The recent succession of the new Federal Reserve Chairman has coincided with a rising possibility of the United States engaging in a conflict with Iran. These developments unfold in an environment where macroeconomic factors do not favor continued interest rate cuts, and President Trump is likely to lose majority control in the upcoming midterm elections. Amidst these unsettling conditions for cryptocurrencies, a new fear, uncertainty, and doubt (FUD) surround Binance, adding further tension to the digital currency realm.

Why Are Cryptocurrencies Falling?

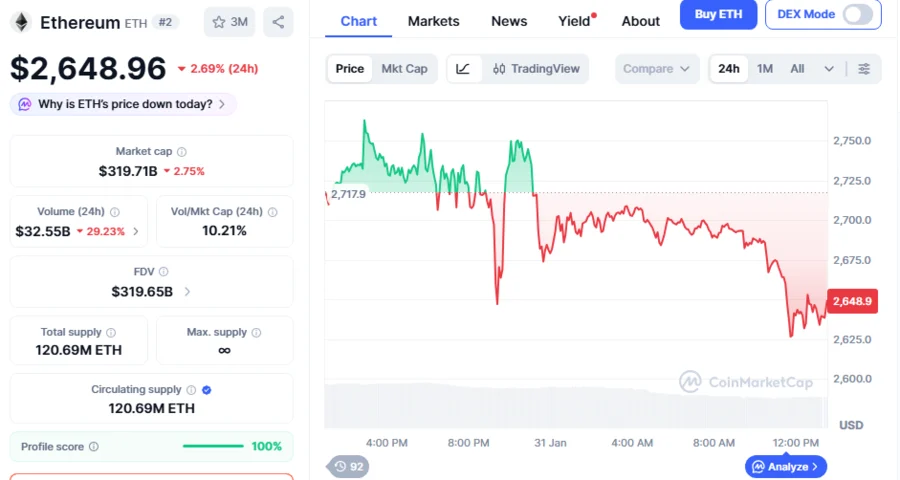

After Bitcoin’s unsuccessful attempt to test the $98,000 mark, there are speculations that it might break its narrow trading range by establishing deeper lows. In evaluations earlier this week, it was suggested that the new Fed chairman is unlikely to take a position in favor of quantitative easing (QE) amidst a backdrop of growing geopolitical risks. A potential test of the $76,000 level over the weekend was also predicted, as the Binance FUD was gaining traction at that time.

As expected, Bitcoin’s price is currently experiencing a significant downturn. Having fallen to its lowest levels since October 2023, it has slipped below the cost level marked by BTC Strategy. Furthermore, it has dropped beneath the estimated $82,000 cost level of ETFs. If the $81,000 and $83,000 levels are not reclaimed, Bitcoin might descend to the $56,000 region, as projected by various analysts.

The precarious state of Bitcoin reflects wider volatility in the cryptocurrency market. Investors are wary of macroeconomic uncertainties, alongside specific factors influencing major digital assets. As market dynamics continue to be influenced by geopolitical tensions and macroeconomic policy shifts, cryptocurrencies face a significant decline.

The crypto market‘s current state exemplifies the complexities and interconnections between traditional financial frameworks and digital currencies. These developments are reshaping investors’ expectations and strategic decision-making regarding the future of cryptocurrencies.

In navigating this turbulent phase, stakeholders are closely monitoring market indicators, geopolitical developments, and institutional movements that might dictate the trajectory of digital assets.

Ultimately, the unfolding events underscore the inherent volatility of the crypto space and the diverse external factors that can precipitate dramatic price shifts.