The Wall Street Slayer on the Latest Bitcoin and Crypto Market Crash

Crypto industry leaders fawned like fans at a boy band when Trump gave the sector a don’s hug ahead of the 2024 election. The same industry that once promised to burn down the system was suddenly bending the knee, hailing Trump as the “Crypto President.” Well, that turned out well, didn’t it?

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With Bitcoin (BTC-USD) continuing its latest downtrend, the “this time it’s different” brigade is now clutching at straws. What has become crypto’s most disappointing cycle now comes with a familiar chill. The prospect of another crypto winter is very real, and many of the space’s biggest proponents are wandering around in a cold sweat, mumbling about long-term fundamentals while staring at the “astrology for men” short-term charts.

Take Tom Lee’s BitMine Immersion Technologies, the world’s largest Ethereum (ETH-USD) treasury. After buying an additional 40,000 ETH last week, bringing total holdings past 4.24 million, the company now faces over $6 billion in unrealized losses as the market liquidates positions mercilessly. Piling into Ethereum during a sell-off is apparently now called “strategy.”

Talking of Strategy, Bitcoin’s biggest prophet/madman Michael Saylor continues to prove his singular talent: buying Bitcoin at all-time highs. With 713,502 BTC at an average cost of roughly $76,052, the portfolio teeters on the edge of the red. One more swoon and the losses could swell into a nine-figure headache as MSTR’s balance sheet starts to look less like Hard Money and more like a seatbelt made of wet spaghetti. Actually, with news just in that Saylor has bought the dip – well done, dude, you’re getting the hang of this – we are offered confirmation the next leg down is imminent.

So, this feels like a good moment to revisit some recent Bitcoin price predictions and enjoy a good laugh.

Standard Chartered, once bullish to the point of evangelism, said Bitcoin would reach $300,000 by the end of 2026, but has now lowered its target to $150,000 – we bet that comes down again this year – while insisting it’s still long-term bullish. Translation: “We still believe… just slightly less delusional than last year.”

Meanwhile, Bernstein analysts had a $200,000 target by the end of 2025. Please, fellow analysts, take the firm’s poor Global Digital Assets team – i.e., its collection of crypto bros – out to dinner and give them an NFT as consolation. Actually, one is going for cheap right now… Jack Dorsey’s first tweet NFT, bought for $2.9 million in 2021 by Sina Estavi, is now worth roughly ten bucks – less than the transaction fees to move it around. If Bitcoin is the rollercoaster, this NFT is the vomit bucket at the front of the ride.

And, of course, we must give an honourable mention to Cathie Wood, who last week said that by the end of February, one Bitcoin will be worth $3 million. She didn’t actually say that, but would you really blink if she did?

Anyway, in tribute to the latest crash, The Wall Street Slayer is launching its own Wall Street Slayer Coin. There are only 6 quadrillion tokens in circulation, making it extremely scarce, because nothing says “buy me” like a number so large it breaks the metric system. Early adopters will, naturally, be rewarded with “trust the process” vibes.

And if history is any guide, this is far from over. Using previous cycles as a rough map, Bitcoin could land somewhere around $30,000 before the next upswing. So, see you all down there, when the whole thing kicks off again.

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

American Financial: Fourth Quarter Earnings Overview

Crypto Dev Launches Site for AI to Hire Humans

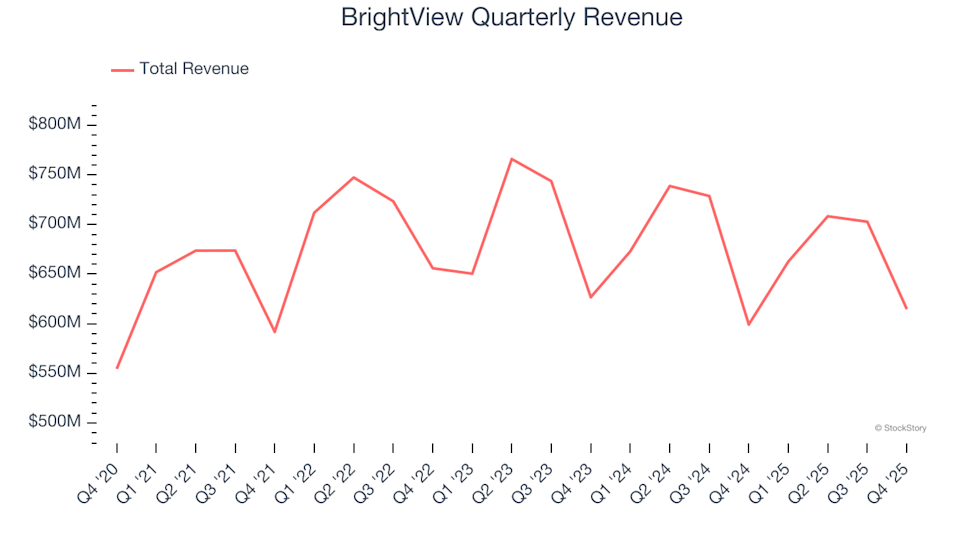

BrightView (NYSE:BV) reported fourth quarter 2025 sales that surpassed expectations

Solana’s White Whale: Rug Pull, Trap, or the Perfect Meme Coin?