Bitcoin And Ether ETFs Record $1.82 Billion Outflows During Precious Metals Rally

US-based Bitcoin and Ether exchange-traded funds recorded $1.82 billion in outflows over five trading days. This occurred as precious metals reached all-time highs.

reports that spot Bitcoin ETFs lost $1.49 billion between Monday and Friday. Spot Ether ETFs saw $327.10 million in net outflows during the same period. The withdrawals coincided with continued price declines for both cryptocurrencies.

Bitcoin fell 6.55% over seven days, trading at $83,400. Ether dropped 8.99%, reaching $2,685. The outflows came despite a brief rally on January 14, when Bitcoin ETFs recorded their highest 2026 inflow day at $840.6 million.

Institutional Sentiment Shifts Toward Precious Metals

The outflows represent a rotation of capital into traditional assets. Gold and silver both reached record highs this week. Gold touched $5,608 per ounce while silver hit $121 before retreating.

ETF analyst Eric Balchunas stated the negativity around Bitcoin's recent performance is short-sighted. He noted Bitcoin performed well in 2023 and 2024. reported Bitcoin ETFs lost a record $4.57 billion over November and December 2025 combined.

The December-to-January period saw sustained selling pressure. As we previously documented, governments worldwide have explored Bitcoin reserve strategies. However, retail and institutional investors currently favor traditional safe havens.

Digital Gold Narrative Faces Reality Test

Bitcoin's positioning as digital gold faces challenges in 2025. notes the asset failed to capture safe-haven flows during geopolitical uncertainty. The precious metals rally absorbed capital that many analysts expected would flow to cryptocurrency.

Research shows gold and silver exhibit more consistent safe-haven behavior across different market shocks. Bitcoin continues to trade as a high-beta risk asset. Central banks purchased 53 tonnes of gold in October 2025 alone.

The divergence reveals how markets classify these assets differently. Gold offers institutional credibility and established reserve status. Bitcoin requires specific conditions to outperform, including regulatory clarity and improved risk appetite. The two assets may coexist rather than compete directly for the same capital flows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

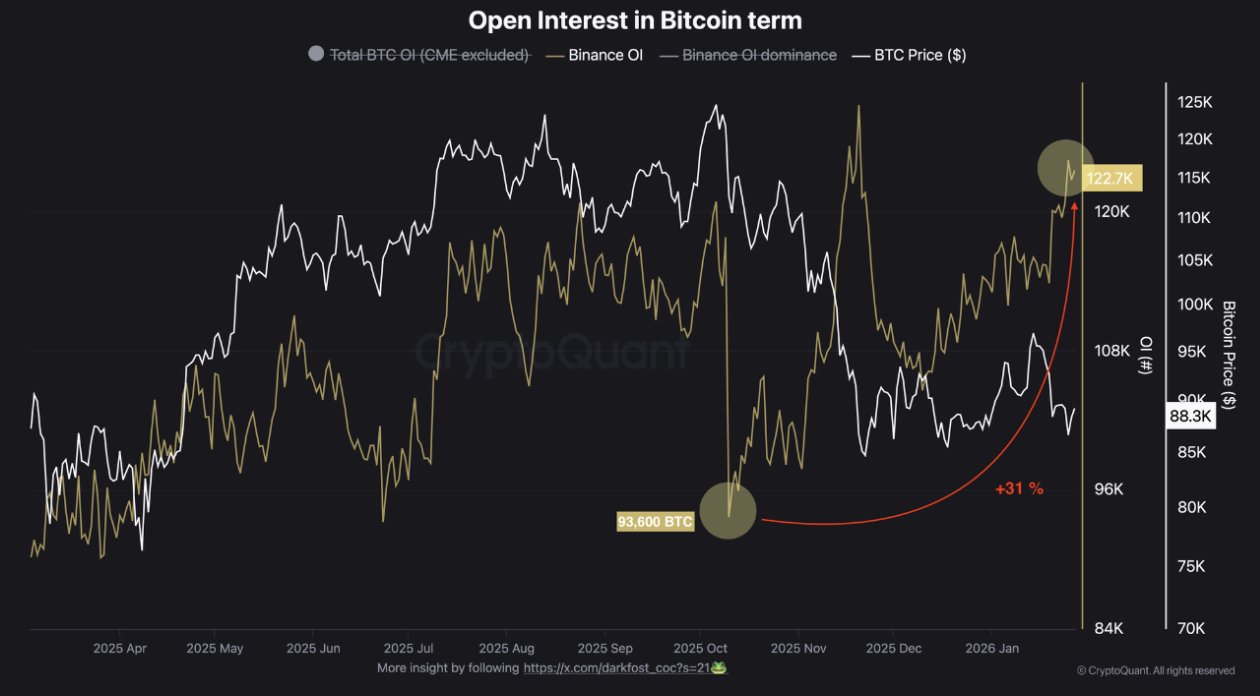

Bitcoin’s leverage builds – Will BTC see a volatility breakout ahead?

ZKP’s $5M Prize Pool Rewards 10 Fortunate Participants as BCH and SHIB Signal Potential Recovery

Gold and silver’s $7 trillion plunge serves as a harsh reminder of the dangers of risk

Is LivLive the Best Crypto Presale to Invest in 2026? Experts Weigh In Amid the Market Crash