Bitcoin has recently slid below the $74,000 mark, while the Bureau of Labor Statistics (BLS) announced new dates for their upcoming reports. The partial government shutdown has caused delays in this week’s employment reports. As Bitcoin continues its downward trend, uncertainty in Iran lingers, and concerns arise for crypto investors to exercise greater caution with Jelle signaling an based on the SOPR Indicator.

Bitcoin Takes a Tumble: Is the Crypto Winter Approaching?

Understanding the SOPR

Bitcoin price made a move out of its narrow range, although investors in cryptocurrency experienced billion-dollar liquidations. As a dull phase ends and Bitcoin breaks out of its limited range, a downward breakout could often herald a path to painful bottoms. If Bitcoin had surpassed the $98,000 and $101,000 levels, a target of $120,000 would be possible. Today, downward breakthroughs to $81,000 and $74,000 suggest that analysts are now eyeing a target of $56,000.

Jelle noted the signs of loss-led selling habits by stating:

“The SOPR chart indicates individuals are once again engaging in loss-sales. While small red fluctuations typically occur at local low points, extended red periods are often associated with bear markets. Be attentive to deep red fluctuations, as they generally present good purchasing opportunities.”

Scrutinizing Cryptocurrencies: Cautious Investors

The BLS has rescheduled the January Non-Farm Payroll (NFP) report to February 11. Additionally, the U.S. January Consumer Price Index (CPI) report is postponed to February 13. A Supreme Court tariff decision is expected by February 20. Thus, the upcoming and following weeks may see markets remain tense. Consequently, significant Bitcoin and cryptocurrency recovery seems unlikely, at least according to current news trends, until possibly Sunday.

Is Bitcoin at a bottom price? On-Chain Mind suggests that price alone doesn’t determine this, referencing historical data.

“Long-term holders react the least. Typically, when this group collectively incurs losses, it signals the bear market is nearing its exhaustion phase.

LTH Risk peaks:

- 2015: 95%

- 2019: 83%

- COVID Crash: 70%

- 2022: 85%

Once above 55-60%, a rapid approach to bottom levels begins.

Currently, we are around 37%. If descending peaks persist, a movement towards above 70% showcases extreme pressure on even the strongest hands, and historically, this serves as a prerequisite for a lasting bottom.”

This analysis suggests that the bottom has not yet been reached, with BTC potentially nearing $56,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

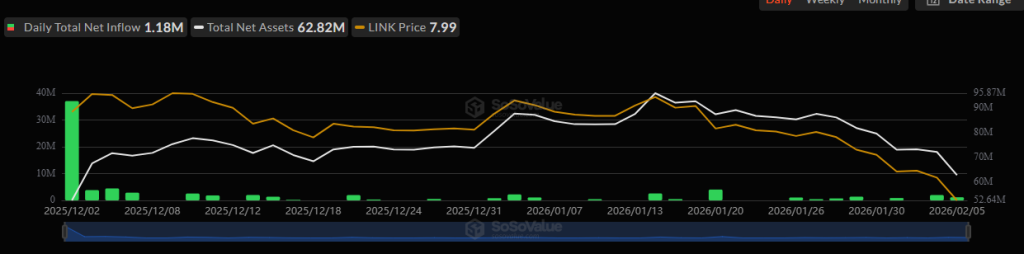

LINK Price Struggles Near $8.60 as Reserves Grow and ETF Inflows Diverge From Market Weakness

LIVE Crypto Market Today: XRP Suddenly Jumps 10% in Sharp Reversal After Market Crash

Solana Spot ETFs See $2.82M Inflows as SOL Trades at $79 Amid Broader Market Stress

Stocks rebound after a dramatic week sparked by ongoing AI uncertainty