Match Group (MTCH) Set to Announce Earnings Tomorrow: What You Should Know

Match Group Set to Announce Earnings: What Investors Should Know

This Tuesday after market close, Match Group (NASDAQ: MTCH), the company behind popular dating apps, is scheduled to release its latest financial results. Here’s a preview of what to look for.

Recent Performance Overview

In the previous quarter, Match Group’s revenue reached $914.3 million, marking a modest 2.1% increase compared to the same period last year. However, the company faced challenges, as its revenue outlook for the upcoming quarter fell short of analyst projections, and EBITDA figures also missed expectations. The platform reported a user base of 14.53 million, reflecting a 4.5% decline year over year.

Analyst Expectations for This Quarter

For the current quarter, analysts anticipate that Match Group’s revenue will rise by 1.3% year over year to $871.6 million, a slight improvement from last year’s flat performance. Adjusted earnings per share are forecasted at $1.02.

Market Sentiment and Analyst Revisions

Over the past month, analysts have largely maintained their forecasts for Match Group, indicating expectations of steady performance as earnings approach. Notably, the company has missed Wall Street’s revenue targets twice in the past two years.

Industry Peers: Recent Results

Several other consumer internet companies have already shared their fourth-quarter results, providing some context for Match Group’s upcoming report:

- Netflix posted a 17.6% increase in revenue year over year, surpassing analyst estimates by 0.7%. Despite this, Netflix shares dipped 2.2% after the announcement.

- Meta reported a 23.8% rise in revenue, beating expectations by 2.5%. Meta’s stock responded positively, climbing 10.6%.

For a deeper dive, you can read our full analysis of Netflix’s results and Meta’s results.

Stock Performance and Market Trends

Concerns over tariffs and changes to corporate tax policy have contributed to market volatility in 2025. While some consumer internet stocks have managed to perform well in these uncertain conditions, the sector as a whole has lagged, with share prices declining an average of 8.9% over the past month. Match Group’s stock has dropped 3.9% during this period. Heading into earnings, the average analyst price target for Match Group stands at $37.59, compared to its current price of $31.26.

Looking Ahead: Opportunities in Enterprise Software

Many younger investors may not be familiar with the classic investment strategies outlined in "Gorilla Game: Picking Winners In High Technology," a book published over two decades ago when Microsoft and Apple were emerging as industry leaders. Applying those same principles today, enterprise software companies harnessing generative AI could become the next dominant players. In line with this perspective, we invite you to explore our Special Free Report on a high-growth, profitable enterprise software stock that is capitalizing on automation and poised to benefit from the generative AI trend.

Should You Buy or Sell Match Group Ahead of Earnings?

Curious about whether Match Group is a good investment as earnings approach? Read our comprehensive analysis—free for active Edge members.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Derivatives data support deeper correction as SOL slips to $100

BNB Price Prediction: Weekly Test Sparks 80% Crash Fear

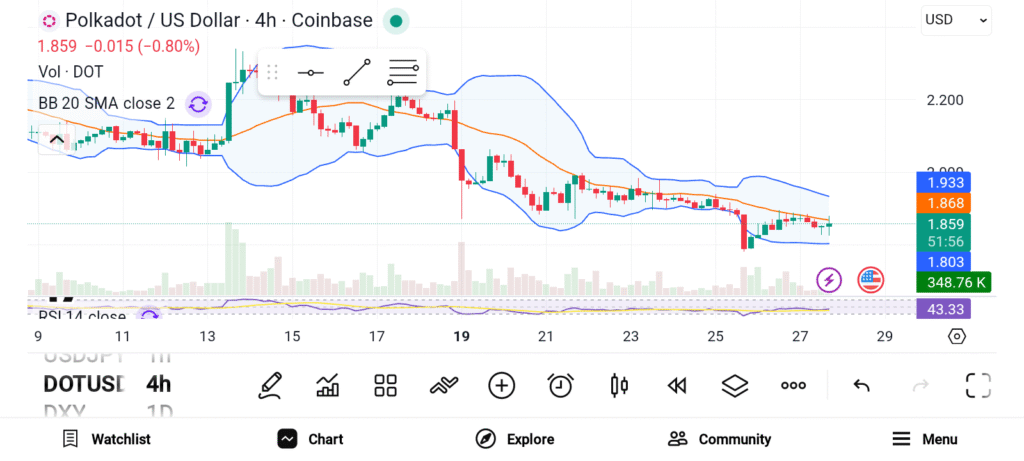

3 Altcoins to Accumulate in February — XMR, WLF, and DOT

Russia Increases Pipeline Gas Deliveries to Europe Through TurkStream