Q4 Overview: Comparing Westamerica Bancorporation (NASDAQ:WABC) with Other Regional Bank Stocks

Q4 Regional Bank Earnings: Highlights and Insights

As the latest earnings season wraps up, let's revisit some of the standout—and less remarkable—performances from the fourth quarter. This overview focuses on regional bank stocks, beginning with Westamerica Bancorporation (NASDAQ:WABC).

Understanding Regional Banks

Regional banks are financial institutions that primarily serve customers within specific geographic regions. They play a crucial role by connecting local savers and borrowers. These banks often benefit from higher interest rates, which can widen the gap between what they earn on loans and what they pay on deposits. Advances in digital technology have also helped them cut costs, while robust local economies can boost loan demand. However, regional banks face challenges such as competition from fintech firms, the risk of customers moving deposits to higher-yielding options, increased loan defaults during economic downturns, and the burden of regulatory compliance. Recent instability in the sector, including notable bank failures and significant exposure to commercial real estate, has added further pressure.

Q4 Performance Overview

Among the 95 regional banks monitored, fourth-quarter results were generally positive, with collective revenues surpassing analyst forecasts by 1.4%.

Following these results, share prices in the sector have remained stable, with an average increase of 2.5% since the earnings announcements.

Westamerica Bancorporation (NASDAQ:WABC)

Established in 1884, Westamerica Bancorporation serves communities from Mendocino County down to Kern County, offering a range of banking services to individuals and small businesses throughout Northern and Central California.

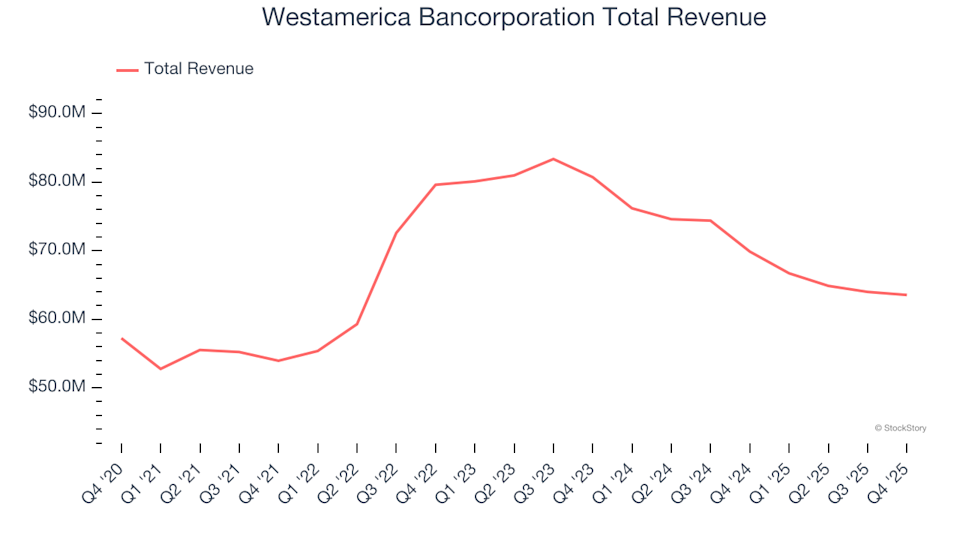

For the fourth quarter, Westamerica Bancorporation posted revenues of $63.55 million, representing a 9.1% decline compared to the previous year. Despite the drop, this figure was 2.7% higher than analyst projections. The company notably outperformed expectations in both net interest income and overall revenue.

Chairman, President, and CEO David Payne commented, “Our fourth quarter results were bolstered by our strong base of low-cost deposits, with 46% held in non-interest-bearing checking accounts. The annualized funding cost for our loan and bond portfolios was just 0.24% during the quarter. We maintained disciplined expense management, keeping operating costs at 40% of total revenues. As of December 31, 2025, nonperforming assets remained steady at $1.8 million, and our allowance for credit losses stood at $11.6 million.”

Westamerica Bancorporation experienced the slowest revenue growth among its peers, yet its stock price has risen 5.5% since the earnings release, currently trading at $51.18.

Top Performer: Merchants Bancorp (NASDAQ:MBIN)

Merchants Bancorp, headquartered in Indiana, focuses on low-risk, government-backed lending. The company specializes in multi-family mortgage banking, mortgage warehousing, and traditional banking services.

In Q4, Merchants Bancorp reported revenues of $185.3 million, down 4.4% year-over-year but surpassing analyst expectations by 7.8%. The quarter was particularly strong, with the company beating both EPS and net interest income estimates.

The market responded positively, with the stock climbing 21.9% since the earnings announcement to $42.60.

Biggest Miss: The Bancorp (NASDAQ:TBBK)

The Bancorp operates behind many well-known fintech platforms and prepaid cards, providing banking infrastructure and specialized lending solutions to fintech companies.

For the fourth quarter, The Bancorp generated $172.7 million in revenue, an 8.2% increase from the prior year but 11% below analyst expectations. The quarter was disappointing, with the company missing both tangible book value per share and revenue estimates by a significant margin.

As a result, the stock has dropped 11% since the earnings report and is now trading at $62.77.

First Hawaiian Bank (NASDAQ:FHB)

Founded in 1858, First Hawaiian is the oldest bank in Hawaii, offering a comprehensive suite of banking services—including deposits, loans, credit cards, and wealth management—across Hawaii, Guam, and Saipan.

First Hawaiian Bank reported Q4 revenues of $225.9 million, up 5.4% year-over-year and in line with analyst forecasts. The quarter was mixed, with a slight beat on tangible book value per share but EPS matching expectations.

The stock has declined 4.3% since the results were released and is currently priced at $26.38.

Fifth Third Bancorp (NASDAQ:FITB)

Fifth Third Bancorp, formed from the 1908 merger of Third National Bank and Fifth National Bank, delivers a range of financial services—including banking, lending, wealth management, and investments—across the Midwest and Southeast.

In the fourth quarter, Fifth Third Bancorp posted revenues of $2.35 billion, a 5% year-over-year increase that matched analyst expectations. The quarter was mixed, with a slight beat on tangible book value per share but a minor shortfall in net interest income.

The company’s stock has risen 5.7% since the earnings release, now trading at $51.96.

Looking for Top-Quality Investments?

If you’re seeking companies with strong fundamentals and growth potential, explore our curated list of the 9 Best Market-Beating Stocks. These businesses are well-positioned to thrive regardless of broader economic or political shifts.

The StockStory analyst team—comprised of experienced professional investors—leverages quantitative analysis and automation to deliver timely, high-quality market insights.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Diamonds Tokenized: UAE’s $280M Blockchain Revolution with Ripple Tech

Is crypto dead, or is there hope for 2026? With Jordi Alexander and Zaheer Ebtikar

Bitcoin Price Target Adjustments: Insights from Peter Brandt

Warren Requests Investigation into Trump's UAE Crypto Agreement