The world's largest jeweler drops nearly 7%, analysts warn it will be hit by sharp silver price fluctuations

Key Points

Pandora's stock price fell as analysts warned the company is facing the dual pressures of surging silver costs and increasingly cautious consumer spending.

On Tuesday, Jefferies analysts downgraded the stock from "Buy" to "Hold," stating that "increasing consumer spending pressure" and rising silver prices have put the business in a dilemma. The analysts commented: "Given the current volatility in silver prices, we are reluctant to make positive investment recommendations in light of this unique situation and fluctuating raw material costs."

The stock price of Pandora, the world's largest jeweler, plunged nearly 7% after analysts warned that the company would be pressured by volatile silver prices and downgraded the stock from "Buy" to "Hold."

Jefferies analysts wrote in their Tuesday report: "The combination of increasing consumer spending pressure and persistently rising silver prices has put Pandora’s business in a dilemma."

The report added: "Given the volatility in silver prices, the most challenging issue will be investors’ long-term reluctance to increase their holdings in the stock. This means that even if silver prices fall back, the stock price may rebound mechanically with profit growth, but investor willingness to enter will be slow to recover."

Pandora’s stock dropped 6.7% in afternoon trading, ending a two-day winning streak. The stock is down 46% cumulatively in 2025 and has fallen 26% so far this year.

Over the past year, Pandora’s stock has fallen sharply, while silver prices have continued to rise.

In January this year, Pandora lowered its profit forecast and warned of weakened consumer confidence in the United States.

However, Jefferies pointed out that the true culprit is the price of silver.

Analysts commented: "Given the current volatility in silver prices, we are reluctant to make positive investment recommendations in light of this unique situation and fluctuating raw material costs. The challenges faced in recent months mean that even if silver prices return to normal levels, Pandora’s stock price will still be far below where it was a year ago."

Despite a recent sell-off in silver, prices are still nearly double what they were a year ago. According to Jefferies' model, this would lead to a 60% decline in the company’s profits by 2027.

The analysts lowered Pandora’s target price from 850 Danish kroner (about $84) to 530 Danish kroner.

They added: "We believe that switching to silver-plated or stainless steel materials is not a panacea—it would increase production complexity and could lead to a decline in product quality, damaging the customer experience."

Last Friday, silver posted its largest one-day drop since 1980. Previously, U.S. President Donald Trump nominated Kevin Warsh as the next Federal Reserve chair, easing market concerns over the Fed’s independence, which had earlier driven money into precious metals and other safe-haven assets.

Rising raw material costs are squeezing Pandora’s profit margins from one side, while a deteriorating macroeconomic environment is hitting the company from the other. Pandora’s core customer base is low-income consumers, who are struggling to cope with rising living costs in what is known as a “K-shaped economy.”

Jefferies noted that to cope with rising raw material costs, Pandora has increased product prices by about 14%, a move that has hurt consumers’ willingness to buy.

In January this year, Citi analysts also downgraded Pandora’s rating to “Neutral,” citing slowing sales growth and extreme inflation in silver prices.

Analysts said: "The short-term performance outlook has darkened significantly. The macro environment in Europe and the U.S. (which accounts for about 80% of the company’s sales) is becoming increasingly volatile, and this, combined with brand and jewelry consumption fatigue, has further worsened the situation."

Pandora is scheduled to release its full-year earnings report on Thursday.

Editor: Guo Mingyu

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

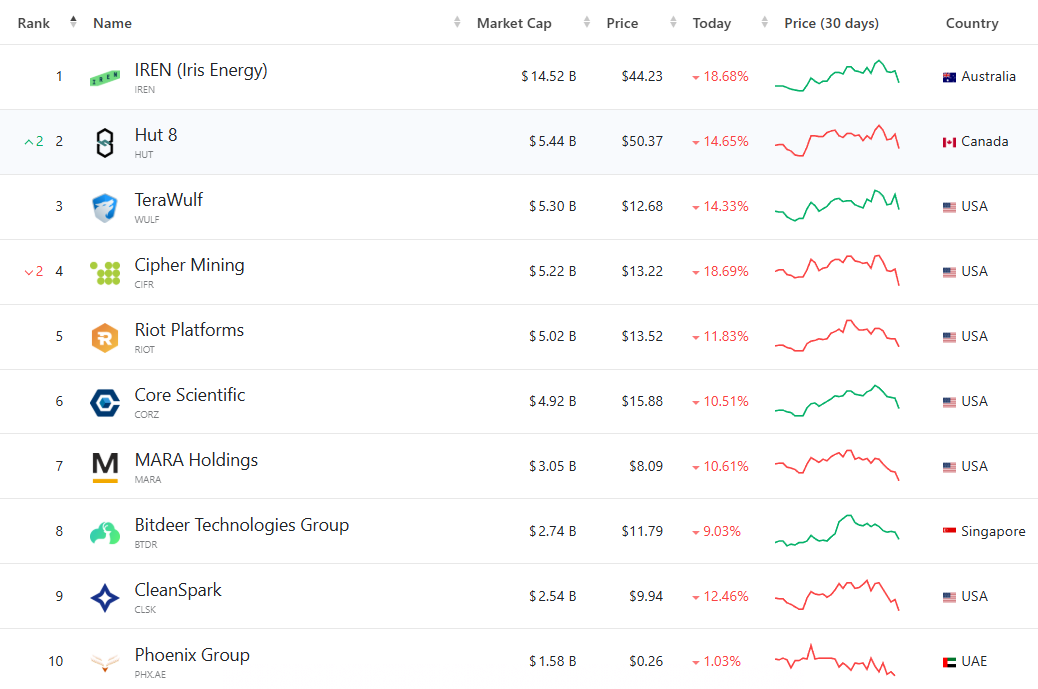

Bitcoin Slides Below $73K as Mining Stocks Sink in Double-Digit Selloff

Block doubles down on European ambitions

Fireblocks Announces Native Bitcoin DeFi Support With Stacks Integration