What Should You Anticipate From Strategy’s (MSTR) Fourth Quarter Earnings

Upcoming Earnings Report for Strategy (NASDAQ:MSTR)

Strategy, a leading Bitcoin development firm, is set to announce its latest financial results this Thursday afternoon. Here’s a summary of what investors should keep in mind ahead of the report.

Recent Performance Highlights

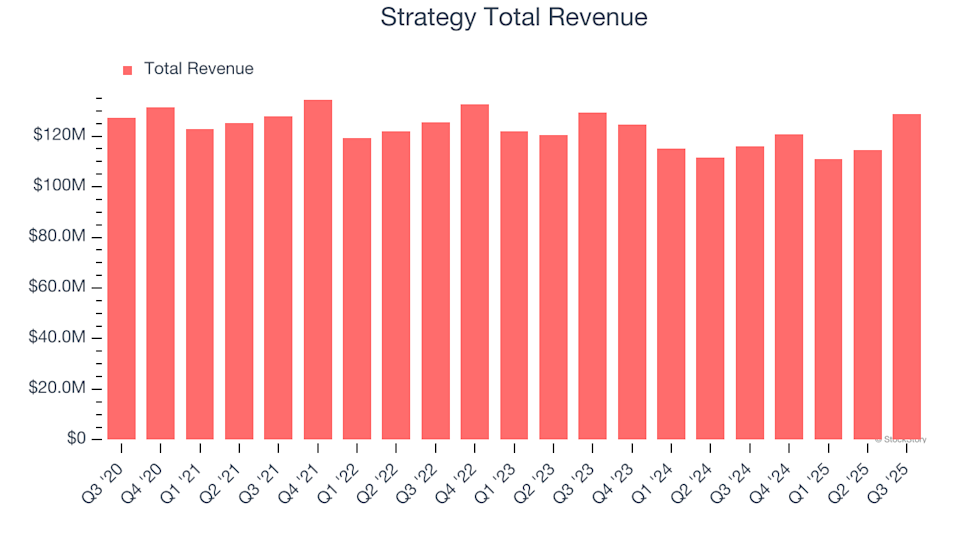

In the previous quarter, Strategy surpassed revenue forecasts by 9.1%, posting $128.7 million in sales—a 10.9% increase compared to the prior year. The company not only exceeded EBITDA projections but also provided annual EPS guidance that outperformed analyst expectations, marking a standout quarter.

Should You Buy or Sell Before Earnings?

Analyst Expectations for This Quarter

For the upcoming quarter, analysts predict that Strategy’s revenue will reach $122.3 million, representing a 1.3% year-over-year increase. This would be a turnaround from the 3% decline reported in the same period last year.

Analyst Sentiment and Track Record

Over the past month, analysts have largely maintained their forecasts, indicating confidence in the company’s direction as earnings approach. However, it’s worth noting that Strategy has fallen short of Wall Street’s revenue projections six times in the last two years.

Peer Comparisons in Data and Analytics Software

Several of Strategy’s competitors in the data and analytics software sector have already released their Q4 results, offering some context for what to expect. Palantir Technologies achieved a 70% year-over-year revenue jump, beating estimates by 4.9%, while Commvault saw a 19.5% revenue increase, also surpassing forecasts by 4.9%. Following these announcements, Palantir’s stock rose 6.3%, whereas Commvault’s shares dropped 30.5%.

Market Trends and Valuation

Concerns over tariffs and changes to corporate tax policy have led to significant market swings in 2025. Despite this, data and analytics software stocks have generally declined, with an average drop of 17.8% over the past month. Strategy’s shares have fallen 20.3% during the same period, and the consensus analyst price target stands at $474.31, compared to the current price of $132.28.

Spotlight on Share Buybacks

When a company has excess cash, repurchasing its own shares can be a smart move—provided the valuation is attractive. We’ve identified a promising, undervalued stock that is generating strong free cash flow and actively buying back shares.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ether and majors rise as bitcoin rebounds to $76,000 but the bounce may not last

ECB convenes for its initial meeting of the year with interest rates anticipated to remain steady

PENGU Pumps While Sentiment Tanks — Early Signs of a Trend Reversal?

Will crypto market recover as Trump signs bill to end partial government shutdown?