A rumored OpenAI public offering expected later this year will gauge how much risk investors are willing to take amid the AI sector’s rapid cash burn.

OpenAI Eyes Late 2026 IPO Amid Investor Uncertainty

OpenAI is reportedly accelerating plans for a potential initial public offering (IPO) in the final quarter of 2026, a move that could gauge investor confidence in the ongoing artificial intelligence surge.

According to , the company has started informal discussions with major Wall Street banks and has brought on new financial leadership to lay the groundwork for going public. While OpenAI currently boasts a $500 billion valuation, it has indicated that profitability may not be achieved until 2030. The company did not immediately respond to Fortune's request for comment.

Investor Skepticism and Competitive Pressures

The timing of OpenAI’s potential IPO comes as some investors are beginning to question whether generative AI can deliver the returns needed to justify the enormous capital flowing into the sector. Despite the excitement around products like ChatGPT, there are growing doubts about whether AI firms can generate enough revenue to offset their substantial infrastructure expenses.

OpenAI may be considering a public debut before the year’s end to beat rival Anthropic to the market, as reported by The Journal. Anthropic has quickly attracted enterprise clients and has told backers it could reach break-even by 2028—two years ahead of OpenAI’s projections. This faster path to profitability could make Anthropic more appealing to investors. However, by listing first, OpenAI could capture significant demand from investors eager for pure AI plays, especially among retail participants.

Limited Public AI Investment Options

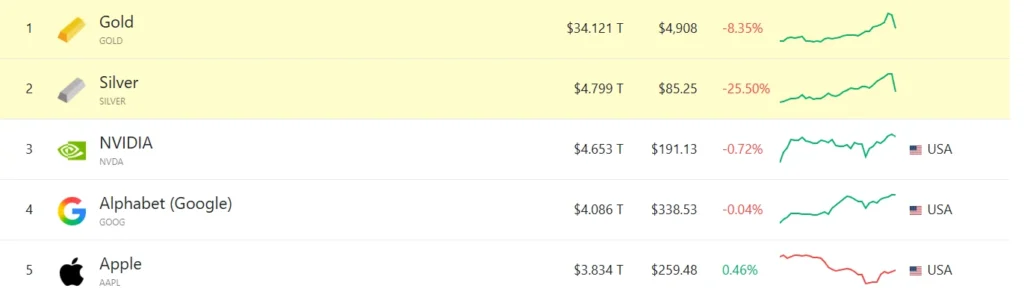

Currently, aside from AI chipmaker and a handful of “neocloud” firms like CoreWeave, there are few publicly traded companies focused solely on AI. Most investment opportunities in the AI space have come through large tech companies such as and , whose AI initiatives are integrated with their established advertising, cloud, and software businesses.

Massive Spending and Fundraising Efforts

Reports of OpenAI potentially moving up its IPO timeline highlight the staggering sums being spent by AI firms to build the data centers necessary for training and running advanced models. OpenAI is said to have committed $1.4 trillion to data center investments by 2033. Despite raising around $64 billion so far and holding a $500 billion valuation, the company is actively seeking additional funding—reportedly aiming for another $100 billion at an $830 billion valuation, according to . An IPO would likely supplement, not replace, these fundraising efforts.

Profitability Challenges and Comparisons

OpenAI would not be the first company to go public while still operating at a loss. , for example, remained unprofitable for years following its 1997 IPO as it focused on expansion. However, OpenAI’s annual cash burn is on a much larger scale. estimates that OpenAI could face a $207 billion funding gap by 2030, even if it generates $213 billion in revenue by then.

What an IPO Could Mean for OpenAI and the AI Sector

If OpenAI manages to go public while still incurring significant losses and burning through billions, it would suggest that enthusiasm for AI remains strong. Conversely, if the IPO falters or is repriced, it could indicate that investors are becoming wary of hype that isn’t backed by solid financials.

Talent Retention and Recruitment

The prospect of an IPO may also be a strategic move to retain and attract talent. Employees may be less likely to leave with the promise of soon-to-be-liquid shares, and new hires could be enticed by the opportunity to receive stock that could be sold shortly after the company goes public.

Risks of Going Public

- Public companies must disclose more detailed financial information and spending habits.

- Shareholders will expect regular quarterly updates, which could complicate OpenAI’s mission to develop “safe, beneficial AI.” CEO Sam Altman has expressed reservations about leading a public company.

- OpenAI may need to reveal more about the risks associated with its products, especially as it faces lawsuits and regulatory scrutiny over alleged psychological impacts of its chatbot.

- Compensation packages could become less attractive, as new employees would receive stock options instead of pre-IPO equity, with the value of those options dependent on post-IPO performance.

This article was originally published on .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market News Today: DeepSnitch AI’s $1.40M Presale Attracts Whales As BTC Market Cap Shrinks, ZCASH and ETH Prepare for Recovery

Why 2026 Could Be a Challenging Year for Both Those Seeking Jobs and Companies Looking to Hire

This year, hosting a Super Bowl party will set you back $140. Here’s how the expenses add up.

Analyst Claims Bitcoin May Have Reached Cycle Low at $77K Level