Research Report|In-Depth Analysis and Market Cap of Zama (ZAMA)

I. Project Introduction

Zama is a leading open-source cryptography company dedicated to building end-to-end encrypted solutions for blockchain and artificial intelligence through Fully Homomorphic Encryption (FHE). Zama’s core vision is to unlock the “HTTPS moment” of blockchain, meaning that all on-chain transactions, asset management, and smart contract logic can remain publicly verifiable while achieving complete data confidentiality.

Zama’s product suite includes TFHE-rs (a Rust-based FHE arithmetic library), Concrete (an FHE compiler for Python), and fheVM, a virtual machine designed specifically for the Ethereum Virtual Machine. It enables developers to build confidential smart contracts on existing L1/L2 networks (such as Ethereum and Solana).

Unlike traditional privacy solutions (such as mixers or simple zero-knowledge proofs), Zama provides programmable confidentiality: smart contracts can define who is allowed to decrypt which data, ensuring end-to-end encryption without sacrificing composability. From a technical architecture perspective, Zama combines FHE, Multi-Party Computation (MPC), and Zero-Knowledge Proofs (ZK) to address the historical performance bottlenecks of FHE. Its FHE technology has now achieved post-quantum security, with computation speeds improving by more than 100× compared to five years ago.

In January 2026, Zama successfully conducted the world’s first confidential ICO (sealed-bid Dutch auction) on Ethereum mainnet, validating scalability in a production environment. On January 24, the auction application became the highest-transaction-volume application on Ethereum, surpassing USDT and Uniswap.

$ZAMA is the project’s native utility token, with a total supply of 11 billion tokens. It is primarily used to pay for network encryption/decryption fees, stake to maintain protocol security, and participate in ecosystem governance. Between 2024 and 2025, the project raised a total of $130 million across two funding rounds, backed by top-tier institutions such as Multicoin Capital and Pantera Capital, with a post–Series B valuation exceeding $1 billion. The mainnet launched in late 2025 and focuses on driving adoption in privacy-sensitive scenarios such as confidential stablecoins and RWA tokenization.

II. Project Highlights

Cryptography’s “Holy Grail” and Standard-Setting Leadership

Zama focuses on Fully Homomorphic Encryption (FHE), which is widely regarded as the ultimate goal of cryptography, enabling computation directly on encrypted data. The TFHE-rs and fheVM developed by Zama have become de facto industry standards, attracting ecosystem partners such as OpenZeppelin and Conduit to integrate with them. This deep foundational technology advantage creates an exceptionally strong moat, making Zama irreplaceable within the privacy sector.

Innovative Confidential Token Auction Model

Zama completed the first confidential sealed-bid Dutch auction using its self-developed protocol. Bid amounts were encrypted via FHE, ensuring fairness in price discovery and completely eliminating bot sniping, gas wars, and copy trading. This auction (January 21–24, 2026) attracted 11,103 independent bidders, with total committed funds reaching $118.5 million, a clearing price of $0.05 per ZAMA, and 218% oversubscription, proving strong market demand for privacy infrastructure.

Top-Tier Capital Backing and High-Valuation Recognition

Zama has raised a total of $130 million to date. Its Series A round (March 2024, $73 million) was co-led by Multicoin Capital and Protocol Labs, while its Series B round (June 2025, $57 million) was co-led by Pantera Capital and Blockchange Ventures, pushing valuation beyond $1 billion. Investors include Anatoly Yakovenko (founder of Solana) and Gavin Wood (founder of Polkadot), reflecting strong capital market confidence in FHE as the ultimate blockchain privacy solution.

Real-World Validation and Scalability Breakthroughs

Zama’s auction application reached $121 million in Total Shielded Value (TVS) within three days, surpassing the scale accumulated by other Ethereum privacy protocols over many years. Through GPU acceleration and planned dedicated hardware (FPGA/ASIC), Zama aims to increase throughput to thousands of transactions per second, supporting financial-grade privacy use cases such as confidential DeFi and RWAs, laying the foundation for large-scale adoption.

III. Market Capitalization Outlook

Zama raised $130 million across two funding rounds, with the latest valuation exceeding $1 billion (based on Series B equity financing). The token auction clearing price was $0.05, corresponding to a Fully Diluted Valuation (FDV) of $550 million (11 billion total supply × $0.05).

Market Capitalization Analysis

Baseline Estimate

Funding-to-FDV ratio: $130 million in funding versus $550 million FDV, resulting in a ratio of 0.236×, which falls within a reasonable range for early-stage high-growth technology projects (reference: typical Web3 funding ratios of 0.2×–0.5×).

Conservative Scenario ($0.5–1.0B FDV)

Referencing peers such as Mind Network (FDV ~$125M) and assuming cautious market expectations regarding FHE adoption speed, FDV may remain near the auction clearing price range.

Neutral Scenario ($1.1–3.0B FDV)

Reflects alignment with the $1 billion equity valuation and $130 million funding scale. As mainnet applications (such as cUSDT) gain adoption and listings on major exchanges (e.g., Binance Pre-Market ZAMA futures) occur, FDV may benchmark equity valuation and expand by 2–3×.

Optimistic Scenario ($5.0B+ FDV)

If Zama realizes the “blockchain HTTPS” narrative and becomes the privacy infrastructure layer for major chains such as Ethereum and Solana, FDV could benchmark top-tier L2 projects (e.g., Arbitrum with ~$15B FDV) and exceed $5 billion. A vertical reference case is Render (FDV ~$12.6B), demonstrating that specialized infrastructure can command premium valuations.

IV. Tokenomics

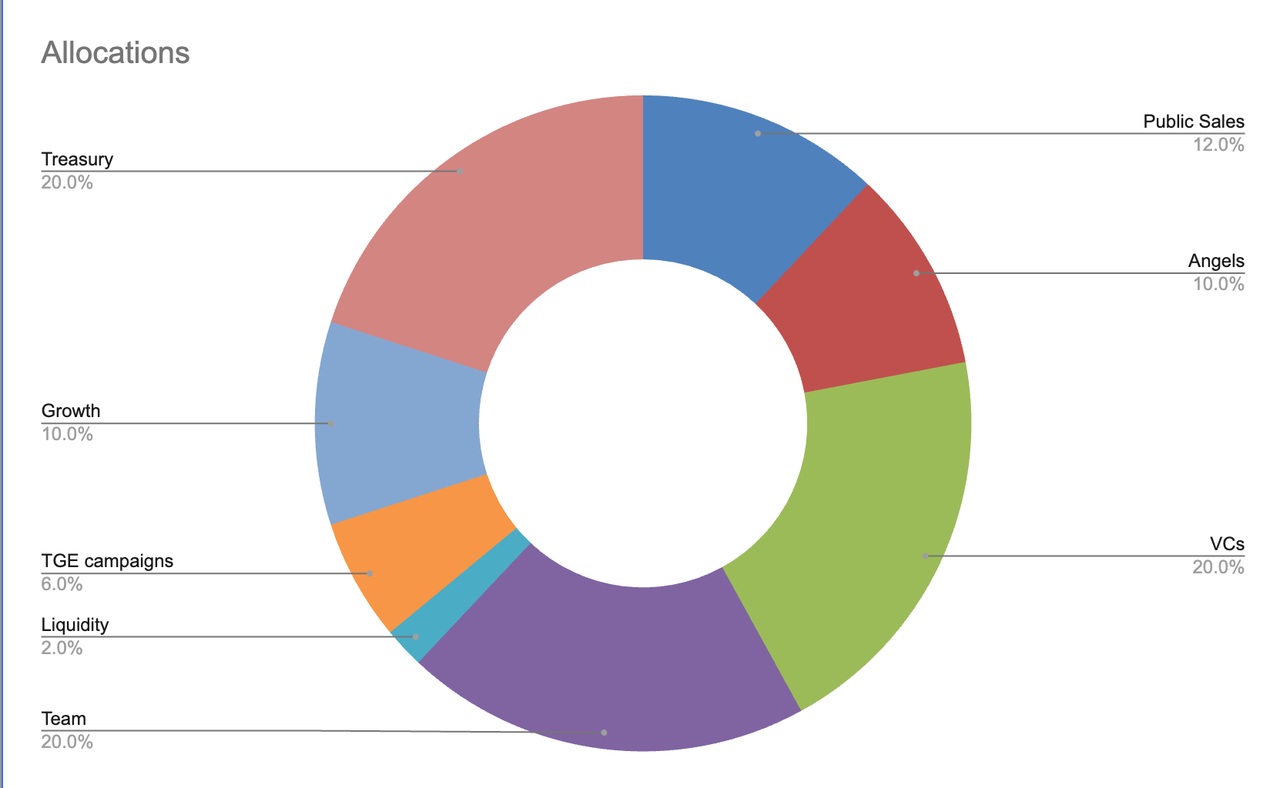

The total supply of $ZAMA is 11 billion tokens. Based on publicly available information, the allocation breakdown is as follows:

Public Sale (12%, 1.32B tokens)

-

Public Auction (8%, 0.88B): issued via sealed-bid Dutch auction at a clearing price of $0.05

-

Community Sale (2%, 0.22B): priority allocation for Zama OG NFT holders (5,500 users) at the auction floor price

-

Pre-TGE Sale (2%, 0.22B): fixed-price subscription at $0.05 for users not filled in the auction

-

Note: Public sale tokens are 100% unlocked at TGE on February 2, 2026

Treasury: 20%, for long-term operations and ecosystem reserves

Team: 20%, allocated to the core development team

VCs: 20%, allocated to institutional investors

Angels: 10%, early supporters and angel investors

Growth: 10%, for marketing and partnerships

TGE Campaigns: 6%, incentives related to the token generation event

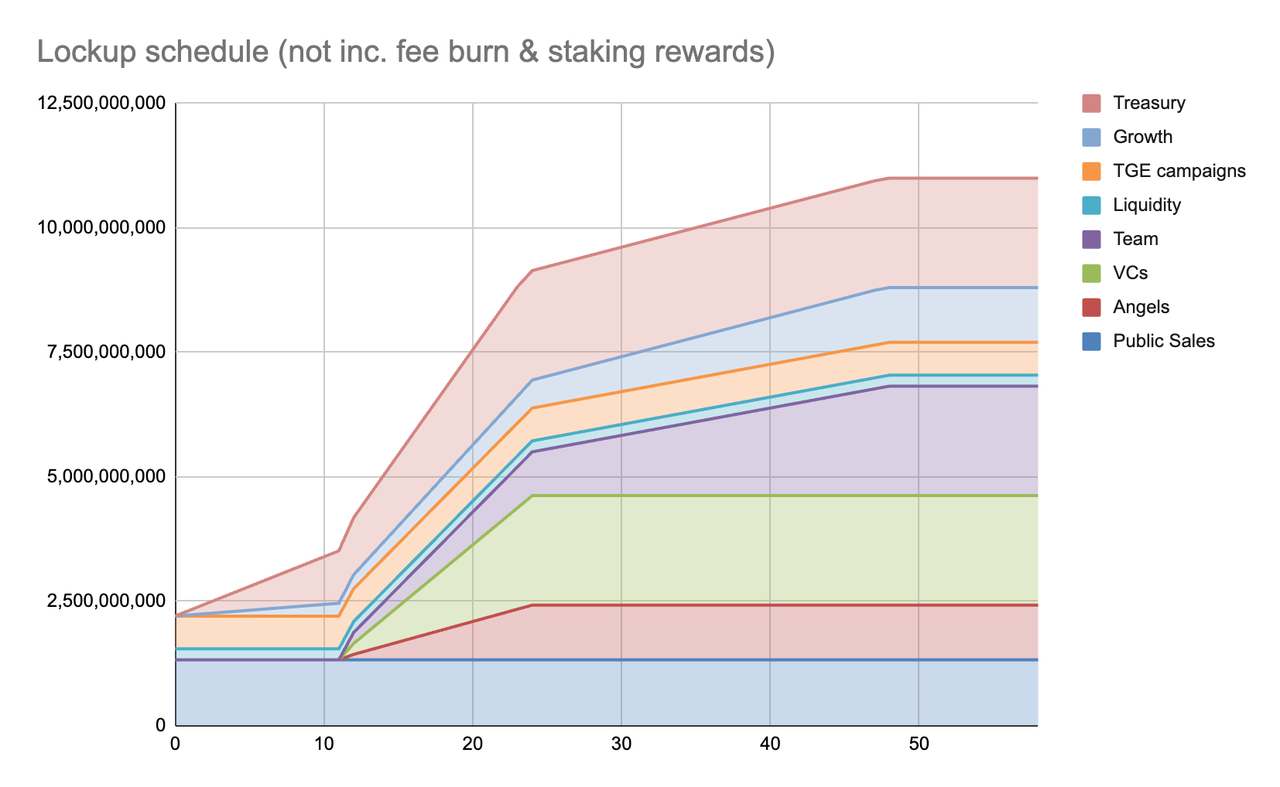

Token Unlock Schedule

TGE (Initial Release)

Initial circulating supply at Month 0 consists of Public Sales, TGE campaigns, Liquidity, and partial Treasury and Growth allocations, totaling approximately 2.25 billion tokens.

Public Sale Tokens

Public sale tokens are fully unlocked at launch (shown as a flat line in the chart).

Month 12: Major Unlock Point

From Months 11–12 onward, most core allocations enter the vesting phase. Team, VCs, and Angels tokens were previously under a cliff and begin rapid linear release after Month 12.

Key Milestones

-

Month 24: VCs and Angels allocations largely complete unlocking

-

Months 48–50: Team, Treasury, and Growth allocations fully unlocked

At this point, total supply reaches approximately 11 billion tokens (excluding fee burns and staking rewards).

Token Utilities

-

Protocol fees: payment for encrypted computation, storage, and decryption

-

Staking rewards: users stake tokens with node operators to secure the network

-

Governance voting: participation in protocol upgrades and ecosystem funding

-

Value capture: benefits directly from growth in confidential transaction volume (e.g., cUSDT transfers)

V. Team and Funding Information

Core Team

-

Rand Hindi, Co-founder & CEO: PhD in Computer Science and Bioinformatics from UCL; founder of Snips (successfully acquired); over 20 years of programming and AI/fintech entrepreneurship experience.

-

Pascal Paillier, Co-founder & CTO: world-renowned cryptographer, co-inventor of the Paillier encryption scheme; over 25 years of FHE research experience; holder of 25 patents.

-

Jeremy Bradley-Silverio Donato, COO: responsible for operations and strategy; former senior executive at multiple technology companies.

Funding Overview

Total funding: $130 million

-

Series A (March 7, 2024): $73 million, led by Multicoin Capital and Protocol Labs; participants included Blockchange Ventures, Anatoly Yakovenko, Gavin Wood, Juan Benet, Metaplanet, and Vsquared Ventures.

-

Series B (June 25, 2025): $57 million, led by Blockchange Ventures and Pantera Capital. Post-round valuation exceeded $1 billion, officially making Zama a crypto unicorn. Funds are primarily used to expand the cryptography R&D team (100+ staff, including 37 PhDs) and accelerate FPGA/ASIC development.

VI. Potential Risk Factors

Token Selling Pressure Risks

1. Initial Phase (0–12 Months): Moderate Growth Period

-

Circulating supply mainly consists of Public Sales (12%), TGE Campaigns (6%), and Liquidity (2%).

-

Primary selling pressure comes from public sale participants taking profits.

-

Team, VCs, and Angels remain under a 12-month cliff, resulting in relatively limited sell-side pressure.

2. First Major Selling Pressure Peak: Month 12

-

Institutional unlocks: VCs (20%), Angels (10%), and Team (20%) begin releasing simultaneously.

-

Massive supply increase: approximately 6.25 billion tokens enter circulation between Months 12–24.

-

Cost advantage: early investors have very low cost bases and strong incentives to realize profits.

3. Second Selling Pressure Peak: Months 24–48

-

Institutional and angel allocations largely completed.

-

Selling pressure shifts to Team and Treasury allocations.

-

Growth tokens continue linear release until Month 48, introducing inflation but often accompanied by ecosystem expansion expectations.

VII. Official Links

Website: https://www.zama.ai

Documentation: https://docs.zama.org

X (Twitter): https://x.com/zama

GitHub: https://github.com/zama-ai/fhevm

Auction Dashboard: https://dune.com/zama_fhe/zama-public-auction

Disclaimer: This report is generated by AI and manually reviewed. It does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The share value of Deckers Outdoor, the company behind Hoka and UGG, is surging today. This is the reason.

Corcept shares tumble after FDA letter reveals warnings before drug rejection

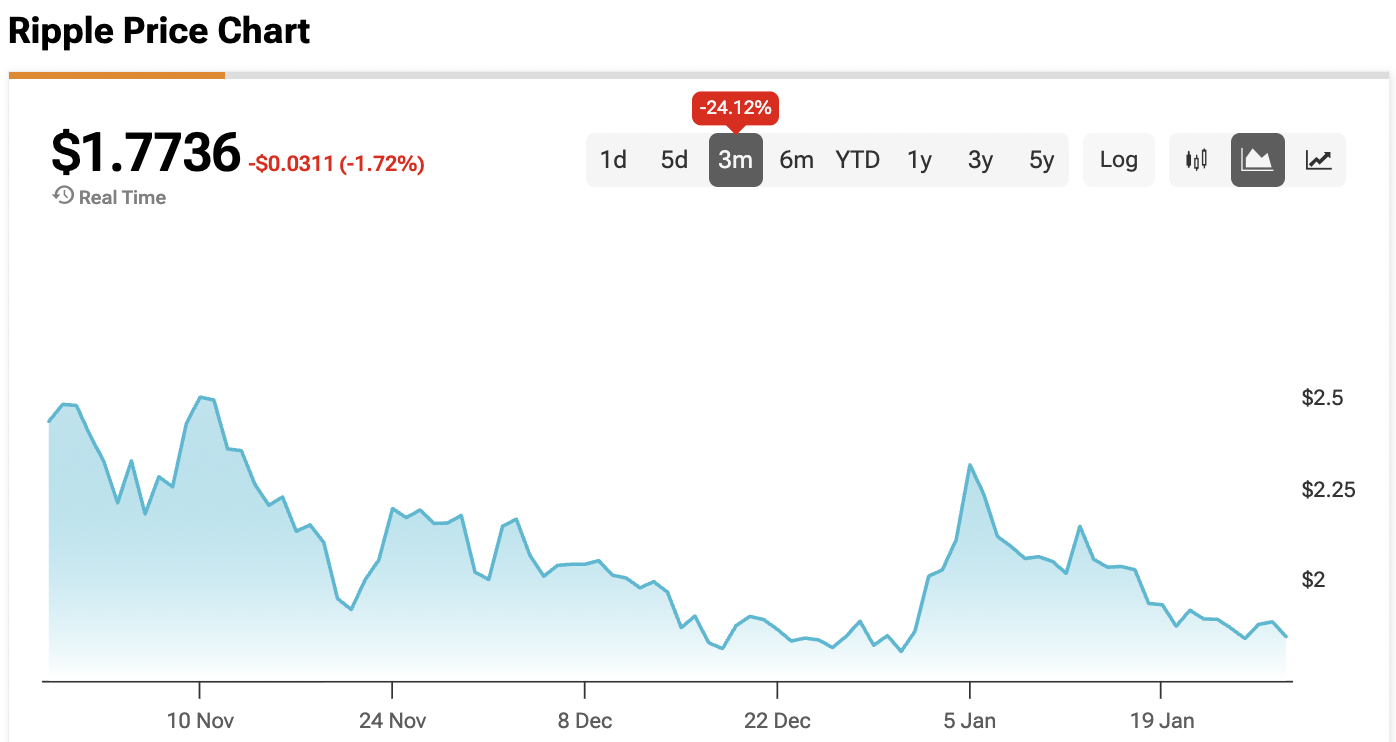

Why the $1 Billion Ripple-GTreasury Deal Matters for XRP Holders