Australian Dollar Shows Mixed Performance as CPI Fails to Ensure RBA Rate Increase

Australian Inflation Data Leaves Rate Hike Uncertain

Australia’s latest quarterly consumer price index (CPI) figures revealed that inflation remains above the Reserve Bank of Australia’s (RBA) preferred range. However, the results were not strong enough to guarantee an interest rate increase in February. Although core inflation, measured by the trimmed mean, is still at elevated levels, both the bond market and the Australian dollar reflected some doubt, indicating that the report did not significantly alter expectations for future monetary policy.

The RBA has kept its overnight cash rate steady at 3.6% for four straight meetings. While the central bank has not officially declared an end to its tightening phase, many analysts believe that rate hikes may be finished. Following a robust employment report for December, futures markets began to price in a...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Herc Holdings: Fourth Quarter Earnings Overview

Ethereum $2,000 Level Faces Fresh Rejection

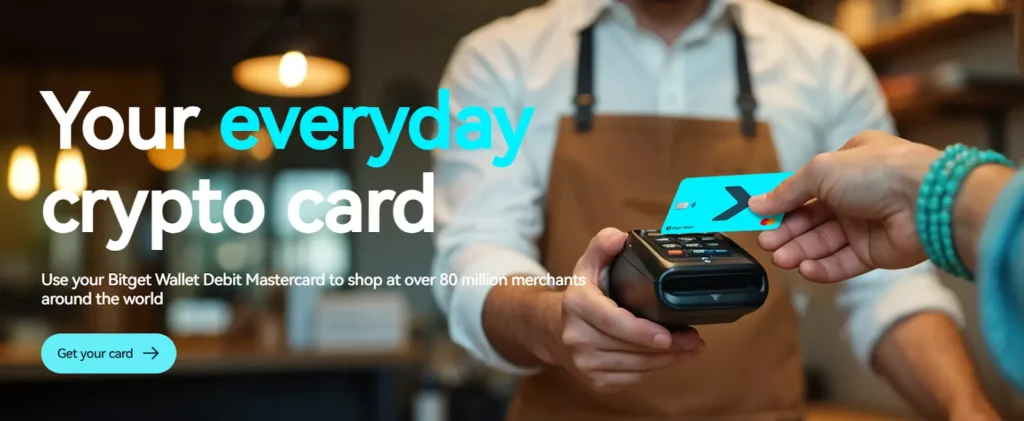

What Is the Best Crypto Card for Payments?

InterDigital renews license agreement with Sony