Why Sunrun (RUN) Shares Are Rising Today

Sunrun’s Recent Surge: What Drove the Stock Higher?

Sunrun (NASDAQ:RUN), a leading provider of residential solar solutions, saw its stock price soar by 11.3% during the afternoon trading session. This sharp rise followed the company’s announcement that it had established the largest distributed power plant in the United States, fueled by a more than fivefold increase in customer participation in 2025.

This remarkable expansion has positioned Sunrun as one of the nation’s top sources of flexible energy. The company reported dispatching nearly 18 gigawatt-hours of electricity from customer battery systems to help stabilize power grids—enough to supply 15 million homes for an hour. At peak, Sunrun’s distributed network delivered 416 megawatts, surpassing the capacity of many traditional fossil-fuel plants. Customer enrollment in Sunrun’s 17 distributed power plant initiatives surged to over 106,000 in 2025, up dramatically from about 20,000 the previous year. CEO Mary Powell highlighted that Sunrun’s power plants reached critical scale at times when grid operators needed support, providing reliable and cost-effective energy when it mattered most.

Market Reaction and Investor Insights

Sunrun’s stock is known for its significant volatility, experiencing 79 swings greater than 5% over the past year. However, a jump of this magnitude is unusual, underscoring the substantial impact of the latest news on investor sentiment.

The last major price movement occurred 13 days ago, when Sunrun shares climbed 9.1% after the U.S. president outlined a framework for a potential agreement with Greenland.

Recently, the broader market rallied, with the S&P 500 advancing 1.2% as worries over global trade tensions diminished. This positive momentum followed a reversal of proposed tariffs related to Greenland, which had previously triggered sharp declines. The shift in policy renewed investor optimism, easing fears of escalating trade disputes and prompting a return to equities.

Since the start of the year, Sunrun’s stock has risen 4.3%, currently trading at $20.27 per share—close to its 52-week peak of $21.41 reached in January 2026. For context, an investor who purchased $1,000 of Sunrun shares five years ago would now have an investment valued at $274.26.

Back in 1999, the book Gorilla Game accurately forecasted the dominance of Microsoft and Apple in the tech sector by identifying early platform leaders. Today, enterprise software companies integrating generative AI are emerging as the new industry giants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Block doubles down on European ambitions

Fireblocks Announces Native Bitcoin DeFi Support With Stacks Integration

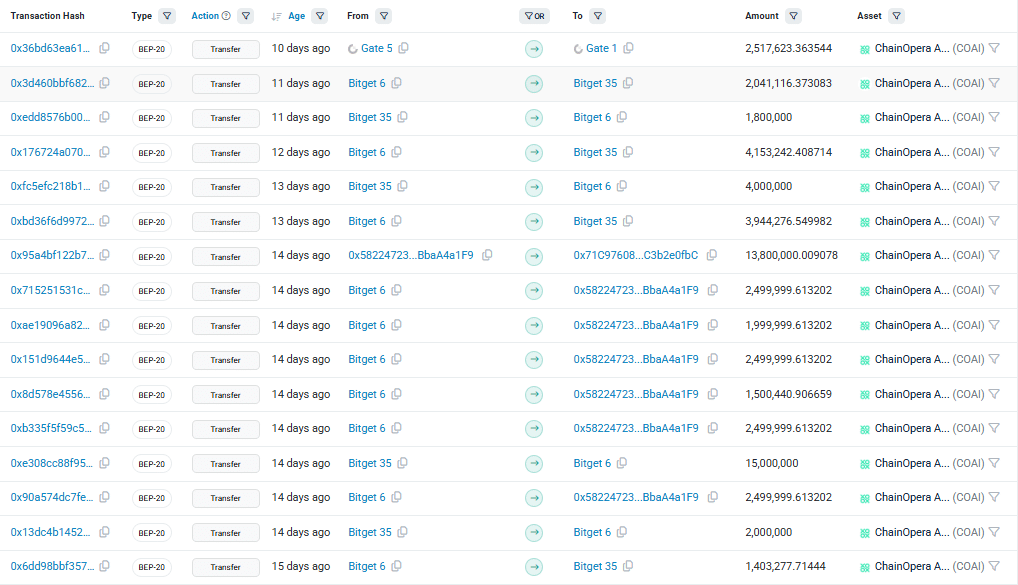

AI narrative lifts ChainOpera AI 24% – But can COAI hold THIS?