Uber Freight reports unchanged fourth-quarter performance, while the overall platform achieves record-breaking profits

Uber Freight Faces Challenges Amid Strong Company Performance

In the final quarter, Uber Freight lagged behind the company’s ride-hailing and delivery divisions, reporting stagnant revenue and a slight dip in gross bookings. This underperformance comes as the North American trucking sector continues to struggle, even as Uber’s overall business achieved record profits.

During the three months ending December 31, Uber Freight reported gross bookings of $1.27 billion, a decrease of about 1% compared to the previous year. Revenue for the segment remained steady at $1.27 billion.

Uber Technologies released its quarterly earnings and held a call with analysts on Tuesday morning before the markets opened.

Despite the decline in gross bookings, company representatives noted that Uber Freight reached breakeven profitability for the first time in over three years during this quarter.

Chief Financial Officer Prashanth Mahendra-Rajah highlighted that this milestone was achieved through disciplined operations rather than improved pricing. He suggested that freight carriers may continue to face pricing challenges into early 2026, as shippers maintain an advantage in negotiations due to ample capacity in the market.

Headquartered in San Francisco, Uber Technologies (NYSE: UBER) operates three main businesses: ride-hailing, logistics through Uber Freight, and food and goods delivery via Uber Eats.

Company-Wide Growth Outpaces Freight

Uber’s overall business delivered a standout quarter, with total gross bookings rising 22% year over year to $54.1 billion. Both the mobility and delivery segments saw double-digit growth, and adjusted EBITDA jumped 35% to $2.5 billion.

Although freight demand remains subdued, Uber’s leadership pointed to autonomous vehicles as a future driver of transformation for the freight division.

CEO Dara Khosrowshahi described autonomous vehicles as a major growth opportunity, noting that they could significantly enhance the efficiency and scale of Uber’s logistics and freight operations by increasing vehicle utilization rates.

Autonomous Vehicles and the Future of Freight

Khosrowshahi told analysts that autonomous vehicles could unlock a multi-trillion dollar opportunity for Uber, and that integrating freight and delivery into Uber’s logistics network would allow these vehicles to operate at higher utilization than competitors.

With plans to launch autonomous operations in 15 cities by year-end, Khosrowshahi said that combining freight and delivery could keep autonomous vehicles active for longer periods each day. This would help reduce costs per unit over time and position Uber Freight to capitalize as autonomous technology becomes more widespread.

Freight Segment Mirrors Industry Trends

Uber did not disclose specific shipment or truckload figures, but the flat results in its freight division reflect broader patterns in the industry. Throughout most of the fourth quarter, North American trucking remained oversupplied, with spot rates under pressure and contract prices continuing to adjust downward.

Uber Freight’s operating loss narrowed to $18 million, a significant improvement from the $41 million loss reported a year earlier. This progress was driven by cost management and operational efficiencies, though the segment still trails Uber’s core businesses in profitability.

Outlook for 2026

For the first quarter of 2026, Uber projected total gross bookings between $52 billion and $53.5 billion, with adjusted EBITDA potentially reaching $2.47 billion. However, the company did not provide specific forecasts for the freight segment.

Executives stressed the importance of maintaining investment discipline and operational efficiency as they look ahead. For Uber Freight, the focus will likely remain on preserving margins and preparing for a market rebound, rather than aggressively pursuing short-term volume in a still-challenging environment.

Uber’s fourth-quarter earnings results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

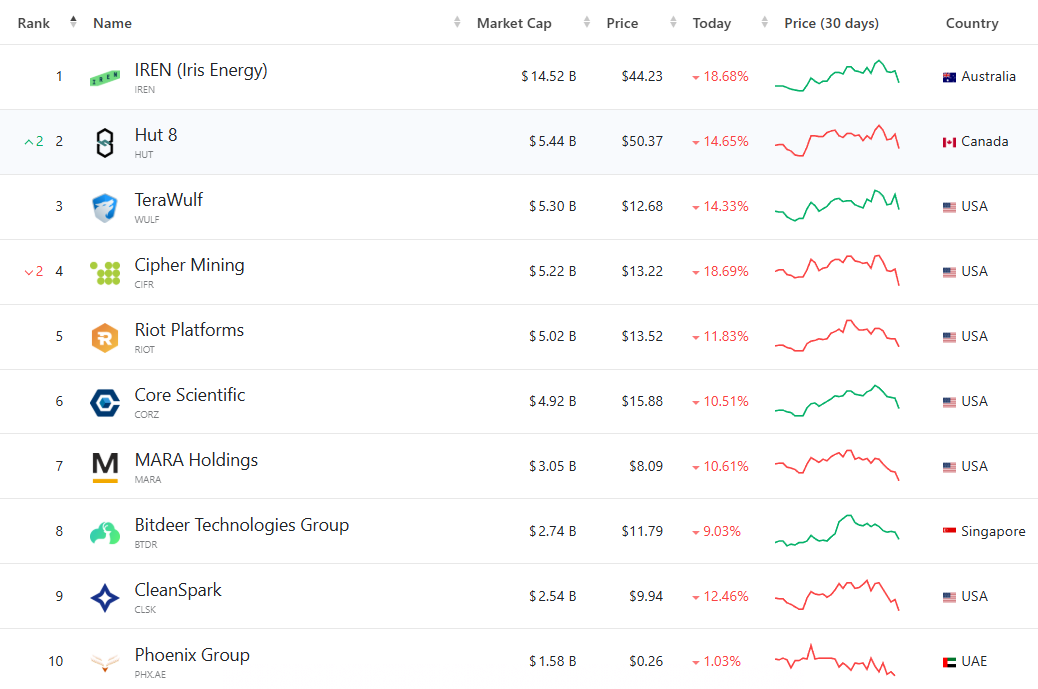

Bitcoin Slides Below $73K as Mining Stocks Sink in Double-Digit Selloff

Block doubles down on European ambitions

Fireblocks Announces Native Bitcoin DeFi Support With Stacks Integration