ERC-20 stablecoins lose $7 billion and break trend.

- ERC-20 stablecoins fall by $7 billion in one week.

- Capital is leaving cryptocurrencies, on-chain analysis indicates.

- Ethereum feels the impact on stablecoin liquidity.

The market capitalization of ERC-20 stablecoins on the Ethereum network shrank by approximately $7 billion in just one week, marking the first significant pullback in this market cycle. This movement interrupts a sequence of months of steady growth, according to data analyzed by the researcher known as Darkfrost, from CryptoQuant.

❌ Stablecoin market cap is dropping !

This is the first time during this cycle that we are witnessing such a sharp decline in the stablecoin (ERC-20) market cap.

📉 Their total capitalization has fallen by $7B in just one week, from $162B to $155B.

This is very negative… pic.twitter.com/mG4PcRLrhT

— Darkfost (@Darkfost_Coc) January 26, 2026

Stablecoins are cryptocurrencies pegged to fiat currencies, primarily the US dollar. They are often used by investors as a temporary store of value within the cryptocurrency market, reducing exposure to the volatility of assets like Bitcoin and other cryptocurrencies.

Throughout much of the second half of 2025, the supply of these stablecoins on Ethereum had been growing consistently. This growth paralleled the appreciation of several digital assets, suggesting a net inflow of capital into the sector and an increase in the liquidity available for trading.

When the market went through periods of correction, the capitalization of stablecoins stopped rising but remained stable. This behavior indicated that the money remained within the ecosystem, even without immediately migrating to more volatile assets.

The recent drop broke this pattern of stability. Data shows that, in addition to the reduction in the supply of ERC-20 stablecoins, cryptocurrency prices also declined during the same period. For Darkfrost, the movement suggests that some investors are withdrawing resources from the cryptocurrency market, rather than simply reallocating capital between different tokens.

The analyst links this dynamic to the positive performance of other markets. Precious metals appreciated in value, while stock markets maintained their strength, which may have attracted capital flows that were previously invested in cryptocurrencies.

A decrease in the supply of stablecoins is often seen as a sign of tightening liquidity in the sector. Since these assets form the basis for trading on various platforms, a significant reduction can impact volumes and the ability to absorb sharp price movements.

Even with this scenario, Bitcoin showed a partial recovery after recent lows, indicating that there is still activity and interest in the market. Nevertheless, the pullback in ERC-20 stablecoins is now being monitored as an important indicator of capital behavior both within and outside the cryptocurrency environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UNH Q4 Analysis: Profit Squeeze, Shrinking Membership, and Medicare Challenges Influence Future Prospects

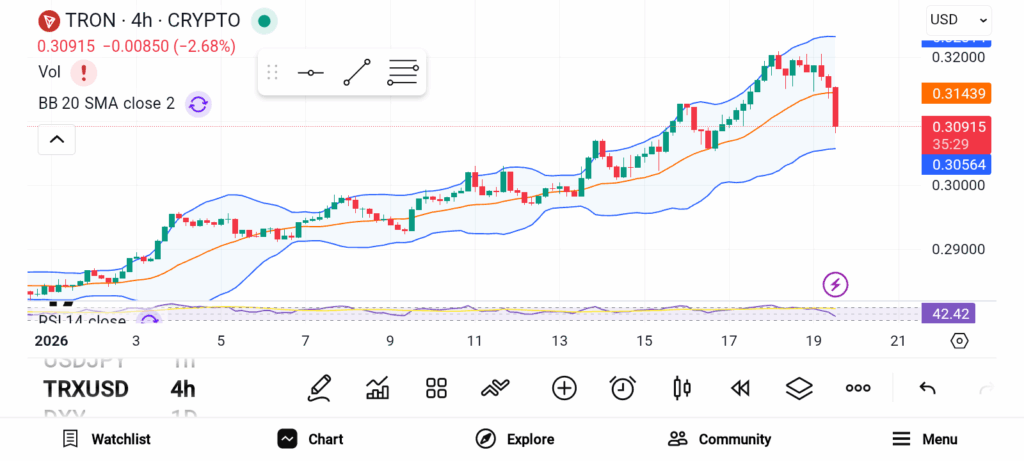

3 Altcoins to Invest in February 2026 — ADA, TRX, and HYPE

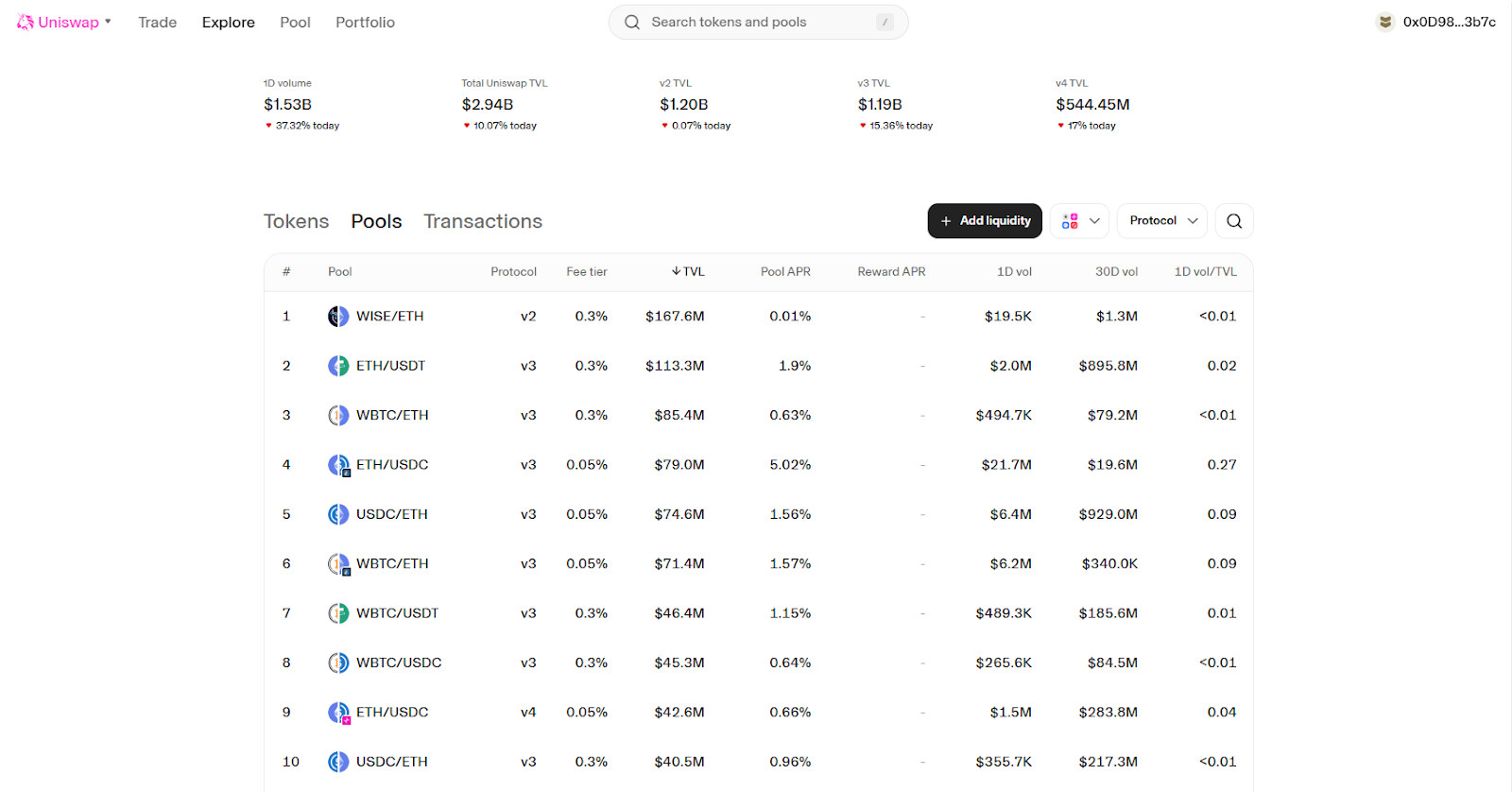

How Crypto Market Liquidity Actually Works

Ethereum Makes Progress Toward Quantum Resilience