The Top 5 Analyst Questions That Stood Out During Stifel’s Q4 Earnings Call

Stifel Surpasses Expectations in Q4 Performance

Stifel delivered fourth quarter results that outperformed analyst forecasts, with leadership crediting the success to robust momentum in both its Global Wealth Management and Institutional divisions. CEO Ronald James Kruszewski highlighted that unprecedented adviser recruitment and heightened client engagement were key drivers of revenue expansion. The institutional arm also saw notable gains, especially in investment banking activities such as advisory services and capital markets transactions. CFO James Marischen pointed out that effective cost management and operational efficiency further boosted profitability, as both compensation and other expenses remained in line with revenue increases. The quarter was also strengthened by a rise in client assets, a solid balance sheet, and heightened activity in sectors like healthcare and financial services.

Should You Consider Buying SF Now?

Curious about whether Stifel is a smart investment at this moment?

Key Takeaways from Stifel’s Q4 2025 Results

- Total Revenue: $1.56 billion, beating analyst projections of $1.52 billion (14.4% year-over-year growth; 2.9% above expectations)

- Adjusted EPS: $2.63, surpassing the $2.51 estimate (4.8% above expectations)

- Adjusted Operating Income: $348.6 million, exceeding the $310.3 million forecast (22.3% margin; 12.4% beat)

- Operating Margin: 20.8%, a decrease from 26.2% in the prior year’s quarter

- Market Cap: $12.63 billion

While executive commentary is always insightful, the unscripted questions from analysts during earnings calls often reveal the most interesting details—sometimes touching on areas management might prefer to avoid or that require nuanced answers. Here are the questions that stood out to us this quarter:

Top 5 Analyst Questions from Stifel’s Q4 Earnings Call

- Mike Brown (UBS): Asked about what’s fueling adviser recruitment and productivity. CEO Kruszewski pointed to the firm’s integrated platform and the strong performance of new advisers, especially those joining from B. Riley.

- Steven Chubak (Wolfe Research): Inquired about Stifel’s ability to sustain lower compensation ratios after restructuring. Kruszewski and CFO Marischen responded that strategic business exits and careful management of recruitment costs would help maintain improved margins.

- Devin Ryan (Citizens Bank): Explored the future balance between employee and independent advisers. Kruszewski noted a trend toward the employee model as market dynamics and economics shift for independents.

- Brennan Hawken (BMO Capital Markets): Asked about commercial loan growth and asset yields. Marischen explained that growth would be driven by fund banking and selective lending, with fee income volatility impacting yield calculations.

- Bill Katz (TD Cowen): Queried about capital allocation and M&A strategy. Kruszewski emphasized that the firm remains selective with acquisitions, focusing on shareholder value and operational fit rather than sheer size.

Upcoming Catalysts to Watch

Looking ahead, our analysts will be monitoring several key factors: the pace and quality of adviser recruitment and its impact on fee-based asset growth; execution of capital markets mandates in advisory and equity issuance; and the realization of cost savings from recent business streamlining efforts. We’ll also keep an eye on how Stifel adapts to changing market conditions and seizes new opportunities in M&A and capital raising across different industries.

Stifel shares are currently trading at $120.75, down from $126.34 prior to the earnings release. Is this a turning point for the company—should you buy or sell?

Resilient Stocks for Every Market Environment

Relying on just a handful of stocks can leave your portfolio vulnerable. Now is the time to secure high-quality investments before the market broadens and attractive prices vanish.

Don’t wait for the next bout of market turbulence. Explore our Top 5 Strong Momentum Stocks for this week—a handpicked list of High Quality companies that have delivered a remarkable 244% return over the past five years (as of June 30, 2025).

Our selections include well-known names like Nvidia, which soared 1,326% from June 2020 to June 2025, as well as lesser-known success stories such as Exlservice, which achieved a 354% five-year return. Discover your next potential winner with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Block doubles down on European ambitions

Fireblocks Announces Native Bitcoin DeFi Support With Stacks Integration

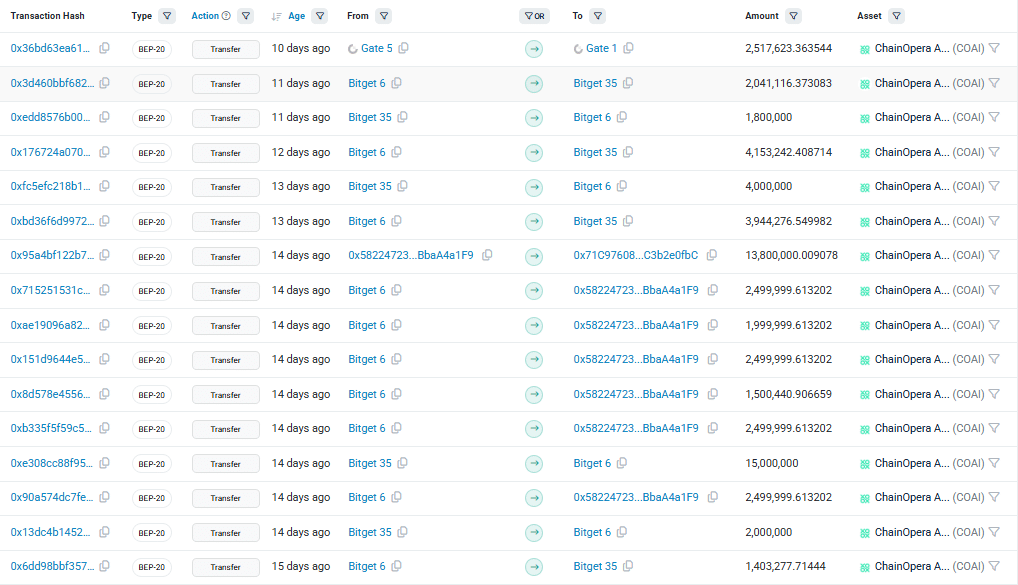

AI narrative lifts ChainOpera AI 24% – But can COAI hold THIS?