Fortive (NYSE:FTV) Exceeds Q4 2025 Sales Expectations

Fortive (FTV) Q4 2025 Earnings Overview

Fortive, a leading industrial technology firm listed on the NYSE under the ticker FTV, delivered fourth-quarter results for calendar year 2025 that surpassed revenue forecasts. The company posted $1.12 billion in sales, marking a 4.6% increase compared to the same period last year. Adjusted earnings per share reached $0.90, coming in 7.4% higher than what analysts had anticipated.

Curious if Fortive is a smart investment right now?

Highlights from Fortive’s Q4 2025 Performance

- Revenue: $1.12 billion, beating projections of $1.09 billion (4.6% year-over-year growth, 2.7% above expectations)

- Adjusted EPS: $0.90, exceeding the $0.84 consensus (7.4% above estimates)

- Adjusted EBITDA: $357.9 million, slightly ahead of the $354.8 million forecast (31.9% margin, 0.9% beat)

- 2026 Adjusted EPS Guidance: Midpoint set at $2.95, 3.8% higher than analyst expectations

- Operating Margin: 20.1%, consistent with the prior year’s fourth quarter

- Free Cash Flow Margin: 28%, similar to last year’s Q4

- Market Cap: $17.26 billion

“The fourth quarter showcased the strong execution of our new Fortive team. With two quarters behind us and our 2026 strategic and financial plans in place, our confidence in our future continues to grow. In Q4, we delivered results that exceeded our expectations, including approximately 3% core revenue growth, 8% growth in Adjusted EBITDA, and a 13% increase in Adjusted EPS. This performance allowed us to surpass the upper end of our full-year Adjusted EPS guidance. We also maintained our disciplined approach to capital allocation, completing $265 million in share buybacks during the quarter, bringing our total repurchases in the second half to about $1.3 billion,” commented Olumide Soroye, President and CEO.

About Fortive

Fortive, whose name is derived from the Latin word for “strong,” specializes in manufacturing industrial products and developing software solutions for a wide range of sectors.

Revenue Trends

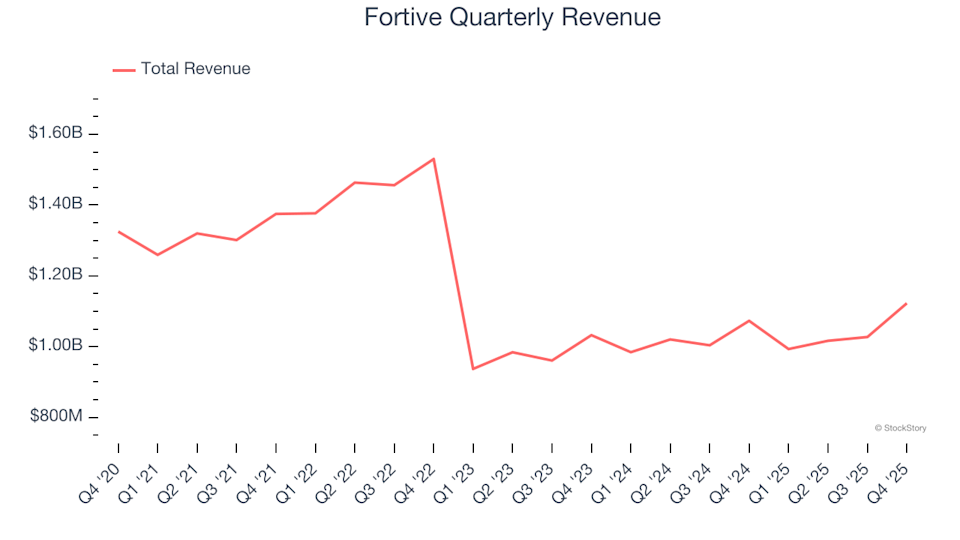

Long-term sales growth is a key indicator of a company’s overall strength. While any business can have a strong quarter, the best companies sustain growth over many years. Over the past five years, Fortive’s sales have declined at an average annual rate of 2.1%, reflecting weaker demand and raising concerns about business quality.

Although five-year trends are important, they may not capture recent shifts in the industrial sector. In the last two years, Fortive’s annualized revenue growth improved to 3.1%, outpacing its longer-term trend, though the results still fell short of expectations.

For the latest quarter, Fortive achieved a 4.6% year-over-year increase in revenue, surpassing Wall Street’s estimates by 2.7%.

Looking Forward

Analysts predict that Fortive’s revenue will decrease by 4% over the coming 12 months, a slowdown compared to recent years. This outlook suggests the company may face some challenges in maintaining demand for its offerings.

While major investors focus on high-profile tech stocks like Nvidia, a lesser-known semiconductor company is quietly excelling in a crucial area of AI hardware.

Profitability and Margins

Over the last five years, Fortive has demonstrated strong profitability for an industrial company, maintaining an average operating margin of 16.4%. This impressive result is supported by the company’s robust gross margins.

Fortive’s operating margin has improved by 1.8 percentage points over the past five years, reflecting gains in efficiency. In the most recent quarter, the company reported an operating margin of 20.1%, matching the previous year’s Q4 and indicating stable cost management.

Earnings Per Share (EPS) Analysis

Tracking long-term EPS trends helps assess whether a company’s growth is translating into profits. Fortive’s EPS has remained flat over the past five years, which, while not ideal, is better than its declining revenue, suggesting management has adjusted costs effectively.

However, over the last two years, Fortive’s annual EPS has dropped by 6.3%, highlighting recent challenges. In Q4, adjusted EPS was $0.90, down from $1.17 a year earlier, but still 7.4% above analyst expectations. Looking ahead, Wall Street forecasts a 5.3% decline in full-year EPS to $3.01.

Summary and Outlook

Fortive’s upbeat full-year EPS guidance and revenue outperformance were notable positives in the latest report. Overall, the quarter showed several areas of strength, with shares rising 1.7% to $55.30 following the announcement.

While Fortive delivered a solid quarter, it’s important to consider the broader context when evaluating the stock’s long-term potential. Both business quality and valuation play a role in investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Block doubles down on European ambitions

Fireblocks Announces Native Bitcoin DeFi Support With Stacks Integration

AI narrative lifts ChainOpera AI 24% – But can COAI hold THIS?