Are Investors Embracing Starbucks' Recovery Strategy? This Year, They're Savoring Every Drop

Main Insights

-

Starbucks shares have outperformed the S&P 500 this year, as investors appear optimistic about the company's efforts to revitalize its business.

-

This week’s quarterly earnings report and investor day could further boost the stock’s momentum.

Starbucks stock has been gaining traction throughout the year, heating up in the eyes of many market watchers.

Putting the coffee puns aside, Starbucks (SBUX) shares are showing renewed strength for the first time since CEO Brian Niccol took the helm in late summer 2024. Although the stock hasn’t fully regained its post-appointment peak, it has climbed roughly 14% this year, handily beating the S&P 500. Currently, shares are trading near $96, marking their highest point in almost a year.

Will this upward trend persist? Two major events scheduled for this week may provide some answers.

What Investors Should Know

Starbucks has long been a favorite among investors, thanks to its history of steady expansion. Now, all eyes are on the new CEO to see if he can deliver on his ambitious plans to turn the company around. The stock’s strong performance this year could get another push from the upcoming earnings announcement and investor day.

The company is set to release its fiscal first-quarter results on Wednesday morning. The following day, Starbucks will host an investor day, featuring remarks from Niccol and other top executives. These events come after the last quarterly report, which showed positive trends in same-store sales—an indication that the company’s “Back to Starbucks” recovery strategy may be taking hold.

In addition, Starbucks has continued to introduce new menu items and initiatives to attract customers back to its cafes. Recent updates include the addition of alcoholic beverages, protein shakes, baked treats, and a revamped chai offering.

Currently, Wall Street’s average price target for Starbucks, according to Visible Alpha, is close to the stock’s present value, suggesting that analysts are waiting for more compelling reasons to become bullish. However, some optimism is already emerging: Bank of America recently raised its price target to $120, the highest among Visible Alpha’s tracked estimates.

As Bank of America analysts noted, “We believe the market will assign a higher valuation to temporarily subdued earnings, given our confidence in the enduring strength of the brand and the potential for significant gains through better resource allocation.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

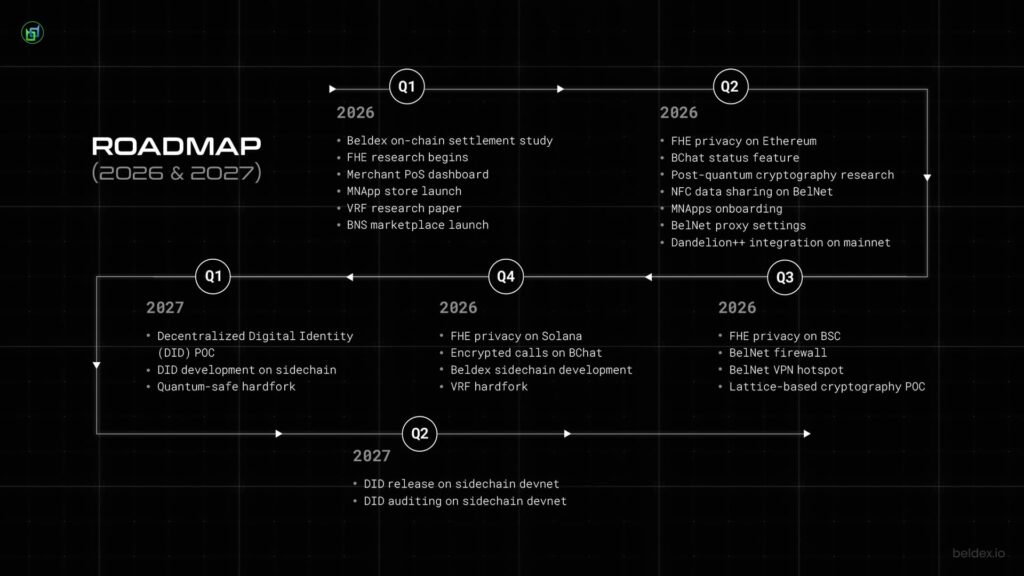

Beldex 2026: Building the Next Phase of Privacy Infrastructure

Nietzschean Penguin surges 39% – Can bulls reclaim the $0.16 high?

iCrypto Awards 2026 Sets a New Global Benchmark for Blockchain Excellence in Dubai

Here's the way China's reaction to Trump's tariffs is quietly shaking up bitcoin