Illinois Tool Works (NYSE:ITW) Reports Q4 CY2025 Revenue Exceeding Expectations

Illinois Tool Works (ITW) Q4 2025 Earnings Overview

Illinois Tool Works, a leading manufacturer listed on the NYSE under the ticker ITW, surpassed analysts’ revenue projections for the fourth quarter of 2025. The company reported sales of $4.09 billion, reflecting a 4.1% increase compared to the same period last year. Earnings per share under GAAP reached $2.72, edging past consensus forecasts by 1.2%.

Considering these results, is ITW currently an attractive investment?

Highlights from Q4 2025

- Total Revenue: $4.09 billion, exceeding the $4.06 billion estimate (4.1% annual growth, 0.7% above expectations)

- GAAP EPS: $2.72, compared to the $2.69 estimate (1.2% above forecast)

- 2026 GAAP EPS Outlook: Midpoint guidance at $11.20, slightly below analyst projections by 0.6%

- Operating Margin: 26.5%, consistent with the prior year’s quarter

- Free Cash Flow Margin: 21%, down from 25.3% a year ago

- Organic Revenue: Up 1.3% year over year (below expectations)

- Market Cap: $76.65 billion

“We wrapped up the year with solid results, including over 4% revenue growth and a 7% rise in GAAP earnings per share. Our disciplined approach across all seven business segments led to record operating margin and income this quarter,” commented Christopher O’Herlihy, President and CEO.

About Illinois Tool Works

Illinois Tool Works, established by Byron Smith—an inventor with more than 100 patents—specializes in producing engineered components and customized equipment for a wide range of industries.

Revenue Trends

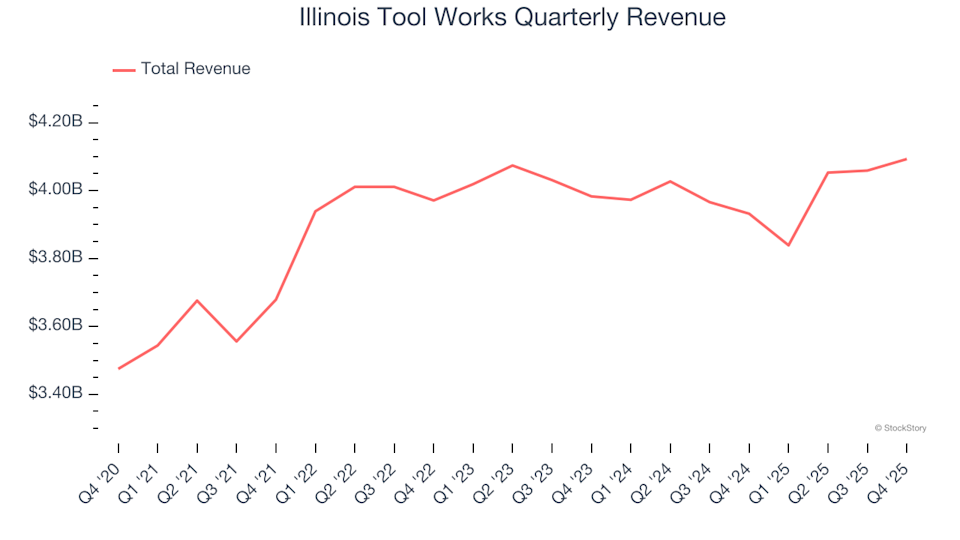

Long-term sales growth is a key indicator of a company’s strength. While short-term performance can be volatile, sustained growth over several years is a sign of a robust business. Over the past five years, ITW’s revenue increased at a modest 5% compound annual rate, which is below the industrial sector’s benchmark and forms a cautious basis for evaluation.

Although we prioritize long-term performance, it’s important to note that five-year snapshots may overlook industry cycles or one-off events. In the last two years, ITW’s revenue has remained essentially unchanged, indicating a slowdown in demand.

Examining organic revenue—which excludes the effects of acquisitions and currency changes—provides a clearer picture of core business performance. Over the past two years, ITW’s organic revenue has also been flat, suggesting that the company’s underlying operations, rather than external factors, have driven its results.

Recent Revenue Performance and Outlook

In the latest quarter, ITW achieved a 4.1% year-over-year revenue increase, beating Wall Street’s forecast by 0.7%.

Looking forward, analysts anticipate a 3% revenue growth over the coming year. While this points to some improvement from new products and services, it remains below the industry average.

Many major companies, such as Microsoft and Coca-Cola, started as lesser-known growth stories before capitalizing on major trends. We’ve identified a promising AI semiconductor opportunity that’s still flying under Wall Street’s radar.

Profitability and Margins

Over the past five years, ITW has consistently delivered strong profitability, with an average operating margin of 25.2%. This impressive figure is supported by the company’s high gross margins.

During this period, ITW’s operating margin improved by 2.2 percentage points, benefiting from operating leverage as sales grew.

In the most recent quarter, the operating margin stood at 26.5%, matching last year’s figure and indicating stable cost management.

Earnings Per Share (EPS) Analysis

Tracking EPS over time helps assess whether a company’s growth is translating into higher profitability for shareholders. ITW’s EPS has risen at a 9.6% compound annual rate over the past five years, outpacing its revenue growth and signaling improved efficiency and profitability per share.

Further analysis reveals that, alongside margin expansion, ITW reduced its share count by 8.8% over five years. These factors have contributed to EPS growth exceeding revenue gains, benefiting shareholders through both profitability improvements and share buybacks.

Looking at shorter-term trends, ITW’s two-year annual EPS growth was 3.8%, trailing its five-year average. The company’s Q4 EPS reached $2.72, up from $2.54 a year earlier and 1.2% above analyst expectations. Wall Street projects full-year EPS of $10.49 for the next 12 months, representing a 6.5% increase.

Summary and Investment Considerations

ITW’s latest quarter saw the company narrowly surpass revenue expectations, though its full-year EPS guidance fell slightly short. Overall, the results were mixed, with the stock price remaining steady at $263.94 following the announcement.

Should investors consider ITW at this point? Evaluating the company’s valuation, business fundamentals, and recent performance is crucial before making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blackstone's Gray says AI disruption risk is 'top of the page' for us

Despite All the Downturns, Standard Chartered Remains Mega Bullish on a Major Altcoin – Price Forecast Shared

Thomson Reuters Plunges 17% Intraday to Record Low, Hit by Anthropic's Legal AI Tool

Bitcoin miner TeraWulf's shares surge 15% after infrastructure acquisitions