AMETEK (NYSE:AME) Surpasses Q4 CY2025 Revenue Projections

AMETEK Surpasses Q4 2025 Revenue Expectations

AMETEK (NYSE:AME), a leading producer of electronic equipment, announced its financial results for the fourth quarter of 2025, posting revenues of $2.00 billion—a 13.4% increase compared to the same period last year. This figure outpaced market forecasts. The company projects next quarter’s revenue to reach approximately $1.91 billion, which aligns closely with analyst predictions. Adjusted earnings per share came in at $2.01, exceeding consensus estimates by 3.4%.

Q4 2025 Performance Highlights

- Total Revenue: $2.00 billion, surpassing analyst expectations of $1.95 billion (13.4% year-over-year growth, 2.6% above estimates)

- Adjusted Earnings Per Share: $2.01, compared to the forecasted $1.94 (3.4% higher than expected)

- Q1 2026 Revenue Outlook: Midpoint guidance at $1.91 billion, in line with market expectations

- 2026 Adjusted EPS Guidance: Midpoint at $7.97, matching analyst projections

- Operating Margin: 25.3%, a decrease from 26.6% in the prior year’s quarter

- Free Cash Flow Margin: 26.4%, down from 28.3% a year ago

- Market Value: $52.42 billion

“AMETEK delivered exceptional results for both the fourth quarter and the full year,” commented David A. Zapico, Chairman and CEO of AMETEK.

About AMETEK

AMETEK began as a motor repair business and has grown into a prominent manufacturer of electronic instruments, serving sectors such as aerospace, energy, and healthcare.

Examining Revenue Trends

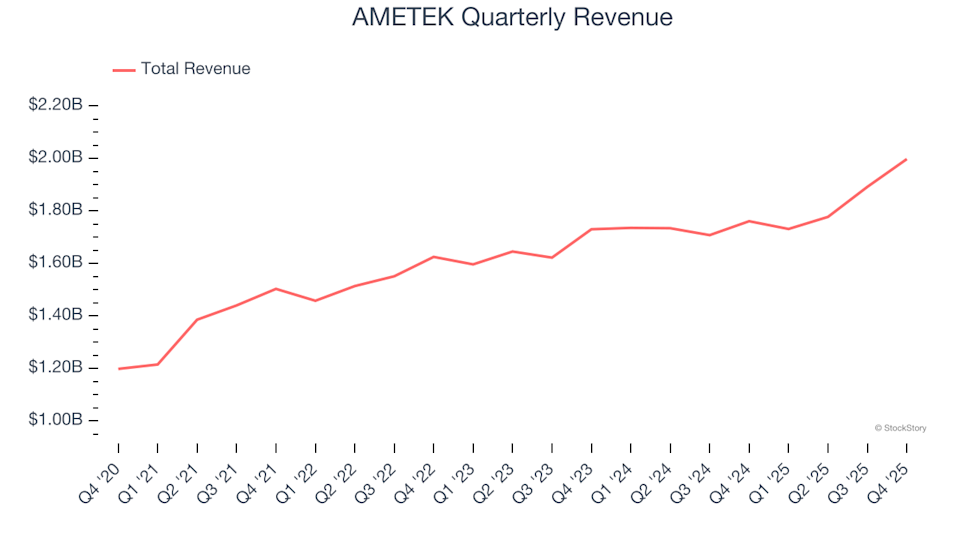

Consistent long-term growth is a hallmark of a high-quality business. While any company can have a strong quarter, sustained expansion is more telling. Over the past five years, AMETEK has achieved a robust compound annual sales growth rate of 10.3%, outperforming the typical industrial sector company and indicating strong market demand for its products.

Although long-term performance is crucial, it’s important to consider recent trends. Over the last two years, AMETEK’s annualized revenue growth slowed to 5.9%, falling short of its five-year average and suggesting a deceleration in demand.

This quarter, the company reported a 13.4% year-over-year increase in revenue, with sales of $2.00 billion beating Wall Street’s expectations by 2.6%. Management anticipates a 10% annual revenue increase for the upcoming quarter.

Looking ahead, analysts predict AMETEK’s revenue will rise by 6.8% over the next year, mirroring its recent two-year pace. This outlook suggests that new products and services may not yet drive significant acceleration in growth.

Many industry giants—such as Microsoft, Alphabet, Coca-Cola, and Monster Beverage—started as lesser-known growth stories. We’ve identified a promising AI semiconductor opportunity that’s still flying under Wall Street’s radar.

Profitability: Operating Margin

Operating margin measures how much profit a company retains from its revenue after covering core expenses, making it a key indicator of efficiency and profitability. It also allows for comparisons across companies with varying debt and tax structures, as it excludes interest and tax expenses.

Over the past five years, AMETEK has maintained impressive profitability for an industrial company, with an average operating margin of 25.1%. This strong performance is partly due to its favorable gross margin.

During this period, AMETEK’s operating margin improved by 2.2 percentage points, benefiting from increased sales and operational leverage.

In the fourth quarter, the company reported an operating margin of 25.3%, which is 1.3 percentage points lower than the previous year. The decline suggests that expenses such as marketing, research and development, and administrative costs rose faster than gross profit.

Earnings Per Share Analysis

Tracking earnings per share (EPS) over time helps assess whether a company’s growth is translating into higher profitability for shareholders. Over the last five years, AMETEK’s EPS has grown at a compound annual rate of 13.5%, outpacing its revenue growth and indicating improved profitability per share.

While the company’s operating margin dipped this quarter, it has expanded over the longer term, contributing to higher EPS. Although factors like interest and taxes also influence EPS, operating performance remains the primary driver.

Looking at more recent trends, AMETEK’s two-year annual EPS growth was 7.9%, below its five-year average, suggesting a slowdown in earnings momentum.

For the fourth quarter, adjusted EPS reached $2.01, up from $1.87 a year earlier and 3.4% above analyst expectations. Wall Street forecasts full-year EPS of $7.43 for the next 12 months, representing a projected 7.8% increase.

Summary of Q4 Results

AMETEK exceeded revenue and EPS expectations this quarter, though its guidance for the next quarter’s EPS was slightly below forecasts, and its full-year outlook was in line with analyst estimates. Overall, the results were mixed, and the share price remained steady at $228.09 immediately after the announcement.

Is AMETEK a compelling buy at its current valuation? While quarterly results are important, long-term fundamentals and valuation play a bigger role in investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blackstone's Gray says AI disruption risk is 'top of the page' for us

Despite All the Downturns, Standard Chartered Remains Mega Bullish on a Major Altcoin – Price Forecast Shared

Thomson Reuters Plunges 17% Intraday to Record Low, Hit by Anthropic's Legal AI Tool

Bitcoin miner TeraWulf's shares surge 15% after infrastructure acquisitions