Head of Major Investment Firm Makes Extremely Bullish Comments About Ripple (XRP)

Roger Bayston, Head of Digital Assets at financial giant Franklin Templeton, discussed how traditional finance (TradFi) is undergoing a “revolution” with blockchain technology and the critical role of XRP in this new ecosystem in his comments on the Paul Barron Podcast.

Responding to Paul Barron’s questions about the future of Ripple and XRP, Bayston argued that XRP has moved beyond being merely an asset to be traded and has become a fundamental infrastructure component for inter-institutional exchange and tokenized finance. Referring to Brad Garlinghouse’s speeches in Davos, the program stated that XRP is beginning to appear as a real asset on balance sheets.

Roger Bayston describes the XRP Ledger (XRPL) as a “payment-oriented blockchain.” According to Bayston, XRP is not just a store of value; it’s a “financial framework” specifically designed for real-time, low-cost, cross-border payments.

Roger Bayston states that they have seen the massive capital the XRP ecosystem has amassed over the past 10 years and its determination to rebuild the system, which is why Franklin Templeton chose to own an XRP ETF.

Franklin Templeton now views XRP not as a speculative asset, but as a fundamental building block of a diversified digital asset portfolio. Bayston argues that XRP’s more than 10 years of sustained market presence and the massive capital it has raised make it trustworthy at the institutional level.

Franklin Templeton is reportedly developing solutions with Singapore-based DBS Bank for tokenized money market funds on the XRP Ledger and integration with Ripple’s RLUSD stablecoin. XRPL was chosen because of its speed and low transaction costs, making it ideal for high-volume institutional transactions.

Bayston says the financial world is on the verge of a new divide. He argues that in the future, it will be digital wallet holders, not banks, who will steer the system, and XRP will be the main bridge providing liquidity between these wallets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spotify says it made record payout of more than $11 billion to music industry in 2025

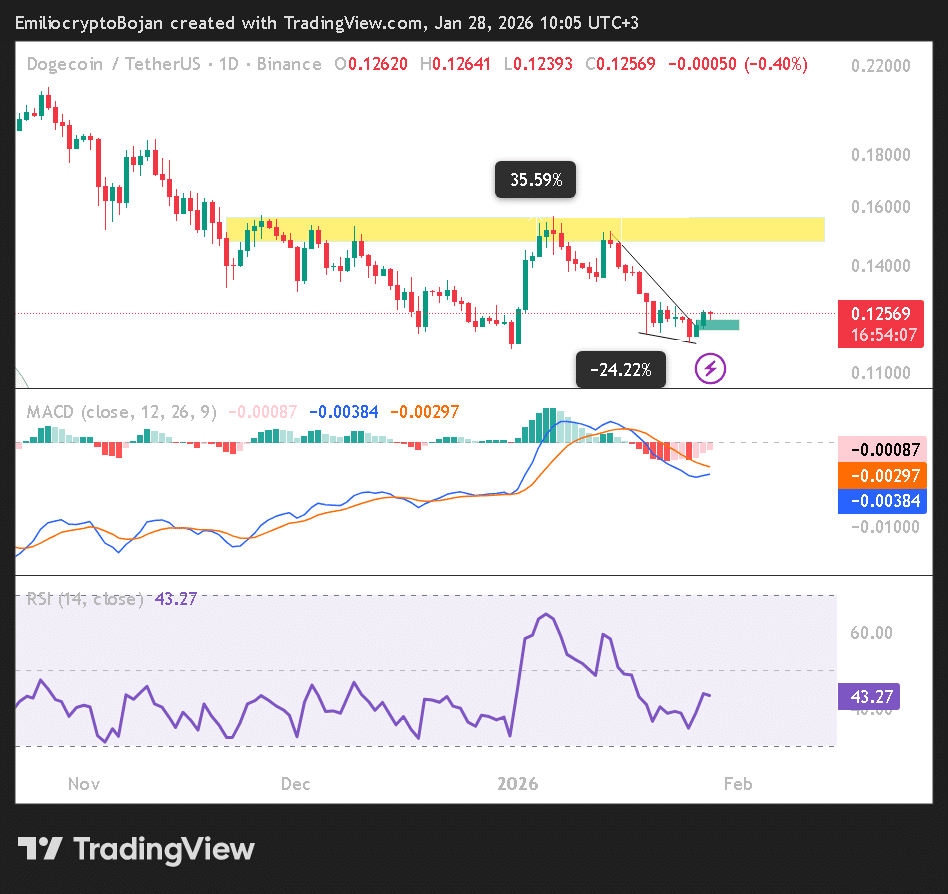

DOGE steadies after 35% January surge, but THIS level decides what’s next!

Ethereum Developers Set Key Target for Upcoming Hegota Upgrade

Bitcoin Hits Milestone as Market Dynamics Shift