Research Report|In-Depth Analysis and Market Cap of Tria (TRIA)

Bitget2026/02/03 09:02

By:Bitget

I. Project Overview

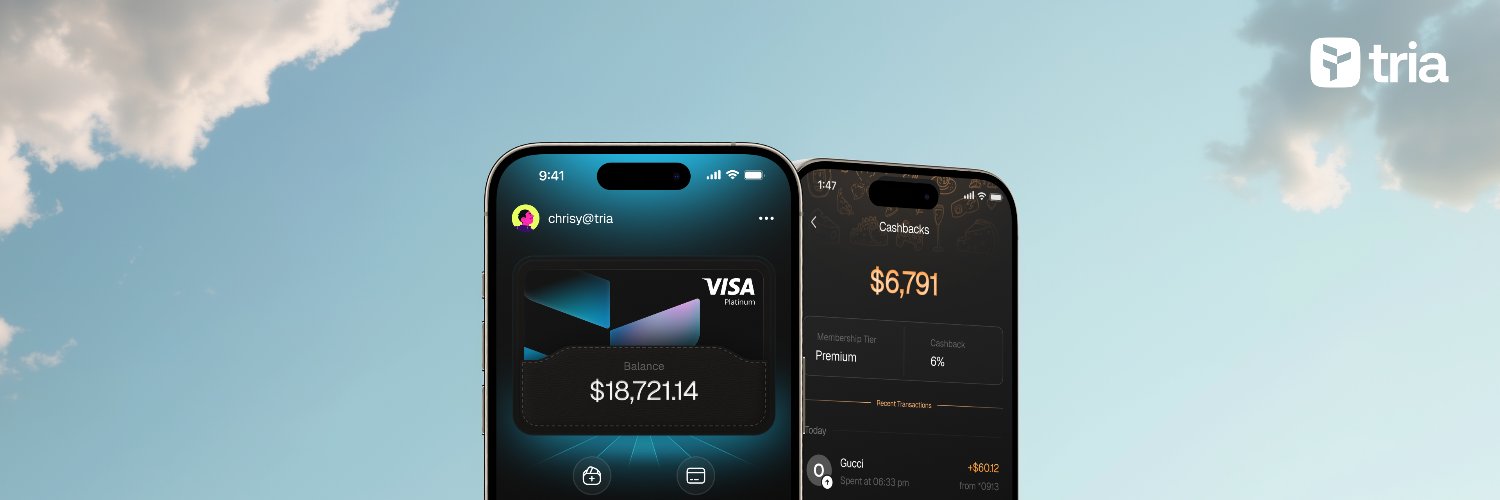

Tria is a chain abstraction infrastructure project focused on building routing and execution layers for modern finance. It enables seamless asset transfers across any virtual machines and supports the development of a self-custodial Web3 neo-bank, allowing users to spend, trade, and earn without gas fees, seed phrases, or blockchain complexity.

The project launched its closed beta in October 2025 and achieved significant growth within just four months. As of January 2026, Tria has surpassed 300,000 users, reached $20 million in annual recurring revenue (ARR), and processed over $100 million in cumulative transaction volume.

Unlike traditional crypto wallets or centralized exchanges, Tria adopts a vertically integrated model, deeply combining a self-custodial wallet, multi-chain trading terminal, yield generation, and physical payment cards. The project emphasizes real revenue and real-world application rather than token speculation.

From a technical perspective, Tria’s core is BestPath AVS, a permissioned chain abstraction and intent market built on the EigenLayer restaking ecosystem. It optimizes cross-chain routing through a Pareto-optimal incentive framework. The underlying settlement layer, Unchained L2, is built on Arbitrum Orbit and MoveVM, utilizing Threshold Signature Schemes (TSS) and Asynchronous Distributed Key Generation (ADKG) to ensure security and cross-chain compatibility.

$TRIA is the project’s native utility token, serving functions including governance, BestPath settlement, fee subsidies, staking rewards, and membership benefits. It is designed as a deflationary model (zero inflation, all tokens pre-minted). In 2025, Tria raised $12 million in an undisclosed-valuation Pre-Seed round, followed by a community round on Legion in November 2025, which was oversubscribed by 4,300%. The mainnet is live, and trading officially opened on February 3, 2026, demonstrating strong product-market fit driven by rapid growth and real cash flow.

II. Project Highlights

Business Model: Self-Custodial Neo-Bank + Chain Abstraction

Tria is the first to combine a

self-custodial neo-bank with

chain abstraction technology, delivering a “

balance-first” user experience through BestPath AVS. Users can spend, trade, or earn using any asset on any chain without manually bridging assets or managing gas tokens.

The platform integrates:

-Visa payment cards (supporting 1,000+ tokens across 150+ countries),

-AI-optimized trading routes (BestPath integrates 70+ protocols including Polygon, Arbitrum, and Sentient),

-Embedded yield products (such as stablecoin and BTC staking),

forming a closed-loop ecosystem from spending to yield generation.

Compared with traditional CeFi solutions (e.g., Revolut), Tria delivers a comparable banking experience while preserving self-custody security, directly addressing crypto’s core usability problem.

Innovative Tokenomics and Utility Model

The $TRIA token establishes a usage-driven economic flywheel. Users earn tokens through spending (up to 6% cashback), trading, referrals, and governance participation. Tokens can be used to pay fees, upgrade benefits (e.g., card tier multipliers), or stake for rewards.

The key innovation lies in the direct linkage between token utility and platform revenue:

-All platform fees (0.1–0.5%) are burned, creating deflationary pressure.

-BestPath settlement and routing demand continuously drive token consumption.

The model emphasizes community ownership, with 41.04% allocated to the community, avoiding VC-dominated extraction. Multi-stage vesting schedules are designed to reduce early sell pressure.

Large-Scale Real-World Adoption and Commercialization

While most chain abstraction projects remain conceptual, Tria achieved explosive real-world growth:

-0 to 300,000 users in 4 months

-75% daily active rate

-$20 million ARR (as of January 2026)

The Legion community round was oversubscribed by 6,670% ($66.7 million requested vs. $1 million target), reflecting strong community confidence. The platform has processed over $100 million in transactions and distributed more than $1 million in user rewards, validating the effectiveness of its incentive model.

Partners include Upshift (institutional treasury), Sentora (yield strategies), and Agora (stablecoins), with ecosystem expansion into AI agent payments.

Addressing Multi-Chain Fragmentation

Tria targets one of Web3’s core challenges: fragmented user experience caused by isolated chains. BestPath AVS operates a competitive solver market (“PathFinders”) that dynamically computes optimal cross-chain routes, enabling sub-second execution and cost optimization.

It supports Ethereum, Solana, Cosmos, Move-based chains, and Bitcoin, with a long-term vision of becoming the on-chain payment infrastructure for humans and AI. The project estimates total on-chain payment volume could reach $100 trillion by 2030, with Tria driving mainstream adoption by abstracting complexity.

III. Market Capitalization Outlook

Tria raised approximately

$13 million across its Pre-Seed and community rounds. The Legion community round offered

FDV options of $100 million or $200 million:

-$100M FDV:

30% unlocked at TGE

-$200M FDV:

60% unlocked at TGE

Baseline Valuation Assumptions

Company valuation: Undisclosed (Pre-Seed); community FDV options imply $100–200M

ARR multiple:

5× at $100M FDV

10× at $200M FDV

These are reasonable for high-growth SaaS/fintech, compared with Revolut’s ~15–20× ARR multiple.

Token FDV Scenarios

-Conservative ($100–200M): Reflects community round valuation; early-stage chain abstraction risk remains, but real ARR supports a premium. Initial circulating market cap estimated at

$30–60M (21.89% circulating).

-Base Case ($200–500M): If FDV converges toward mature chain abstraction benchmarks, Tria’s user and revenue growth could justify valuation expansion.

-Bull Case ($500M–1B): Comparable to DePIN valuations (e.g., Helium Mobile ~$2B FDV), contingent on AI payment adoption and global expansion.

Key variables include TGE timing (February 3, 2026), circulating supply (21.89%), sector sentiment, and ARR sustainability (targeting

$100M ARR in 2026).

However, current crypto market liquidity may not fully support these valuation expectations.

IV. Token Economics

Total Supply: 10 billion $TRIA

Initial Circulating Supply: 2.1885 billion (21.89%)

Allocation:

-Investors (13.96%): 0% at TGE, 36-month linear vesting

-Core Contributors (12.00%): 0% at TGE, 12-month cliff + 36-month vesting

-Community (41.04%): 8.9% at TGE, no cliff, 37-month vesting

-Foundation (18.00%): 7.0% at TGE, 12-month cliff + 48-month vesting

-Ecosystem & Liquidity (15.00%): 6.0% at TGE, 12-month cliff + 48-month vesting

Token Utilities:

-BestPath settlement fees

-Staking and routing access

-Gas and fee subsidies

-Governance voting

-Membership benefits (e.g., Premium card with 6% cashback)

V. Team & Funding

Team

-Parth Bhalla (Co-founder & CEO): Former Binance and Polygon executive

-Vijit Katta (Co-founder & CTO): Infrastructure specialist leading BestPath AVS and Unchained L2

-Team members from OpenSea, Nethermind, Intel, combining crypto-native and traditional tech experience

Funding History

-Pre-Seed (Oct 14, 2025): $12M led by P2 Ventures (Polygon Ventures) and Aptos, valuation undisclosed

-Community Round (Legion, Nov 2025): $1M target, $66.7M demand (6,670% oversubscription), FDV options $100M or $200M

Total funding: ~$13M, allocated toward product development, global expansion, and ecosystem growth.

VI. Risk Factors

Fundamental Risks

-Technical execution risk: Complex chain abstraction architecture; reliance on EigenLayer security and cross-VM compatibility

-Competition risk: LayerZero, Axelar, and traditional neo-banks integrating crypto features

Token Sell Pressure

-Phase 1 (TGE): Community unlocks drive distributed selling pressure

-Phase 2 (2–12 months post-TGE): Investor and contributor vesting may increase volatility

-Phase 3 (Long-term): Community emissions vs. burn-driven deflation; ARR growth is critical

Overall, sell pressure is concentrated in the

short-to-mid term, particularly dependent on community investor behavior.

VII. Official Links

Website:

https://www.tria.so/zh

Docs:

https://docs.tria.so

X (Twitter):

https://x.com/useTria

GitHub:

https://github.com/tria-so

Disclaimer: This report is generated by AI and manually reviewed. It does not constitute investment advice.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

The Ambitious Path of OCBC Bank's New CEO

新浪财经•2026/02/05 09:36

Bitcoin Could Drop to $63,800 Amid Institutional Selling, Says Peter Brandt

Coinspeaker•2026/02/05 09:36

HyperGPT Launches HyperStore to Advance Web3 and AI App Adoption

BlockchainReporter•2026/02/05 09:30

Hyperliquid Price Prediction: HYPE Price Pauses After Rally as Treasury Unlocks New Yield Path

CoinEdition•2026/02/05 09:18

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$71,389.32

-5.93%

Ethereum

ETH

$2,130.56

-5.36%

Tether USDt

USDT

$0.9983

-0.02%

BNB

BNB

$696.32

-7.84%

XRP

XRP

$1.42

-11.06%

USDC

USDC

$0.9996

+0.00%

Solana

SOL

$92.33

-4.67%

TRON

TRX

$0.2809

-2.02%

Dogecoin

DOGE

$0.1019

-5.33%

Bitcoin Cash

BCH

$524.58

-0.52%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now