QCR Holdings (NASDAQ:QCRH) Announces Q4 CY2025 Results Meeting Projections

QCR Holdings Q4 2025 Earnings Overview

QCR Holdings, a regional bank based in the Midwest and listed on NASDAQGM as QCRH, reported fourth quarter 2025 results that matched Wall Street’s revenue forecasts. The company generated $107 million in sales, reflecting a 2.8% increase compared to the same period last year. Adjusted earnings per share came in at $2.21, surpassing analyst expectations by 11.3%.

Wondering if QCR Holdings is a smart investment right now?

Highlights from Q4 2025

- Net Interest Income: $68.35 million, nearly matching analyst projections and up 11.7% year-over-year

- Net Interest Margin: 3.1%, falling short of the 3.6% consensus estimate by 51 basis points

- Total Revenue: $107 million, in line with expectations and up 2.8% from last year

- Efficiency Ratio: 58.7%, above the anticipated 53.3% (a 542.8 basis point difference)

- Adjusted EPS: $2.21, beating the $1.99 forecast by 11.3%

- Tangible Book Value per Share: $57.86, slightly ahead of the $57.68 estimate and up 15.2% year-over-year

- Market Cap: $1.47 billion

Todd Gipple, President and CEO, commented, “We achieved our best quarter and set new records for the full year, driven by strong results in our core banking, wealth management, and LIHTC lending segments. We also continued to invest in digital innovation, building a future-ready bank for our clients and team members.”

About QCR Holdings

Founded in 1993 and named after the Quad Cities region, QCR Holdings operates four community banks in Iowa and Missouri. The company offers a range of commercial and personal banking services, as well as trust solutions, to both businesses and individuals.

Revenue Trends

Banks typically earn money through two main channels: the difference between interest earned on loans and paid on deposits, and fees from various services. Over the past five years, QCR Holdings has posted a modest 7% compound annual revenue growth rate, which falls short of industry benchmarks and sets a low bar for performance evaluation.

While long-term growth is crucial, recent shifts in interest rates and market conditions can have a significant impact. In the last two years, QCR Holdings’ annualized revenue growth slowed to 2.2%, trailing its five-year average and indicating softer demand.

Recent Performance Details

In the latest quarter, QCR Holdings’ revenue rose 2.8% year-over-year to $107 million, aligning with analyst expectations.

Lending remains the company’s primary revenue driver, with net interest income accounting for 63.1% of total revenue over the past five years.

Investors typically value steady growth in net interest income more highly than fee-based revenue, as it tends to be more predictable and reliable.

While tech giants like Nvidia dominate headlines, there are lesser-known semiconductor suppliers playing a crucial role in the AI industry.

Tangible Book Value Per Share (TBVPS)

A bank’s profitability is closely tied to its balance sheet, as earnings are generated from the spread between borrowing and lending rates. As a result, investors focus on capital strength and the ability to grow equity over time.

TBVPS is a key metric for banks, as it excludes intangible assets and provides a clear view of per-share net worth. While earnings per share can be influenced by mergers and loan loss provisions, TBVPS offers a more reliable measure.

QCR Holdings has delivered impressive TBVPS growth, averaging 12.5% annually over the past five years. In the last two years, this growth accelerated to 14.9% per year, rising from $43.81 to $57.86 per share.

Looking ahead, analysts expect TBVPS to climb another 12.8% over the next year, reaching $65.26 per share—a solid pace of growth.

Summary of Q4 Results

QCR Holdings exceeded earnings expectations this quarter, with several positive highlights in its report. The company’s stock price remained steady at $88.06 following the announcement.

Is QCR Holdings a compelling buy at its current valuation? Before making a decision, it’s important to consider the company’s overall financial health, business fundamentals, and recent performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

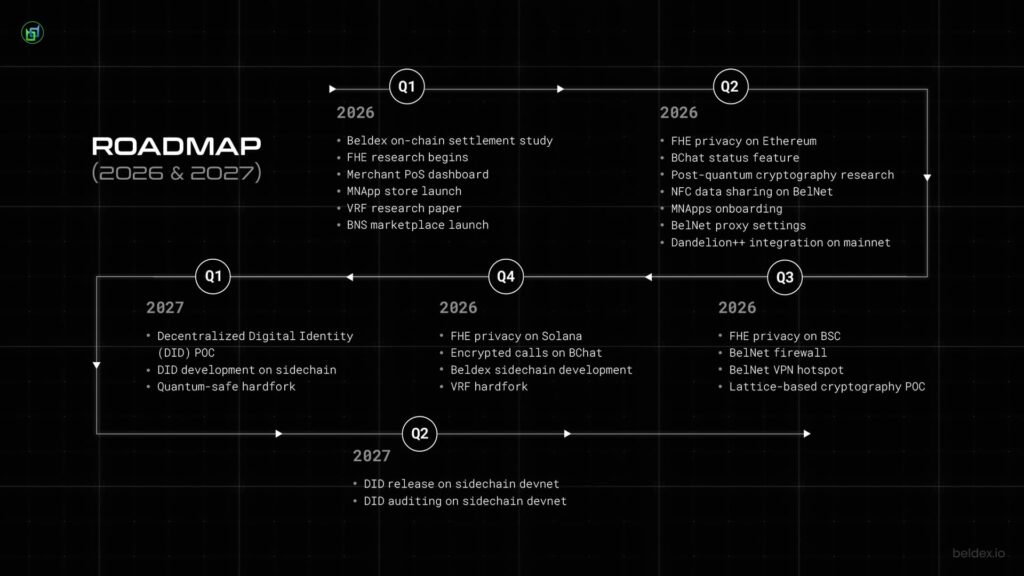

Beldex 2026: Building the Next Phase of Privacy Infrastructure

Nietzschean Penguin surges 39% – Can bulls reclaim the $0.16 high?

iCrypto Awards 2026 Sets a New Global Benchmark for Blockchain Excellence in Dubai

Here's the way China's reaction to Trump's tariffs is quietly shaking up bitcoin