AUD: The Strongest King

Morning FX

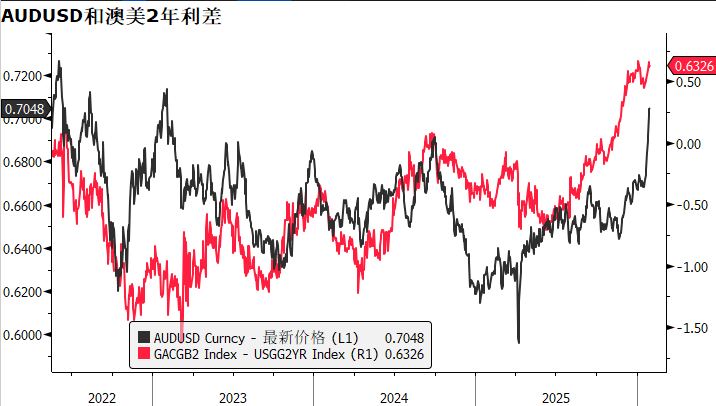

The Australian dollar had been performing flatly throughout 2025, but at the start of this year, buoyed by the commodity supercycle and expectations of rate hikes in Australia, the AUD finally experienced a breakout, crossing the important 0.70 threshold this week (for the first time in three years). In the first month of the year, the AUD has appreciated 5.7% against the USD, becoming the king among the G10 currencies.

I. Three Major Reasons Behind the Strong AUD

1. High Inflation + Low Unemployment, RBA May Hike Rates

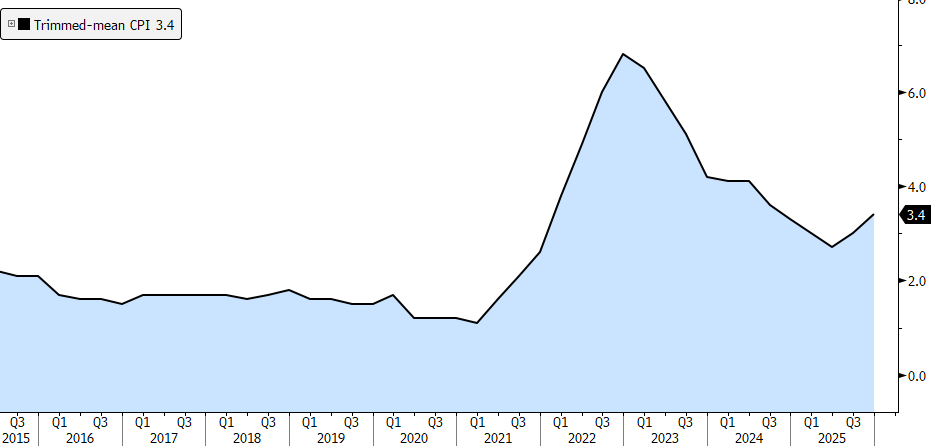

The inflation data for December 2025 in Australia released this Wednesday exceeded market expectations.

December CPI MoM 1.0%, YoY 3.8% (expected 3.6%, previous 3.4%)

The RBA's main focus, trimmed-mean CPI rose 0.2% MoM, and 3.3% YoY (expected 3.3%, previous 3.2%)

Q4 trimmed-mean CPI MoM0.9%, YoY 3.4% (expected 3.3%, previous 3.0%)

The job market is also starting to recover, with employment in December growing by 65,200 from -28,700 last month, far above the market expectation of 27,000; the unemployment rate dropped from 4.3% to 4.1%, well below the expected 4.4%.

PMI figures performed even better, with January manufacturing PMI rebounding from 51.6 to 52.4, services PMI surging from 51.1 to 56.0, and composite PMI rising from 51.0 to 55.5.

Supported by robust fundamental data, the current rate futures market has priced in a 67% probability of an RBA rate hike in February, with expectations for 2.3 hikes in 2026.

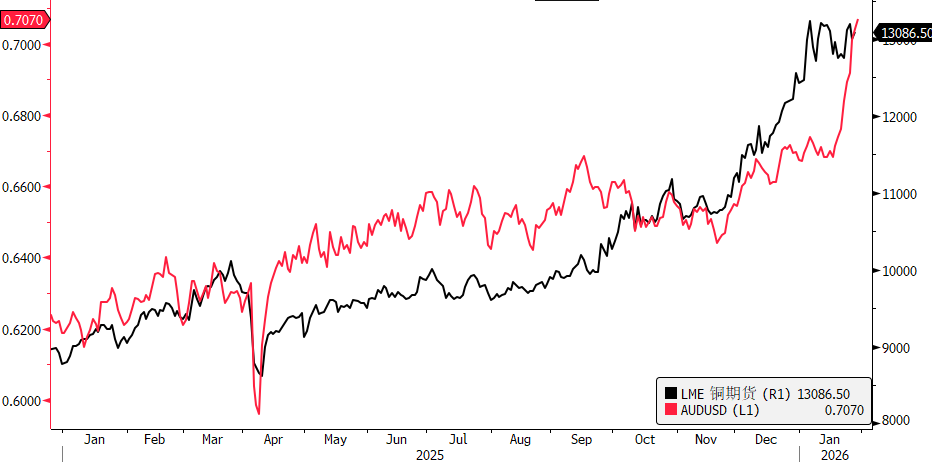

2. Rally in Non-ferrous Metals Drives AUD Higher

Yesterday, daily copper prices soared by 7% to a new historical high, with gold and silver also rallying strongly. Australia is a major global exporter of commodities, rich in resources such as iron ore, coal, copper, and gold. Rising metal prices directly boost Australia's exports and drive up the AUD.

3. Australian Institutions Hedging USD Exposure

Australia's second-largest pension fund ART clearly stated last week that it intends to hedge its US equity holdings' FX exposure (which means buying AUD/USD), citing the expectation that with potential Fed rate cuts and possible hikes in Japan and Australia, the USD will weaken this year, and that the US government hopes for a weaker dollar to boost competitiveness.

Currently, ART holds about AUD 53 billion (around USD 35 billion) in USD assets. Rough estimates: if the current hedge ratio increases from 20% to 40%, this would result in approximately USD 7 billion of USD selling.

In an environment of declining US yields and a weakening USD, this move by large overseas institutions to reduce USD exposure and increase FX hedging could bring sustained USD selling pressure. For instance, yesterday Canada's largest pension fund (IMCO) also announced plans to increase FX hedging on its USD assets.

II. Outlook for the AUD Going Forward

In summary, the rally in the AUD is strong and the outlook for the currency this year remains positive.

However, in the short term, there are still a few bearish factors to watch out for:

1) From a positioning perspective, the market has been unanimously bullish on the AUD since the start of the year, and AUD long positions are currently quite full. Also, the market's expectation for 2.3 RBA rate hikes throughout the year may be a bit aggressive.

2) From the commodity angle, the recent commodity frenzy has been quite extreme, and domestic real estate policy tailwinds are still only at the expectation level. If commodities correct, the AUD could pull back as well.

3) From a sentiment perspective, the AUD is still a risk currency. If the US launches an attack on Iran in the near term, risk-off sentiment will inevitably drag down the AUD.

Overall, the recent trading strategy for AUDUSD and AUD crosses remains dip-buying, not chasing highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin Season Index Stagnates at 32, Revealing a Cautious Crypto Market

Dollar set for weekly decline amid escalating global tensions

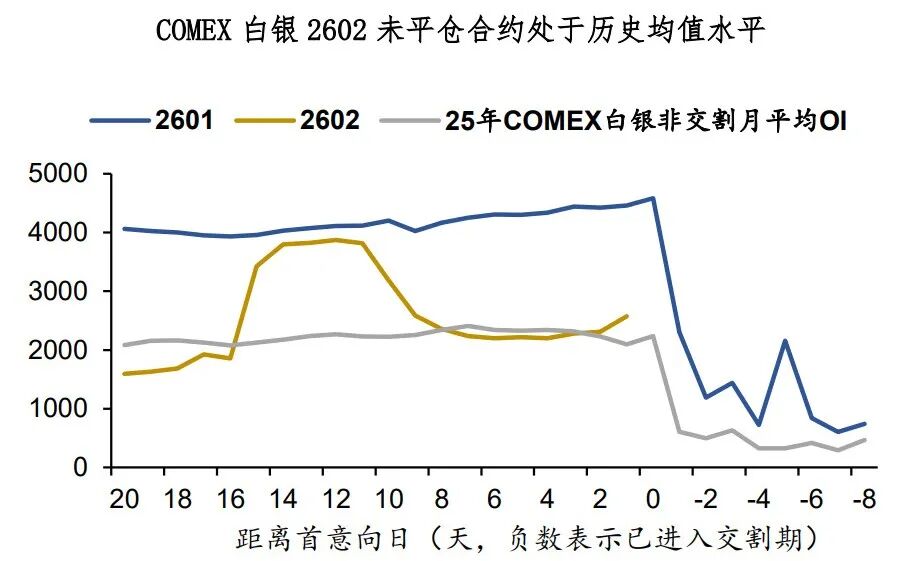

Silver: The Bull Market Needs a Breather