How will Waller reform the US monetary policy rules and the monetary policy implementation framework?

On January 30, 2026, Trump announced Kevin Warsh as the new Federal Reserve Chairman. This was somewhat unexpected, as he had previously been hawkish: he opposed QE, emphasized monetary policy soundness and policy rules, and advocated for deregulation. Now, he is also supporting rate cuts—clearly to cater to Trump.The market only became confident in Warsh’s selection in the last couple of days.

Warsh's connections may have played a role. His wife is a direct heir to the cosmetics giant Estée Lauder. His father-in-law, Ronald Lauder, was Trump’s classmate at Wharton Business School and was also the proposer for the purchase of Greenland.

However, as a serious person, I am not interested in his wife (her looks are only slightly better than Sanae Takaichi). What I care about is how he will revise America’s monetary policy rules, and how he will modify the framework for the implementation of monetary policy.

I. How will Warsh adjust monetary policy rules?

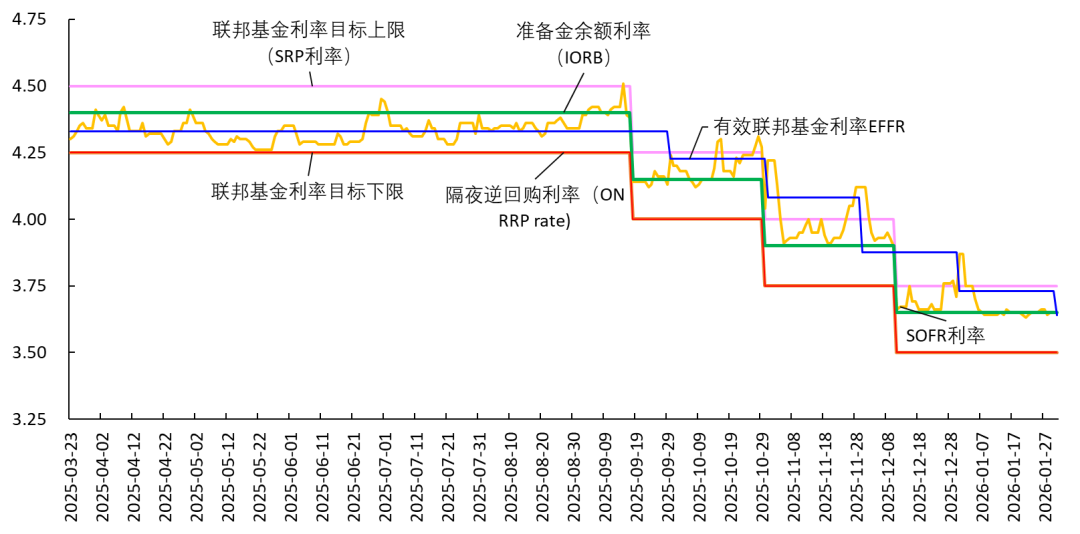

On December 14, 2025, Trump said: "Warsh believes interest rates must be cut." In reality, everyone knows it’s Trump who wants the rate cuts. In 2025, he spent the whole year calling for rate cuts. On August 14, 2025, he demanded a 3-4 percentage point cut, bringing the federal funds rate from 4.25–4.50% down to 1%.On January 29, 2026, he also said a 2-3 percentage point cut was needed.

However, I still expect only a one percentage point cut in 2026. I anticipate a 25BP cut on March 19, 50BP on June 18, and another 25BP on July 30 (see details).

But the problem is, the Federal Reserve has always determined the federal funds rate based on the neutral interest rate (see details). According to the current US neutral rate, just a 25BP cut is needed in both 2026 and 2027 (). That’s why I said in September 2025 that this rate-cutting cycle would be very slow ().

If Warsh cuts rates by 100BP in 2026, it would mean breaking previous rules and, in the absence of a significant rise in unemployment and with core PCE clearly above 2%, allowing the US real interest rate to fall well below the neutral rate, shifting monetary policy from a neutral to an accommodative stance. Considering that the Fed and the FOMC are also an ecosystem, he is capable of this. However, this means convincing others at the Fed to adjust policy rules, and such changes will undoubtedly have a major impact on monetary policy, market expectations, and expectation management in the coming years—worthy of our attention.

A significant rate cut would undoubtedly support the US economy and asset prices. But why did gold, silver, and US stocks plummet on January 29-30? Perhaps it’s because Warsh wants to reduce the Fed's balance sheet while cutting rates. This involves the issue of the monetary policy implementation framework.

II. How will Warsh revise the monetary policy implementation framework?

1. The current monetary policy implementation framework

In January 2019, after years of successful implementation and extensive review, the FOMC officially adopted the "ample-reserves implementation framework". For more on this framework, see the following articles:

The FOMC defines this framework as "primarily exercising control over the federal funds rate and other short-term rates by setting the Fed's administered rates, without the need for active management of reserve supply". Therefore, the reserve supply must be large enough to meet demand on most days.

This framework can successfully control policy rates and effectively transmit them to other money market rates and broader financial conditions under various circumstances. In recent years, it has worked fairly well.

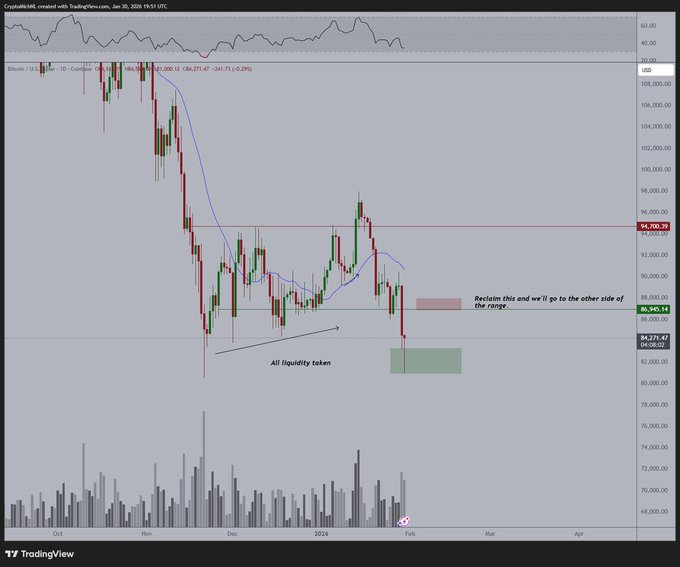

Between 2020 and 2021, in response to the pandemic, the Federal Reserve massively expanded its balance sheet, causing it to balloon rapidly. In June 2022, it began quantitative tightening again. By October 14, 2025, reserves were about to reach the ample level, so balance sheet reduction might stop in the coming months. The October 30, 2025, decision was to stop QT starting December 1. Subsequently, at the December 10, 2025, FOMC meeting, it was believed that as reserves would fall sharply by mid-to-late April 2026, "Reserve Management Purchases (RMPs)" would begin in mid-December to continuously maintain an ample reserve level (see details).

In other words, the Fed and the FOMC have a complete, mature, and well-functioning implementation framework for deciding when to expand or shrink the balance sheet, to what extent, when to carry out Reserve Management Purchases, and what kind of open market operations to use to regulate money market rates. It’s not arbitrary. The usual workflow is: New York FedSystem Open Market Account (SOMA) staff monitor the market and decide what policy to take, then report to the New York Fed, which then reports to the Fed. At each FOMC meeting, the SOMA manager briefs on market conditions and offers policy recommendations for discussion and voting, forming a resolution. The final resolution is sent back to the New York Fed for implementation. This set of rules has worked well in recent years.

2. If Warsh shrinks the balance sheet, the monetary policy implementation framework needs to be revised

Warsh believes that US inflation is related to the previous large-scale expansion of the balance sheet, so liquidity needs to be withdrawn by shrinking the balance sheet to curb inflation.

However, this practice contradicts the Fed's current implementation framework. As previously mentioned, under the current framework, QT stopped on December 1, 2025, and "Reserve Management Purchases (RMPs)" began to meet daily liquidity needs. If balance sheet reduction is carried out rashly, it will inevitably lead to insufficient reserves and rising money market rates.

Figure 1: The Federal Reserve’s Interest Rate System

Therefore, Warsh must first design a new monetary policy implementation framework to smoothly replace the current one. This is no easy task. He must first convince everyone of the flaws in the current framework, then propose his own, and then go through lengthy discussions and evaluations before it can be implemented. I estimate that by the time it’s operational, Trump will have gone home to enjoy his grandchildren.

I estimate that right now, everyone at the New York Fed, from President John C. Williams to SOMA ManagerRoberto Perliare secretly worried, knowing the current framework works well, but Warsh insists on shaking things up as the new boss.

III. If Warsh wants to "have it both ways," interest rate and asset price volatility may increase

Shrinking the balance sheet means tightening liquidity in the money market and rising interest rates, implying the central bank will reduce bond purchases, pushing up Treasury yields. But rate cuts mean a lower federal funds rate target—wanting both is essentially a contradiction.

In effect, rate cuts help stimulate the economy and asset prices, and will lift inflation; shrinking the balance sheet withdraws liquidity from the market, suppressing asset prices. But doing both is like walking a tightrope. If not careful,it may artificially amplify interest rate and asset price volatility. The drop in US stocks, gold, and silver on January 29-30 was partly due to market concerns about balance sheet reduction.

Currently, we don't know what Warsh intends to do. Of course, after he takes office, he may just follow Trump’s instructions and cut rates, while abandoning his previous view and not shrinking the balance sheet. That would be the easiest. Otherwise, I’d have to learn their new framework.

Let’s pay close attention to his upcoming speeches!

By the way, we should also watch to see if Mr. Powell, when his term ends on May 15, will resign from the Board of Governors (his term as governor ends January 2028). After all, if he stays, other governors may be embarrassed to express their feelings to the new chair.

Some senators on the Senate Banking Committee are preparing to obstruct Warsh’s confirmation. Let’s wait and see.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What “Early” Really Means in Crypto — And Why Bitcoin Everlight Fits the Profile

Microsoft Stock Plunge Wipes Out $357 Billion Market Cap

Bitcoin Eyes $100K as Oversold Signals and Whales Return