Record-breaking Surge in Gold and Silver May Signal Changes in the Global Monetary System

Huitong Network, January 29—— The recent record surge in gold and silver prices is mainly driven by a crisis of confidence in fiat currencies, especially the US dollar. The ongoing weakness of the dollar, geopolitical uncertainties, US trade policy, and debt issues have accelerated the global trend of "de-dollarization." Investors are viewing gold as a tool to hedge against inflation, currency depreciation, and macro risks, and central banks in many countries are also adjusting their reserve structures. Analysts believe that the rise in gold prices reflects not only market anxiety but also signals deep concerns about the stability of the global monetary system, and this trend may continue to drive demand for gold allocation.

Although gold and silver prices may seem excessive at record highs, they continue to be firmly supported as the persistent weakness of the dollar reinforces a broader shift in investor sentiment toward hard assets.

Both metals have greatly benefited from the dollar's decline,

Julia Khandoshko, CEO of Mind Money, stated that although gold may be vulnerable to short-term pullbacks, the overall trend remains unchanged.

She said: "We are seeing

Analysts also noted that gold and silver continue to benefit from the resurgence of the "Sell America" sentiment first seen in April 2025, when Trump implemented aggressive global tariffs aimed at reducing the US trade deficit.

Market analyst Linh Tran said the growing importance of gold is increasingly reflected in the composition of global reserves.

In a report, Tran noted: "

The weakness of the dollar has become obvious. In 2025, the US Dollar Index recorded one of its worst performances in over 50 years, falling about 9.4% from a closing level near 108.5 in December 2024 to around 98.3 at year-end. This downward momentum has continued into the new year, with the dollar dropping almost 2% in January. This week, the index fell to a four-year low of 95.566.

As the dollar depreciates, Trump stated that he is not worried about the devaluation. When asked by reporters in Iowa on Tuesday whether he was concerned about the dollar's depreciation, Trump said: "I think it's fine; I think the value of the dollar—look at the business we're doing—the dollar is performing very well."

However, analysts warn that

Aaron Hill, head of market analysis at FP Markets, stated in a report: "While a weaker dollar benefits exporters, it may add inflationary pressure. Think about it: the problem is, when the dollar depreciates, if you want to buy things abroad, it becomes more expensive because the purchasing power of the dollar falls. For businesses, those importing materials will also face rising costs, which they can pass on to customers, leading to inflation. Now, the issue is the unpredictability of Trump. From threatening tariffs to plans regarding Greenland, his actions continue to disrupt the markets, prompting investors to reduce their exposure to US assets. This exacerbates the dollar's decline, which could ultimately fuel inflation."

Besides the dollar, some analysts warn that confidence in fiat currencies more broadly is weakening. The market remains sensitive to recent turbulence in the Japanese bond market, which has sparked concerns about liquidity risks in the global financial system.

Guy Wolf, global head of market analysis at Marex, stated that

"Private investors are returning to gold as both a hedge against currency depreciation and a form of insurance against geopolitical risks, overvalued equity markets, and broader macro uncertainty. The rise in gold is not just about the weakness of the dollar; rather, it reflects a broader erosion of confidence in fiat currencies worldwide, with gold prices rising in almost every currency."

Looking ahead, Nitesh Shah, Head of Commodities and Macroeconomic Research at WisdomTree, stated that

He noted that his models still recommend investors allocate 15% to 20% of their portfolios to gold. He added that given the vast size of the global bond market, even minor shifts in asset allocation could have a dramatic impact on prices. He said: "I understand why gold prices are where they are; if the dollar remains the world’s reserve currency, the status quo and the global monetary system will face tremendous threats."

Spot Gold Daily Chart Source: EasyHuitong

GMT+8 January 29, 11:17 Spot Gold quoted at $5,534.56/ounce

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Microsoft’s $381 Billion Plunge Reveals the Risks Behind the AI Frenzy

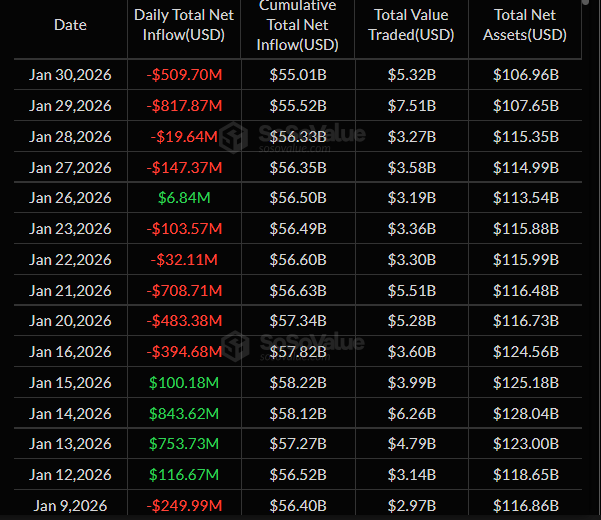

Bitcoin Leads Crypto ETF Outflows as Nearly $1B Exits in Risk-Off Sell-Off

Here's why bitcoin traders are now betting billions on a drop below $75,000 and bailing on price rising higher

Ethereum slides to $2,300 – $1.16B liquidations trigger whale buying