward extension. As a result, short-term movement reflected balance rather than expansion.

PEPE also experienced a minor change in valuation against big trading pairs. The coin was trading at 0.0105604 BTC, a 0.6 per cent rise against Bitcoin. In the meantime, PEPE gained 0.9 percent over Ethereum at 0.081692 ETH. It is worth noting that these relative gains were contrary to the dollar-denominated fall. But the break indicated rotating instead of the mass laying out.

Momentum Indicators Signal Market Indecision

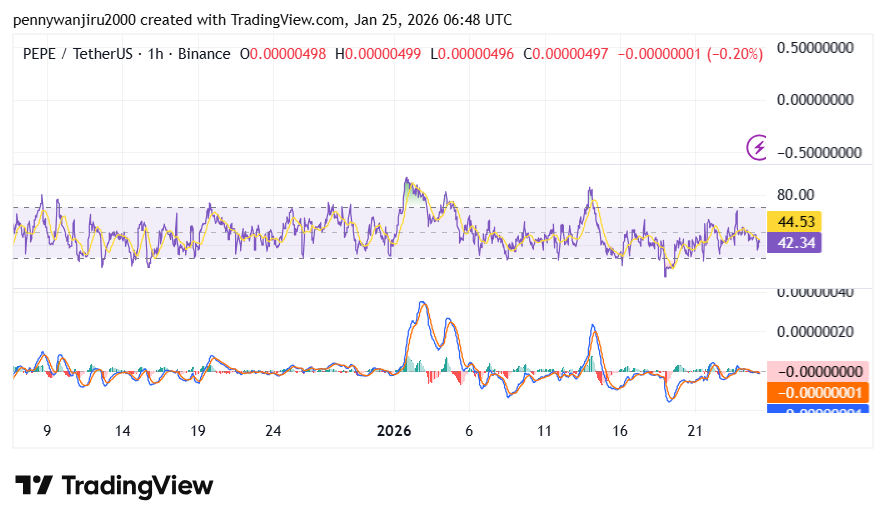

Based on the momentum indicators, the coin is in a neutral position with RSI at 44.53 as indicates that it is neither overbought nor oversold. This action demonstrates balanced momentum since both forces of buying and selling are quite equal

Source:

TradingView

Source:

TradingView

Moreover, the MACD lines appear closely aligned, moving with shallow separation and frequent convergence. The signal line is trading above the MACD line which shows bearish momentum. Histogram bars also appear relatively small, reinforcing the lack of strong directional force. As price compresses, the indicators mirror that compression rather than diverging from it. Price, RSI, and MACD are all moving in sync within constrained boundaries. This alignment shows market participants waiting rather than reacting aggressively

Range Structure Shapes Near-Term Market Expectations

The narrow spread between support and resistance continued to define PEPE’s immediate structure. Notably, repeated tests near resistance failed to produce continuation. However, sustained support defense limited sharper downside moves. This compression maintained directional uncertainty. At the same time, market discussions referenced broader valuation thresholds, including $200 billion and $250 billion, as contextual benchmarks. However, price action remained confined to current levels. As trading progressed, this structure continued guiding short-term market behavior without directional confirmation.