- Gold sees a record $5.5T intraday swing as volatility jumps beyond 2008 crisis levels.

- Crypto drops sharply with $1.71B in liquidations as Bitcoin falls briefly below $82K.

- ETF outflows and Fed policy shifts deepen market stress before prices stabilize overnight.

Global markets absorbed one of their most jarring sessions in recent memory on January 29, 2026, as a wave of volatility tore through assets usually seen as anchors in uncertain periods. Gold led the disruption with a surge to new highs before a sudden air pocket in liquidity sent prices tumbling into the $5,100–$5,200 range.

The drop erased more than $3 trillion in value in under an hour. However, by the close, the metal had clawed back roughly $2.3 trillion, producing a swing so large that even veteran analysts struggled to place it in historical context. For many traders, the episode felt like a collision of profit-taking, tense geopolitics, and a thinning order book at precisely the wrong moment.

Silver, which often tracks the broader metals mood, echoed the chaos with a slide from $121 to $106 before bouncing back toward $117. Regardless, markets eventually steadied early the next morning, though the atmosphere remained uneasy.

A Reversal Without Modern Precedent

Analysts at The Kobeissi Letter, who track daily flows and cross-asset stress points, described the move in gold as one of the sharpest intraday reversals they had ever recorded. Their breakdown showed a $3.2 trillion evaporation between 9:30 and 10:25 a.m. ET, roughly $58 billion a minute, followed by an equally abrupt recovery.

Source: X

While plenty of dramatic sessions occupy market lore, this one pushed volatility readings past levels seen during the 2008 crisis. That comparison underscored the intensity of positioning in assets normally considered a haven during geopolitical flare-ups.

Meanwhile, Silver provided little relief for investors seeking a calmer read on sentiment. Its wide arc through the session, swinging more than $15 at the lows, reinforced the feeling that liquidity was simply too thin to absorb heavy orders without causing dislocation.

Crypto Liquidations Amplify the Shock

The disruption didn’t stay confined to metals. Stress spilled quickly into digital assets, where leverage tends to act as an accelerant. More than $1.71 billion in long positions across the crypto market were wiped out as automated liquidations kicked in.

Source: CoinGlass

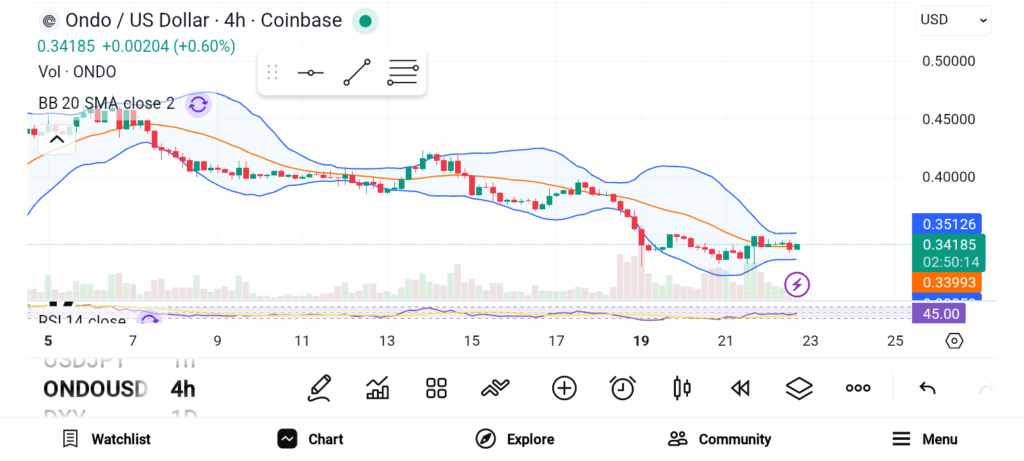

Bitcoin, which had been attempting to hold higher ranges earlier in the week, broke briefly below $82K and liquidated about $786 million in value during peak selling pressure. As a result, board-wide declines appeared on market heat maps.

Bitcoin went down more than 7% on the day, while Ethereum slipped nearly 9%. Analysts reviewing the tape later noted that little of the move stemmed from token-specific developments. The selling was largely structural: too much leverage meeting too little liquidity at once.

Defensive Positioning and Policy Headwinds

Fundamentally, the tone among institutional investors has turned noticeably more cautious. Spot Bitcoin ETFs saw roughly $1.08 billion in net outflows over the past five sessions. While not a panic signal, it hinted at fatigue after weeks of elevated volatility.

Source: SoSoValue

With forced liquidations still echoing through the system, the absence of steady inflows left the market to fend for itself. Policy developments added another complication. The Federal Reserve’s choice to pause rate cuts removed the liquidity narrative that had supported risk appetite across several asset classes.

Meanwhile, geopolitical unease, particularly renewed U.S.–Iran tension, fed into a defensive tilt. Traders were also watching speculation that former Fed Governor Kevin Warsh, known for a more hawkish stance, could emerge as a candidate for Fed Chair.

Related: WLD Extends Rally With 15% Jump as OpenAI Explores Proof of Personhood

Long-Term Outlook Remains Intact

Despite the turbulence, long-term views on gold remain largely unchanged among major banks. JPMorgan reiterated its expectation that prices could eventually push beyond $8,000, citing persistent inflation pressures. By early January 30, gold had drifted back toward $5,100, silver hovered near $106, and Bitcoin steadied above $82K.

Market analysts agreed on at least one point: both precious metals and crypto have entered a stretch where erratic intraday swings may become more common, shaped less by narratives and more by how liquidity reacts under stress.