‘This Is the End of Tinkerbell Effect for Bitcoin,’ Says Deutsche Bank

According to a note from Marion Laboure, a senior macro strategist at Deutsche Bank (DB), Bitcoin’s recent behavior could be the end of what she calls the “Tinkerbell Effect,” which is a period when price gains relied heavily on belief and speculation. In her view, Bitcoin may now be transitioning toward a more realistic, though still developing, role as a financial asset. That shift is happening alongside a steep correction, as Bitcoin fell to roughly $73,500 from its October peak of nearly $125,000.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, its most recent slide was triggered by news that President Trump plans to nominate Kevin Warsh as the next Fed Chair, a move markets viewed as negative for risk assets. This is because Warsh is known for supporting higher real interest rates and a smaller Fed balance sheet. Meanwhile, institutional investors appear to be stepping back.

Indeed, U.S. spot Bitcoin ETFs saw more than $3 billion in outflows in January, following roughly $2 billion in December and about $7 billion in November 2025. Laboure added that U.S. crypto adoption has fallen from 17% in July 2025 to around 12%, while Bitcoin’s performance has sharply diverged from gold, which rose 13% in January and delivered a 65% return in 2025, compared with Bitcoin’s 6.5% decline that year. Still, she believes that Bitcoin is unlikely to disappear and will continue to mature into a regulated institutional asset, even if it never replaces traditional ones.

Is Bitcoin a Good Buy?

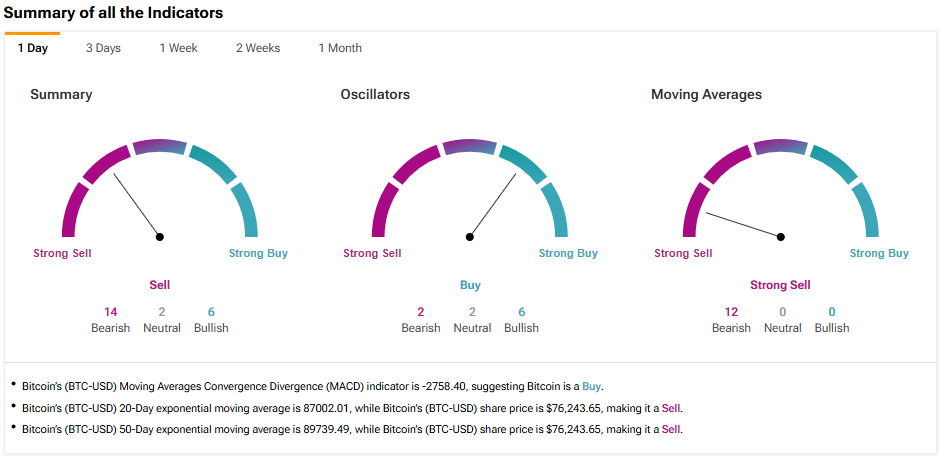

Using TipRanks’ technical analysis tool, the indicators seem to point to a negative outlook for Bitcoin. Indeed, the summary section pictured below shows that six indicators are Bullish, compared to two Neutral and 14 Bearish indicators.

See more Bitcoin technical analysis

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China-Based Investor Who Earned $3 Billion from Gold Now Takes Major Short Position on Silver

Cost-Averaging SPX6900 Crushed the HODLers – Here’s the Next Play for the 2026 Supercycle

How could Dogecoin price respond to SpaceX’s DOGE mission in 2027?

Chainlink Prognose 2026 – LINK im Vergleich mit Bitcoin Hyper