Monarch (NASDAQ:MCRI) Reports Fourth Quarter 2025 Revenue Matching Projections

Monarch (MCRI) Q4 2025 Financial Overview

Monarch, a leading luxury casino and resort company listed on NASDAQ (MCRI), matched analysts’ revenue projections for the fourth quarter of calendar year 2025, posting $140 million in sales—a 4.1% increase compared to the same period last year. However, its GAAP earnings per share came in at $1.25, falling 8.9% short of market expectations.

Is Monarch a good investment right now?

Q4 2025 Highlights

- Total Revenue: $140 million, slightly above the $139.4 million consensus (4.1% year-over-year growth)

- GAAP EPS: $1.25, compared to the expected $1.37 (an 8.9% shortfall)

- Adjusted EBITDA: $51.81 million, surpassing the $48.95 million estimate (37% margin, a 5.8% beat)

- Operating Margin: 20.8%, up from 7.6% in the prior year’s fourth quarter

- Market Cap: $1.71 billion

Leadership Perspective

John Farahi, Monarch’s Co-Chairman and CEO, remarked, “We achieved record-breaking fourth quarter results, capping off another outstanding year in 2025. Net revenue and adjusted EBITDA for the quarter rose by 4.1% and 9.6% year over year, respectively. Adjusted EBITDA margin reached a new high of 37.0% for the quarter, up from 35.1% a year ago. For the full year, adjusted EBITDA margin climbed to 36.5%, nearly 200 basis points higher than 2024.”

About Monarch

Founded in 1993, Monarch operates upscale casinos and resorts, providing premium gaming, dining, and hospitality services.

Revenue Trends

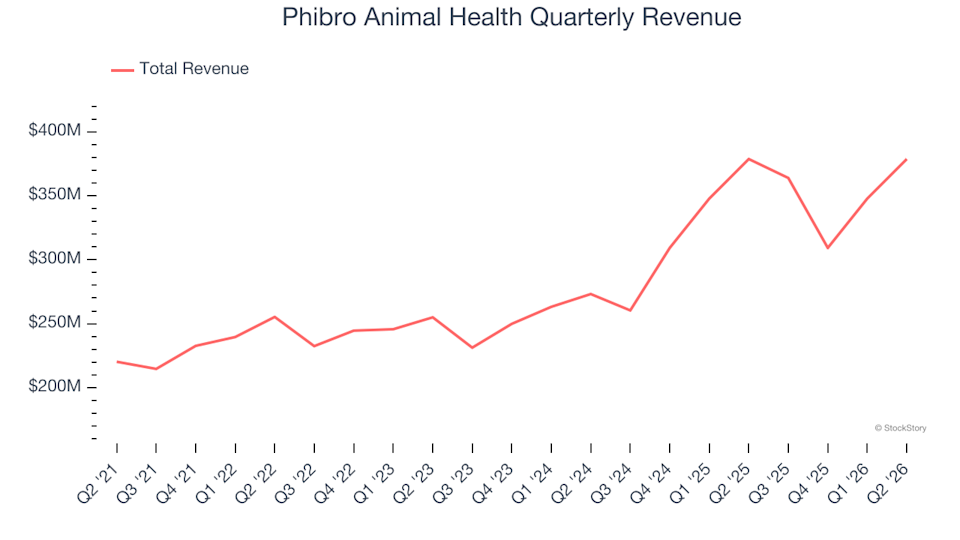

Consistent long-term growth is a hallmark of quality businesses. While short-term gains are common, sustained expansion is more telling. Over the past five years, Monarch’s annual sales growth averaged 24.2%. Although this is a solid figure, it slightly lags behind the typical growth seen in the consumer discretionary sector, which benefits from several favorable trends.

While long-term growth is crucial, the consumer discretionary industry is known for rapid product cycles and shifting consumer tastes, which can make revenue unpredictable. Monarch’s recent two-year annualized revenue growth slowed to 4.3%, trailing its five-year average. The company faced significant challenges during the COVID-19 pandemic in 2020 and early 2021 but rebounded strongly afterward.

Revenue by Segment

Monarch’s business is divided into three main segments: Casino (58% of revenue), Dining (24.4%), and Hotel (12.8%). Over the past two years, all segments have seen revenue increases. Casino operations (including Poker and Blackjack) grew by an average of 5.5% year over year, while Dining and Hotel revenues rose by 1.4% and 3.7%, respectively.

Recent Performance and Outlook

This quarter, Monarch’s revenue rose 4.1% year over year, meeting Wall Street’s expectations at $140 million. Looking forward, analysts predict a 3.5% revenue increase over the next year, which is consistent with recent trends but suggests that new offerings are not expected to drive significant growth in the near term.

Some of the world’s most successful companies—like Microsoft, Alphabet, Coca-Cola, and Monster Beverage—started as lesser-known growth stories. We’ve identified a promising AI semiconductor company that’s currently flying under Wall Street’s radar.

Profitability: Operating Margin

Operating margin is a key indicator of profitability, reflecting earnings before taxes and interest. Monarch’s operating margin has improved over the past year, averaging 21.2% over the last two years. While efficiency gains are evident, the company’s cost structure still leaves room for improvement compared to other consumer discretionary businesses.

In the fourth quarter, Monarch’s operating margin reached 20.8%, a significant 13.2 percentage point increase from the previous year, highlighting improved operational efficiency.

Earnings Per Share (EPS)

Tracking long-term EPS growth helps assess whether a company’s expansion is translating into higher profitability. Monarch’s EPS has grown at a compounded annual rate of 34.4% over the past five years, outpacing its revenue growth and indicating increasing profitability per share.

For Q4, Monarch reported EPS of $1.25, up from $0.22 a year earlier. Although this result missed analyst forecasts, the company’s long-term EPS trajectory remains positive. Wall Street expects Monarch’s full-year EPS to reach $5.43 in the next 12 months, representing a 5.2% increase.

Summary of Q4 Results

Monarch exceeded EBITDA expectations this quarter, but Hotel revenue and EPS fell short of analyst estimates. Overall, the quarter was somewhat disappointing, and the company’s share price remained steady at $93.25 following the report.

Considering an investment in Monarch? Be sure to evaluate the company’s valuation, business fundamentals, and recent earnings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google’s Gemini application now boasts over 750 million users who are active each month

Barclays sees rising risk premium weighing on US dollar

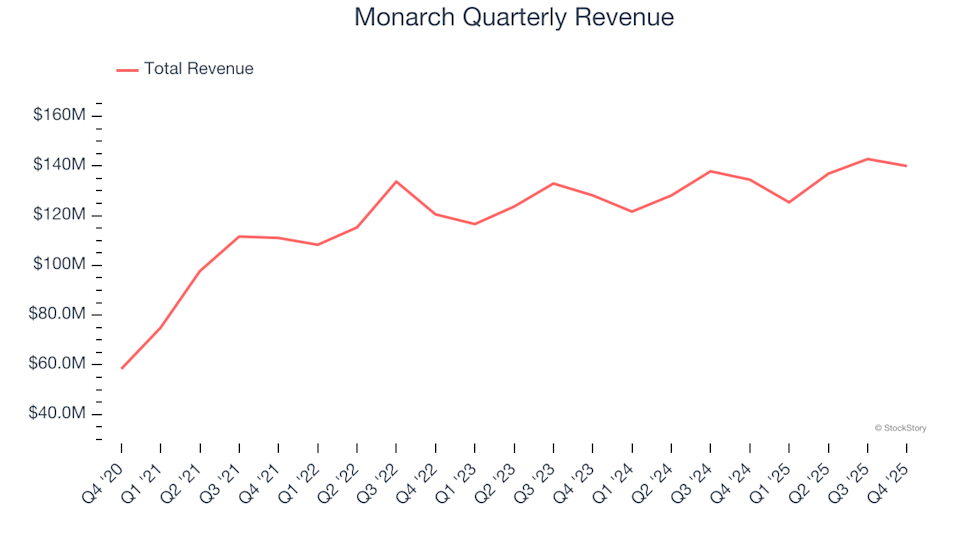

Phibro Animal Health (NASDAQ:PAHC) Falls Short of Q2 CY2026 Revenue Projections, Yet Shares Jump 5.5%