Tom Lee Predicts $ETH Rebound As $LIQUID Presale Goes Live

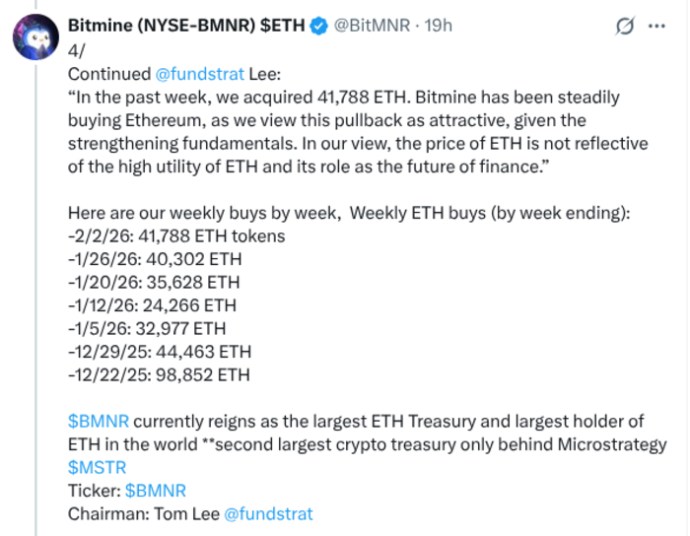

Fundstrat Global Advisors’ Managing Partner Tom Lee is doubling down on a risk-on rotation. His thesis? The recent consolidation in precious metals could catalyze a significant capital flight back into digital assets, with Ethereum poised to play catch-up.

Source: X

While Bitcoin dominated institutional inflows throughout Q1, the macro setup indicates a shifting tide. As gold and silver hit resistance at historical highs, smart money is eyeing assets that offer both appreciation and native yield.

Why does that matter? Historically, the market treats Ethereum as a high-beta play during liquidity expansion cycles. Lee’s analysis suggests the current lull in $ETH price action is deceptive, a classic accumulation phase before a repricing event driven by ETF flows and renewed DeFi activity.

The on-chain data backs this up. While retail sentiment remains cautious, accumulation by large wallets has accelerated, mirroring patterns seen right before the 2021 bull run.

However, a resurgent Ethereum ecosystem resurrects the industry’s most persistent bottleneck: fragmentation.

As liquidity rotates from commodities back into the ‘Big Three’ (Bitcoin, Ethereum, and Solana), traders face the friction of siloed ecosystems. This renewed activity highlights the critical need for infrastructure that handles cross-chain volume without the headache of bridges or wrapped assets.

That’s exactly where LiquidChain ($LIQUID) is positioning its Layer 3 infrastructure, aiming to serve as the execution layer for this incoming wave of liquidity.

LiquidChain ($LIQUID) Solves The Trillion-Dollar Fragmentation Problem

While market pundits obsess over asset prices, the real battle is being fought in the infrastructure layer. The current DeFi landscape forces users to make a hard choice: Bitcoin’s security, Ethereum’s liquidity, or Solana’s speed.

LiquidChain ($LIQUID) attempts to dismantle these silos through its proprietary Layer 3 protocol. Unlike traditional bridges that rely on vulnerable ‘lock-and-mint’ mechanisms, which have accounted for over $2B in hacks historically, LiquidChain utilizes a unified execution environment.

This architecture allows for what the protocol terms ‘Single-Step Execution.’ Instead of manually bridging $ETH to Solana just to buy a meme coin, LiquidChain fuses the liquidity of $BTC, $ETH, and $SOL into a single interface.

Source: LiquidChain

By operating as a Cross-Chain VM (Virtual Machine), LiquidChain enables verifiable settlement across heterogeneous networks. That matters—it removes the centralization risk associated with multi-signature bridges, replacing trusted intermediaries with cryptographic proofs.

‘Deploy Once’ Architecture Targets Developer Efficiency

The economic moat of any blockchain is its developer community, yet the current standard requires teams to maintain separate codebases for EVM (Ethereum), SVM (Solana), and Bitcoin L2 environments.

LiquidChain ($LIQUID) addresses this resource drain with its ‘Deploy-Once’ architecture. This feature allows protocols to write code in a single language that natively interacts with liquidity on all three major chains simultaneously.

This efficiency is crucial as institutional interest returns to the market. Hedge funds and asset managers require deep liquidity to enter positions without slippage.

A fragmented market creates shallow pools; LiquidChain’s model aggregates them. By enabling ‘Liquidity Staking,’ the protocol incentivizes users to provide the transaction fuel needed to settle these cross-chain swaps, creating a circular economy where the $LIQUID token captures value from the velocity of money moving between ecosystems.

If Tom Lee’s prediction holds and capital rotates aggressively out of commodities into crypto, Ethereum network congestion could spike gas fees. That makes L3 solutions not just a luxury, but a necessity for solvent trading.

LiquidChain positions itself as the hedge against this congestion, offering a high-throughput lane for the market’s most active liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood Scoops Crypto Stocks BMNR, CRCL, BLSH, and HOOD in Recent Fall

5 Key Facts to Be Aware of Before the Stock Market Starts Trading

今買うべき仮想通貨は?2026年を見据えてBitcoin Hyperが注目される理由