Fluence Energy (NASDAQ:FLNC) Falls Short of Q4 CY2025 Revenue Projections, Shares Decline 11.5%

Fluence Energy Q4 CY2025 Earnings Overview

Fluence Energy (NASDAQ: FLNC), a leader in electricity storage and software solutions, reported fourth-quarter revenue of $475.2 million, representing a 154% increase compared to the previous year. However, this figure was below Wall Street’s projection. The company’s guidance for full-year revenue stands at $3.4 billion, which is 1.3% higher than what analysts anticipated. On the earnings front, Fluence posted a GAAP net loss of $0.34 per share, which was significantly wider than consensus estimates.

Should You Invest in Fluence Energy?

Curious if now is the right time to consider Fluence Energy for your portfolio?

Highlights from Fluence Energy’s Q4 CY2025 Results

- Revenue: $475.2 million, falling short of analyst expectations of $484.3 million, but marking a 154% year-over-year increase

- GAAP EPS: -$0.34, compared to the anticipated -$0.21

- Adjusted EBITDA: -$52.06 million, reflecting an 11% negative margin and a 4.8% decline from last year

- Full-Year Revenue Outlook: Maintained at $3.4 billion (midpoint)

- Full-Year EBITDA Guidance: $50 million (midpoint), slightly below analyst consensus of $51.5 million

- Adjusted EBITDA Margin: -11%, an improvement from -26.6% in the prior year’s quarter

- Free Cash Flow: -$236.1 million, compared to -$216.4 million a year ago

- Order Backlog: $5.5 billion at quarter-end, up 7.8% year over year

- Market Cap: $4.26 billion

Julian Nebreda, President and CEO, commented, “The global surge in energy storage demand—driven by expanding data centers, utilities, and industrial needs—is evident in our pipeline, which has grown by about 30% to $30 billion since September 2025.”

About Fluence Energy

Fluence Energy (NASDAQ: FLNC) is at the forefront of integrating lithium-ion battery technology into grid-scale storage, enabling the efficient storage of renewable energy sources.

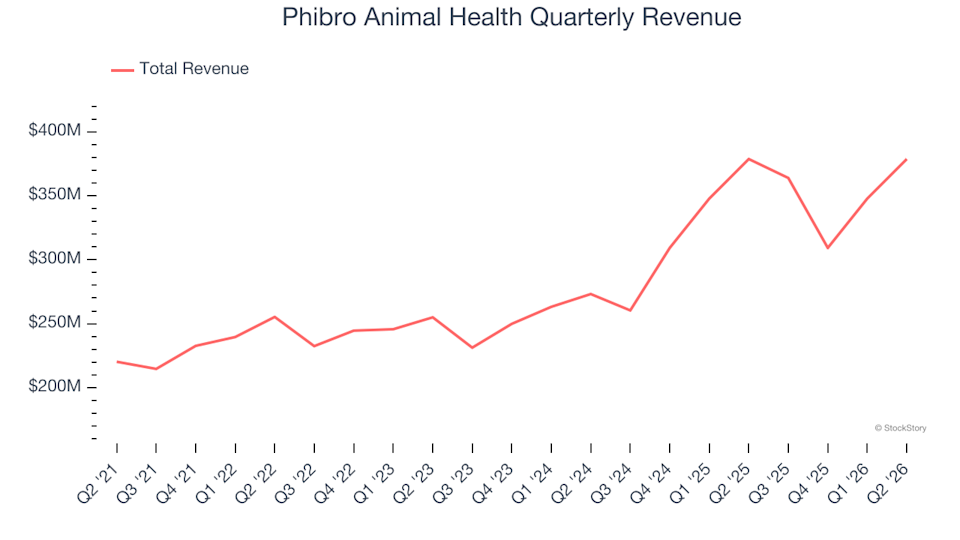

Examining Revenue Trends

Assessing a company’s long-term sales trajectory helps gauge its overall quality. While short-term gains are possible for any business, sustained growth is a hallmark of industry leaders. Over the past five years, Fluence Energy has achieved a remarkable compounded annual revenue growth rate of 33.8%, outpacing the average for industrial companies and indicating strong market demand for its solutions.

Although long-term growth is crucial, it’s important to recognize that five-year trends may overlook industry cycles or recent catalysts. In the last two years, Fluence Energy’s annualized revenue growth slowed to 6%, a notable deceleration from its five-year average.

This quarter, the company delivered an impressive 154% year-over-year revenue increase, but still did not meet analysts’ lofty expectations.

Looking Forward

Analysts predict that Fluence Energy’s revenue will climb by 37.1% over the next year, signaling optimism for improved performance driven by new products and services.

For investors interested in high-growth enterprise software, the landscape is shifting as companies leverage generative AI.

Profitability: Operating Margin

Operating margin measures how much profit a company retains from its revenue after covering core expenses. It’s a useful metric for comparing companies regardless of their debt or tax situations.

Fluence Energy has averaged a negative operating margin of 6.7% over the past five years, reflecting high costs. While unprofitable industrial firms warrant caution, Fluence has improved its operating margin by 32.2 percentage points over this period, thanks to revenue growth. However, the company still has work to do to achieve sustainable profitability.

In the fourth quarter, Fluence Energy’s operating margin stood at negative 14.8%.

Earnings Per Share (EPS) Analysis

Tracking EPS over time reveals whether a company’s growth translates into profitability. Over the last five years, Fluence Energy’s EPS has declined at an average rate of 4.6% annually, signaling deepening losses. Persistent declines in EPS can indicate underlying challenges and increase the risk of significant share price drops if conditions worsen.

Shorter-term analysis shows a similar trend, with EPS falling by 5.1% annually over the past two years. In Q4, the company reported an EPS of -$0.34, down from -$0.23 a year earlier, missing analyst forecasts. Looking ahead, Wall Street expects Fluence Energy to narrow its losses, projecting full-year EPS to improve from -$0.38 to -$0.08.

Summary: Q4 Takeaways for Fluence Energy

Fluence Energy’s latest quarter featured revenue guidance that slightly exceeded expectations, but both EBITDA and EPS missed analyst targets. The market responded negatively, with shares dropping 11.5% to $25.68 after the announcement.

While this quarter’s results were underwhelming, a single report doesn’t define a company’s long-term prospects. When evaluating whether to invest, it’s essential to consider broader fundamentals and valuation, not just recent performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google’s Gemini application now boasts over 750 million users who are active each month

Barclays sees rising risk premium weighing on US dollar

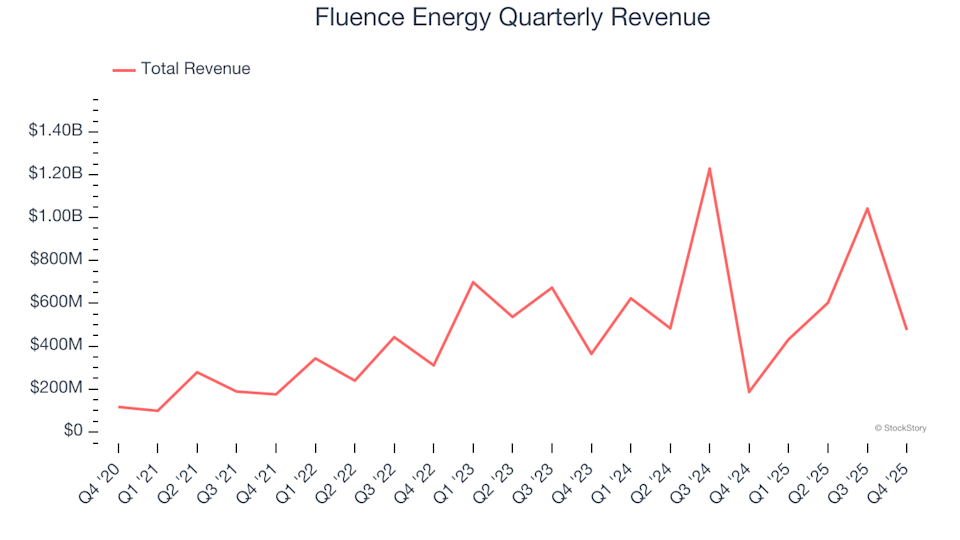

Phibro Animal Health (NASDAQ:PAHC) Falls Short of Q2 CY2026 Revenue Projections, Yet Shares Jump 5.5%