Chainlink opens 24/5 onchain access to US equities

Chainlink has launched 24/5 US equities data streams that allow decentralised finance protocols to access institutional-grade stock and ETF data beyond standard market hours.

The new service enables continuous onchain use of US equity pricing across regular sessions, pre-market, post-market, and overnight trading periods.

The launch is positioned as a major step in linking traditional financial markets with decentralised applications that operate without downtime.

Chainlink said the data streams cover all major US-listed equities and exchange-traded funds used by institutional and professional investors.

Decentralised applications can now reference US equity markets nearly around the clock rather than relying on limited Wall Street trading windows.

The move effectively opens access to the roughly $80 trillion US equity market for onchain financial products.

The data streams are live across more than 40 blockchain networks, expanding reach across the DeFi ecosystem.

Developers can use the feeds to build always-on products such as equity-linked perpetuals, lending markets, prediction markets, and synthetic assets.

Chainlink said the service delivers full market context rather than a single reference price.

The streams include bid and ask prices, associated trading volumes, and indicators designed to detect stale or delayed data.

These features aim to support more accurate pricing, safer liquidations, and improved risk controls for decentralised protocols.

The launch addresses long-standing issues in bringing real-world assets onchain, particularly the mismatch between blockchain uptime and equity market hours.

Off-hours gaps have historically created pricing uncertainty and higher risk for equity-based DeFi products.

By extending coverage beyond traditional sessions, the new streams seek to reduce volatility tied to market closures.

Several platforms have already integrated the feeds to support equity-based trading products.

Lighter, described as the second-largest perpetual decentralised exchange by volume, is among the early adopters.

BitMEX, known for creating the first crypto perpetual contracts, is also using the new equity data streams.

For derivatives markets, security and data integrity matter more than anything. Chainlink’s 24/5 U.S. Equities Streams are a critical component of our professional-grade 24/7 equity derivatives infrastructure, providing the verifiable pricing context needed to operate beyond standard market hours.

Stephan Lutz said.

Chainlink said the infrastructure is built on its established data standard used across multiple decentralised markets.

The company reported that its oracle systems have facilitated more than $27 trillion in transaction value to date.

Demand for tokenised real-world assets continues to grow as institutions explore blockchain-based financial products.

Chainlink positioned the new data streams as infrastructure designed to meet institutional expectations around reliability and transparency.

The company said the service supports the development of equity markets that operate with minimal interruption.

The rollout reflects broader efforts to expand decentralised finance beyond crypto-native assets.

Chainlink said the data streams are designed to scale alongside increasing institutional participation.

The company added that continuous equity data could unlock new use cases across lending, derivatives, and settlement layers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

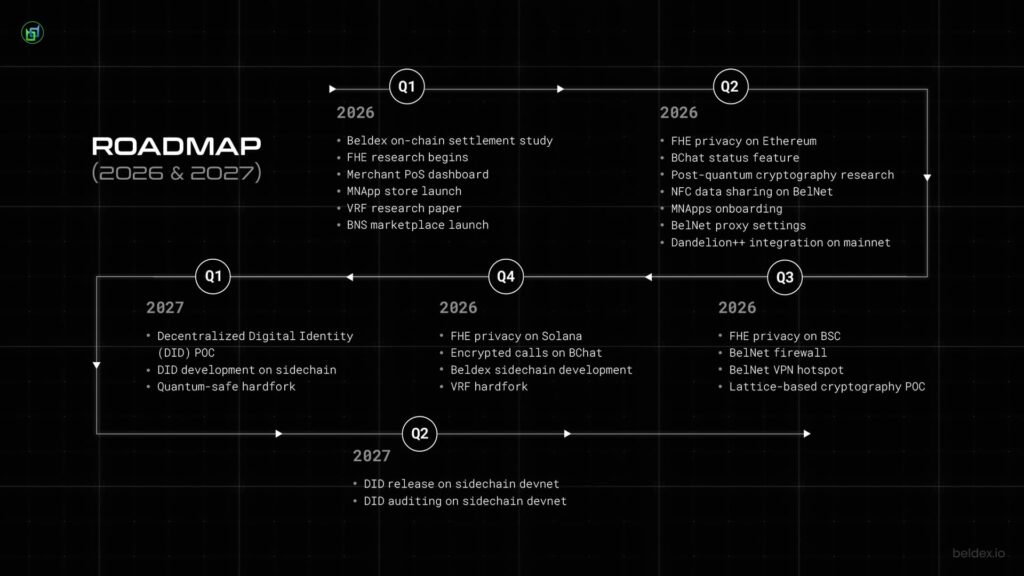

Beldex 2026: Building the Next Phase of Privacy Infrastructure

Nietzschean Penguin surges 39% – Can bulls reclaim the $0.16 high?

iCrypto Awards 2026 Sets a New Global Benchmark for Blockchain Excellence in Dubai

Here's the way China's reaction to Trump's tariffs is quietly shaking up bitcoin