When Too Many Expectations Are Placed on Monetary Policy

The Federal Reserve’s Dual Responsibilities

Congress has tasked the Federal Reserve with two primary objectives: ensuring stable prices and promoting maximum employment. To fulfill these goals, the Fed employs a range of strategies, including adjusting interest rates, managing its balance sheet, and issuing public communications. These measures are especially important during significant economic challenges, such as the COVID-19 crisis and the sharpest inflation surge since the early 1980s.

While these monetary policy tools are effective in moderating excessive demand and providing support during economic slowdowns, they have their limitations. They cannot substitute for robust fiscal policy, nor can they resolve deep-rooted structural issues within the economy. Recent research continues to highlight these constraints.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

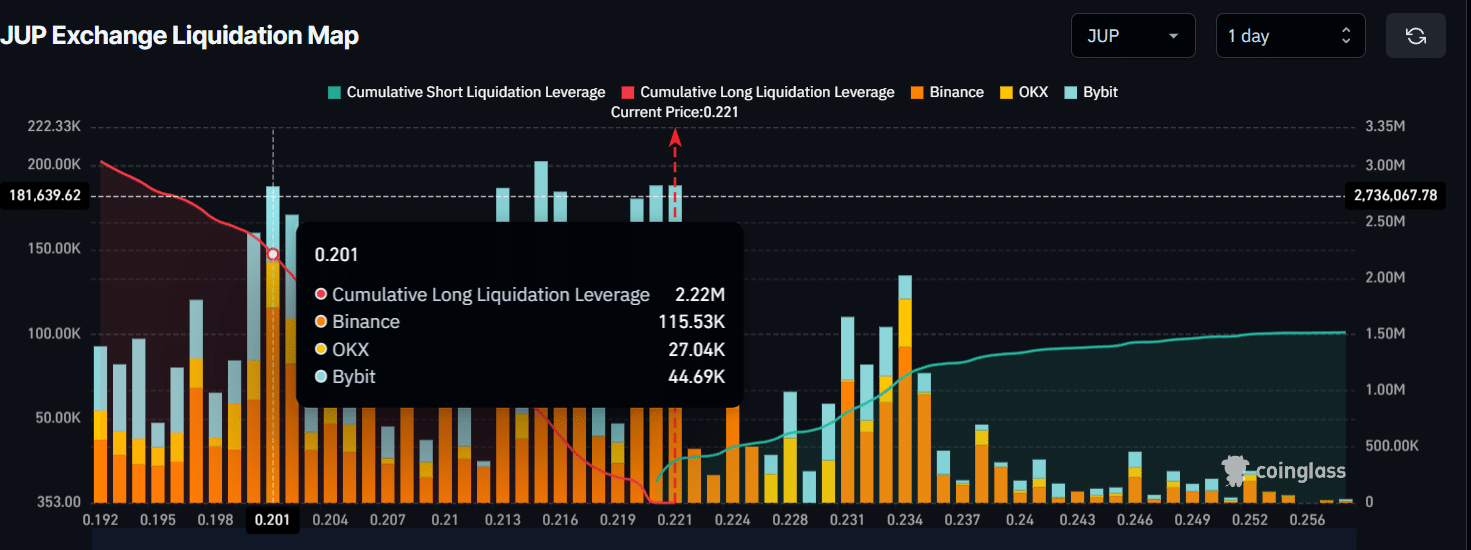

Jupiter jumps 15% ahead of 200mln airdrop – But THIS could stall JUP’s rally

Pundi AI and REI Network Join Forces to Provide Zero Cost Data on Next Gen AI Resorting

H&M flags slow winter sales after Q4 profit rises more than expected

Indonesian stocks recover as authorities attempt to allay investor worries