5 Thought-Provoking Analyst Inquiries from Landstar’s Fourth Quarter Earnings Discussion

Landstar Q4 Performance Overview

Landstar faced ongoing difficulties in the freight sector during the fourth quarter, with financial results missing analyst forecasts for both revenue and earnings. Company leaders pointed to the persistent freight downturn, inflationary pressures, and rising insurance and claims costs—particularly those linked to major accidents and legal settlements—as key factors behind the shortfall. CEO Frank Lonegro described the quarter as “difficult,” noting that while truckload volumes and pricing stayed weak, the heavy haul division achieved record-breaking revenue. The management team maintained a cautious outlook, highlighting external uncertainties that continue to disrupt supply chains and the broader industrial landscape.

Should You Consider Buying LSTR?

Curious if now is a good time to invest in Landstar?

Key Q4 2025 Metrics for Landstar (LSTR)

- Total Revenue: $1.18 billion, slightly below the $1.19 billion analyst estimate (down 2.9% year-over-year, 1.4% shortfall)

- Adjusted Earnings Per Share: $0.75, missing the $1.09 consensus (31.3% below expectations)

- Adjusted EBITDA: $64.12 million, compared to the $66.15 million forecast (5.4% margin, 3.1% miss)

- Operating Margin: 2.5%, a decrease from 4.8% in the prior year’s quarter

- Market Value: $5.41 billion

While management’s prepared remarks are always insightful, the real highlights often come from analyst Q&A sessions, where unscripted questions can reveal deeper issues or complexities. Here are some of the most notable exchanges from the call:

Top 5 Analyst Questions from Landstar’s Q4 Call

- Jason Seidl (TD Cowen): Asked about the effects of winter weather on BCO utilization. CEO Lonegro responded that although storms temporarily reduced loads, Landstar typically rebounds as weather improves, and utilization remained robust thanks to operational enhancements.

- Paul Stoddard (Goldman Sachs): Inquired about trends in BCO headcount and the impact on margins. VP Matthew Miller noted better truck additions and reduced turnover, while CFO James Todd said that a larger BCO base should help margins once rates recover.

- Bascome Majors (Susquehanna): Explored the link between utilization, rates, and fleet growth. Todd explained that higher rates usually boost utilization, and recent gains were encouraging, though seasonal and market shifts can cause fluctuations.

- Stephanie Moore (Jefferies): Asked about demand trends in specific sectors. Management reported ongoing strength in data center and machinery shipments, but continued weakness in building materials and automotive, illustrating the mixed demand across industries.

- Andrew Cox (Stifel): Questioned the adoption of AI tools among agents. Lonegro and Todd acknowledged that while adoption rates vary, the company’s entrepreneurial structure supports quick adaptation, and there is strong interest in AI solutions from agents.

Looking Ahead: What to Watch in Upcoming Quarters

Key areas to monitor in the coming quarters include:

- The speed and tangible benefits of AI and digital tool integration among agents and BCOs

- The continued momentum and expansion of heavy haul and specialized freight services

- Stabilization of insurance and claims-related expenses

- Progress in optimizing the network, improving onboarding processes, and adapting to regulatory changes that could influence freight volumes

Landstar’s stock recently traded at $158.82, up from $153.51 before the earnings announcement. Considering these developments, is Landstar a buy or a sell?

Top Picks for Quality-Focused Investors

Relying on just a handful of stocks can leave your portfolio exposed. Now is your chance to secure high-quality investments before the market broadens and prices rise.

Don’t wait for the next market shock. Explore our Top 5 Growth Stocks for this month. This handpicked selection of High Quality stocks has delivered a 244% return over the past five years (as of June 30, 2025).

Among these are well-known names like Nvidia, which soared 1,326% from June 2020 to June 2025, and lesser-known companies such as Comfort Systems, which achieved a 782% five-year gain. Discover your next standout investment with StockStory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

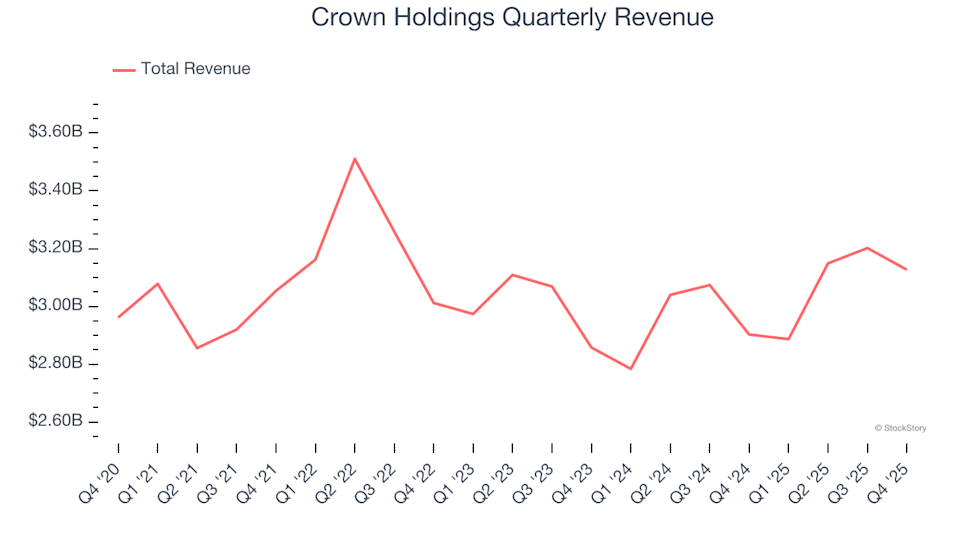

Crown Holdings (NYSE:CCK) Surpasses Q4 CY2025 Revenue Forecasts

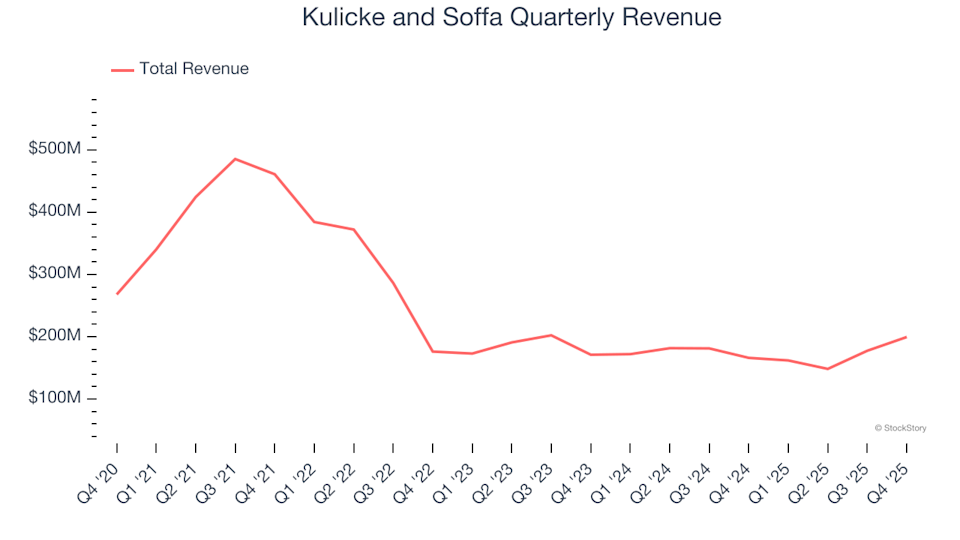

Kulicke and Soffa (NASDAQ:KLIC) Surpasses Forecasts with Robust Q4 Performance, Though Inventory Rises

Snap: Q4 Financial Highlights

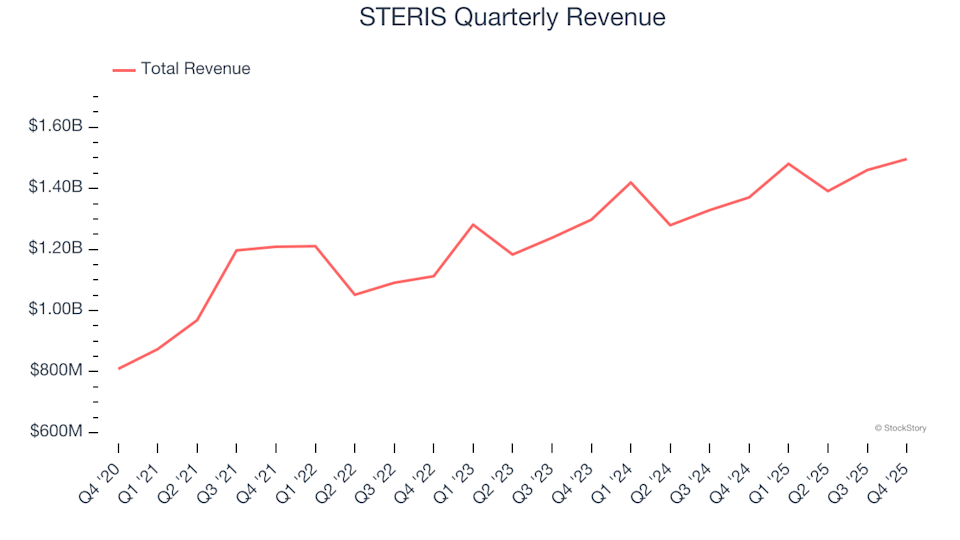

STERIS (NYSE:STE) Surpasses Q4 CY2025 Revenue Projections