Rising Above The Ashes: XRP ETFs Set New Record

Despite a major outflow just a day earlier, Spot XRP ETFs have defied bearish sentiment, setting record trading volumes and attracting fresh inflows. This resilience and surge in investor demand is particularly surprising given the recent crash in the XRP price and the overall downturn in the broader crypto market.

XRP ETFs Defy Trends And Hit Record Volume

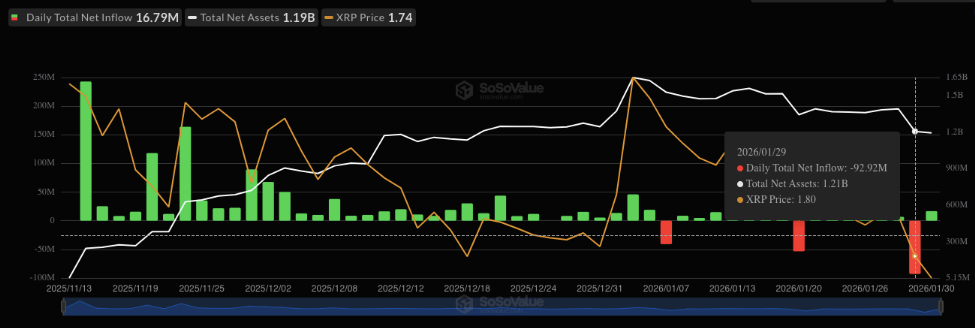

XRP is making headlines after its ETF experienced fresh inflows following a significant outflow. According to data from SoSoValue, XRP ETFs saw a record $92.9 million drop on January 29, 2026. This marked the largest reduction since their launch on November 13, 2025.

Since becoming available for trading, XRP ETFs have registered only three outflows, with the recent $92.9 million decrease being the third. This withdrawal was primarily driven by Grayscale’s GXRP, which saw a whopping $98.39 million leave the fund, partially offset by inflows into Franklin Templeton’s XRPZ, Bitwise’s XRP ETF, and Canary’s XRPC.

At the time of the outflow, the total net assets of XRP ETFs fell to $1.21 billion from $1.39 billion the day earlier. The decline coincided with a drop in XRP’s price, which fell from $1.92 to $1.80 over 24 hours. Unexpectedly, XRP ETFs picked up just a day after the $92.9 million withdrawal. They recorded a daily total net inflow of $16.79 million, although total net assets still declined slightly to $1.19 billion.

XRPUSD now trading at $1.69. Chart:

TradingView

XRPUSD now trading at $1.69. Chart:

TradingView

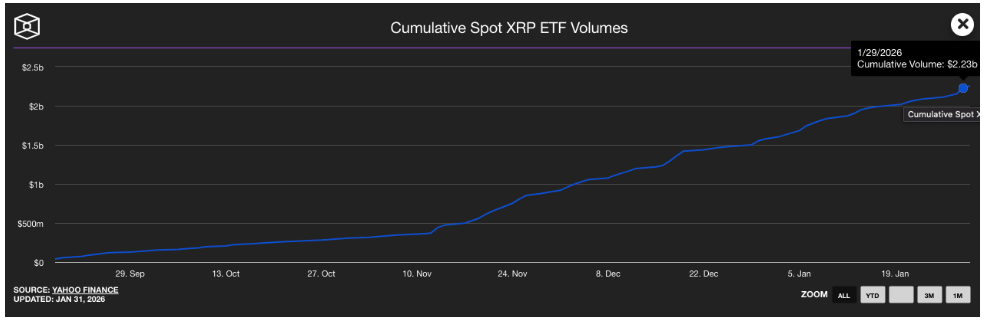

More impressively, Spot XRP ETFs achieved record trading volumes despite the overall downtrend. Data from The Block shows that XRP ETFs saw their cumulative volume rise to $2.23 billion from $2.15 billion just one day after the $92.9 million daily outflow. Reports indicated that Bitwise’s XRP ETF had the highest trading volume at the time, followed by Grayscale’s GXRP, Franklin Templeton’s XRPZ, Canary’s XRPC, and 21Shares TOXR, in that order.

In terms of total Assets Under Management (AUM), XRP ETFs declined slightly, falling from $1.48 billion to $1.32 billion following the January 29 outflow.

XRP Price Continues Slide Amid Market Uncertainty

While XRP ETFs are recovering from recent outflows, the cryptocurrency’s price continues to decline, extending its losses from earlier this year. According to CoinMarketCap, XRP has dropped by more than 11% over the past week and a little over 3% in the last 24 hours. Following this decline, its price now sits around $1.69, representing a more than 15% fall from its $2 level seen just a few weeks ago.

XRP’s daily trading volume is also down by more than 26.6% at the time of writing, indicating a potential decline in trader confidence and growing uncertainty in the market. Supporting this trend, XRP’s Fear and Greed Index has fallen into the “Fear” zone. The broader crypto market is showing similar weakness, with the index signaling extreme fear across major digital assets.

Featured image from Unsplash, chart from TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big Bull Cathie Wood Names Three Altcoins During the Downturn

Bitcoin Hyper Price Prediction: Nubank Enters US Market, and Ethereum Cuts Costs, but DeepSnitch AI Is the Best AI Crypto Coin to Buy Now

How decentralized AI training will create a new asset class for digital intelligence

Solana DeFi platform step finance hit by $27 million treasury hack as token price craters