Google's 2025 Revenue Surpasses $400 Billion, Cloud Business Becomes Core Growth Engine

On February 4, 2026 local time, Alphabet released its financial results for the fourth quarter and full year ended December 31, 2025. The financial report shows that the company’s annual revenue surpassed $400 billion for the first time, with Q4 revenue up 18% year-over-year. AI technology drove comprehensive growth in core businesses, Google Cloud maintained rapid growth, and overall profitability steadily improved, with all key metrics showing positive trends.

I. Overall Performance Overview: High Growth in Both Revenue and Profit, Scale Effect Evident

In 2025, consolidated revenue reached $402.836 billion, up 15% year-over-year; fourth quarter revenue surged 18% year-over-year to $113.828 billion.

Annual net profit reached $132.17 billion, a year-over-year increase of 32%, and diluted earnings per share (EPS) reached $10.81, up 34% year-over-year. Q4 net profit was $34.455 billion, up 30% year-over-year, with diluted EPS at $2.82, a 31% increase year-over-year. The profit growth rate significantly outpaced revenue growth, highlighting the effects of scale and cost control.

On the operational side, the company maintained an annual operating margin of 32%, with Q4 operating margin at 31.6% (including $2.1 billion in Waymo employee compensation), maintaining a high level within the industry.

In terms of cash flow, net cash provided by operating activities for the whole of 2025 reached $164.713 billion, up 31.5% year-over-year; Q4 net operating cash was $52.402 billion, up 34% year-over-year.

II. Business Segment Analysis: Steady Growth in Core Business, Cloud as Growth Engine

(1) Google Services: Revenue Foundation, Diversified Drivers for Growth

As the core revenue segment, Google Services achieved Q4 2025 revenue of $95.862 billion, up 14% year-over-year, accounting for 84.2% of total revenue, and remaining the cornerstone of the company’s performance. Within this, Google Search and other businesses grew 17% year-over-year, rising from $54.034 billion in Q4 2024 to $63.073 billion, with deep AI integration driving search usage to record highs. Google subscriptions, platforms, and devices also grew 17% to $13.578 billion in revenue, with paid consumer service subscribers exceeding 325 million; Google One and YouTube Premium have become key growth drivers. YouTube advertising grew 9% to $11.383 billion, and with subscription revenue included, YouTube’s total annual revenue in 2025 surpassed $60 billion, marking a milestone leap.

(2) Google Cloud: Leading High Growth, AI Demand as Core Driver

Google Cloud continued its explosive growth, with Q4 2025 revenue of $17.664 billion, a massive 48% year-over-year increase, far outpacing overall business growth. By the end of 2025, Google Cloud’s annual run rate exceeded $70 billion, making it the company’s primary growth engine. Q4 operating profit reached $5.313 billion, up 154% year-over-year.

(3) Other Businesses: Slight Decline, Losses Expanded

Other Bets recorded Q4 revenue of $370 million, down 7.5% year-over-year, with an operating loss of $3.617 billion, up from a $1.174 billion loss in Q4 2024, mainly due to continued investment in the autonomous driving business Waymo.

III. Financial Health: Asset Expansion, Optimized Capital Structure

As of December 31, 2025, Alphabet’s total assets reached $595.281 billion, up 32.2% from $450.256 billion at the end of 2024. Cash and cash equivalents were $30.708 billion, and marketable securities were $96.135 billion, totaling $126.843 billion, indicating extremely ample liquidity. On the liabilities side, long-term debt rose from $10.883 billion at the end of 2024 to $46.547 billion, mainly due to the issuance of $24.8 billion in senior unsecured notes in November 2025 for general corporate purposes. The overall debt-to-asset ratio is about 30.2%, and the financial structure remains sound.

In terms of cost control, total Q4 2025 expenses were $77.894 billion, up 18.9% year-over-year, basically in line with revenue growth. R&D expenditure was $18.572 billion, up 41.6% year-over-year, while sales and marketing, and general and administrative expenses grew more moderately, at 11.6% and 21.2% respectively, reflecting a generally rational cost structure.

IV. Regional Performance: Asia-Pacific Leads in Growth, Balanced Global Development

From the perspective of regional revenue distribution, Q4 2025 revenue in the US market was $55.444 billion, accounting for 48.7% of total revenue and up 17% year-over-year, remaining the largest single market. EMEA region revenue was $33.056 billion, accounting for 29.0%, up 17% year-over-year. The Asia-Pacific region was the standout performer, with revenue of $18.527 billion, up 22% year-over-year and 23% at constant currency, leading global growth. Other Americas revenue was $6.869 billion, up 20% year-over-year and 19% at constant currency, indicating balanced global market growth.

V. Key Strategies and Developments

AI Strategy Deepening: The self-developed Gemini 3 model has become a major milestone, processing over 10 billion tokens per minute via direct API. Gemini app monthly active users exceed 750 million, with AI technology continuing to drive growth in search, cloud, and other core businesses.

Capital Expenditure Plan: Capital expenditure for 2026 is expected to be $175–185 billion, primarily to meet AI-related infrastructure needs and business expansion.

Waymo Financing and Expenses: In February 2026, Waymo announced $16 billion in financing, most of which was funded by Alphabet; Q4 2025 recorded $2.1 billion in Waymo employee compensation expenses.

Dividend Policy: The Board of Directors announced a quarterly cash dividend of $0.21 per share, to be paid on March 16, 2026, to shareholders of Class A, B, and C shares on record as of March 9.

VI. Conclusion

In Q4 and full year 2025, Alphabet achieved strong dual growth in revenue and profit driven by AI technology, with annual revenue surpassing $400 billion for the first time. The explosive growth and improved profitability of Google Cloud became the biggest highlight, while core search and YouTube businesses maintained steady growth, providing a solid revenue foundation for the company. Ample cash flow, a sound financial structure, and continued heavy investment in AI will support the company’s leading position in the global technology race. However, sustained losses from innovative businesses like Waymo and global market exchange rate fluctuations may still pose potential risks. Continued attention should be paid to the commercialization effectiveness of AI technology and the sustainability of cloud business growth.

Editor: Li Tong

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google’s Gemini application now boasts over 750 million users who are active each month

Barclays sees rising risk premium weighing on US dollar

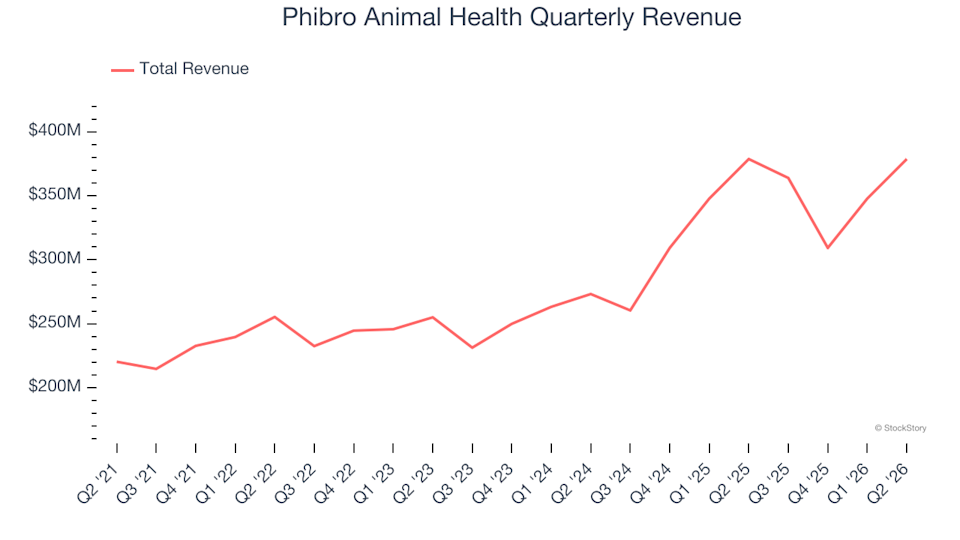

Phibro Animal Health (NASDAQ:PAHC) Falls Short of Q2 CY2026 Revenue Projections, Yet Shares Jump 5.5%