Quant price today trades near $79.54 after pulling back from a failed attempt at the descending channel resistance. The setup places QNT at a critical juncture where the EMA cluster converges, creating a tight range that will likely resolve with a directional move in the coming sessions.

QNT Price Action (Source: TradingView)

QNT Price Action (Source: TradingView)

On the daily chart, QNT trades at the intersection of three major moving averages. The 20-day EMA sits at $78.02, the 50-day at $78.55, and the 100-day at $81.91. This tight clustering creates a decision zone between $78 and $82 where the next trend will be determined.

Price has oscillated around these levels for several weeks, with neither bulls nor bears able to establish control. The 200-day EMA at $87.05 represents the next major target if bulls can break through the cluster, while the Supertrend support at $68.11 anchors the downside.

Key levels now:

- Immediate resistance: $81.91 (100 EMA)

- Channel resistance: $85 to $87

- Major resistance: $87.05 (200 EMA)

- Immediate support: $78.02 (20 EMA)

- Secondary support: $78.55 (50 EMA)

- Supertrend support: $68.11

- Breakdown target: $70

The descending channel from July highs near $145 continues to cap rallies. Each touch of the upper boundary has resulted in rejection, making this the primary resistance to watch.

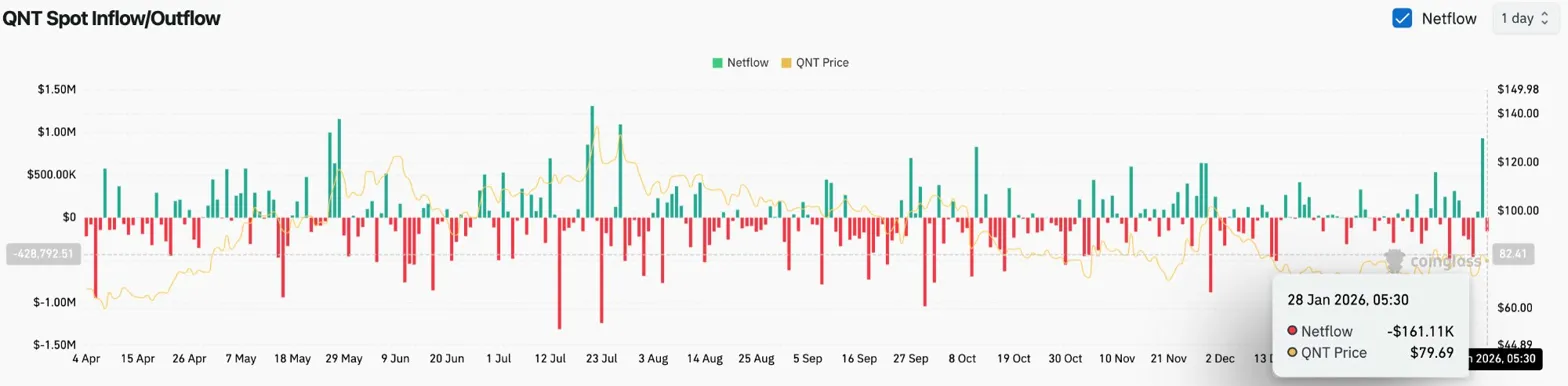

QNT Netflows (Source: Coinglass)

QNT Netflows (Source: Coinglass)

Exchange flow data shows quiet accumulation. Coinglass recorded $161.11K in net outflows on January 28, meaning tokens are moving off exchanges into private wallets.

The outflow magnitude is modest compared to larger-cap assets but represents consistent accumulation during the consolidation phase. When spot flows remain positive during range-bound trading, it suggests that holders are gradually building positions rather than distributing.

The pattern aligns with Quant’s institutional narrative around enterprise blockchain interoperability. Overledger’s partnerships with major banks and the growing tokenization market provide fundamental support that may attract longer-term positioning.

QNT Price Dynamics (Source: TradingView)

QNT Price Dynamics (Source: TradingView)

Shorter timeframes reveal the bounce dynamics. On the hourly chart, QNT recovered from a low of $73 on January 26 to test $80 resistance. The Parabolic SAR flipped bullish at $78.76 and now sits just below current price.

RSI has climbed to 57.89, entering bullish territory after bouncing from oversold conditions hit during the recent selloff. The indicator shows room for continuation toward overbought levels if the rally extends.

The $80 level acts as the immediate pivot. Holding above this zone would confirm the bounce and target a retest of the 100 EMA at $81.91. Failure to hold risks another test of the recent $73 low.

The setup presents a consolidation pattern at key moving average confluence. The descending channel has contained price for seven months, but the EMA cluster creates conditions for a decisive break. Resolution will determine whether QNT continues lower or begins a new uptrend.

- Bullish case: Price breaks above $82 and clears the descending channel resistance. A close above $87 (200 EMA) confirms the trend reversal and targets $100.

- Bearish case: Rejection at the 100 EMA sends price back to test $78 support. A close below $75 breaks the EMA cluster and targets the Supertrend at $68.