Moelis (NYSE:MC) Delivers Impressive Q4 Results for CY2025

Moelis & Company Surpasses Q4 2025 Expectations

Moelis & Company (NYSE: MC), a leading investment banking firm, delivered fourth-quarter 2025 results that outperformed market forecasts. The company generated $487.9 million in revenue, marking an 11.2% increase compared to the same period last year. Adjusted earnings per share reached $1.13, exceeding analyst predictions by 35.4%.

Highlights from Moelis’s Q4 2025 Performance

- Revenue: $487.9 million, surpassing the $443.5 million consensus estimate (11.2% year-over-year growth, 10% above expectations)

- Pre-tax Profit: $138 million, representing a 28.3% margin

- Adjusted EPS: $1.13, compared to the $0.83 analyst forecast (35.4% higher)

- Market Cap: $5.13 billion

About Moelis & Company

Established in 2007 by industry veteran Ken Moelis, Moelis & Company operates as an independent investment bank. The firm offers strategic and financial advisory services to a diverse client base, including corporations, private equity sponsors, government entities, and sovereign wealth funds.

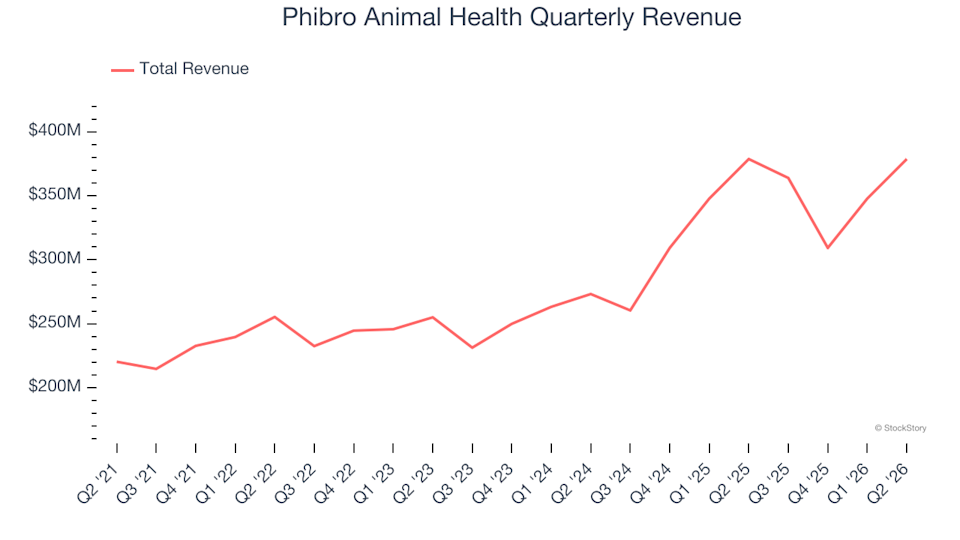

Examining Revenue Growth

Evaluating a company’s long-term revenue trajectory can provide valuable insight into its overall strength. While any firm can post strong results in the short term, sustained growth is a hallmark of enduring businesses. Over the past five years, Moelis has achieved a compounded annual revenue growth rate of 10.2%, slightly outpacing the average for its sector and indicating strong market demand for its services.

At StockStory, we prioritize long-term growth, but it’s important to consider recent trends in the financial sector, such as interest rate shifts and market performance. Moelis’s annualized revenue growth over the last two years stands at 33.6%, well above its five-year average, suggesting a recent acceleration in business momentum.

Note: Certain quarters have been excluded from the analysis due to atypical investment gains or losses that do not reflect the company’s core operating performance.

For the latest quarter, Moelis posted an 11.2% year-over-year revenue increase, with total revenue beating Wall Street’s projections by 10%.

Spotlight on Emerging Growth Opportunities

Summary of Moelis’s Q4 Results

Moelis delivered impressive earnings this quarter, outperforming analyst expectations for both revenue and earnings per share. Despite these strong results, the company’s stock price remained steady at $71.00 immediately following the announcement.

While Moelis’s recent performance is encouraging, a single quarter does not determine the long-term investment case. Assessing the company’s overall quality and valuation is essential before making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google’s Gemini application now boasts over 750 million users who are active each month

Barclays sees rising risk premium weighing on US dollar

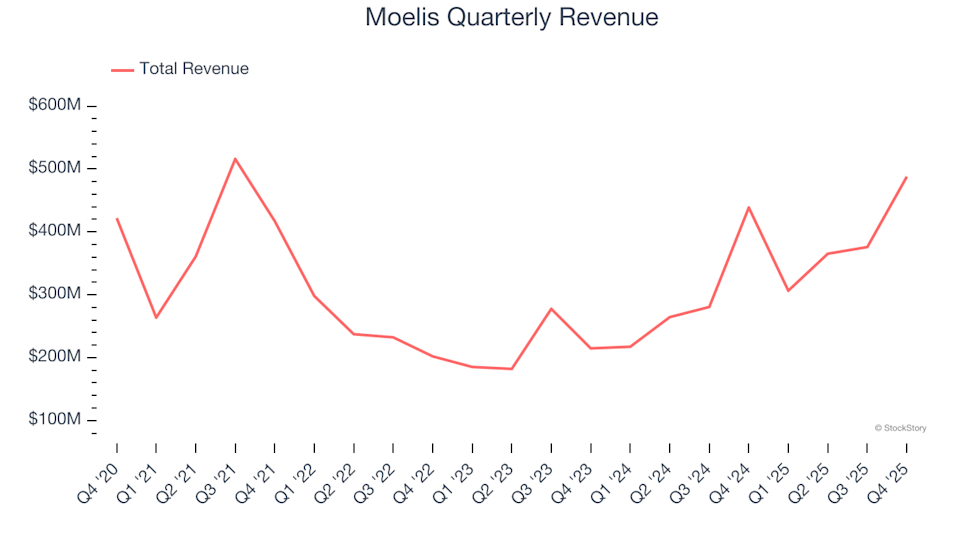

Phibro Animal Health (NASDAQ:PAHC) Falls Short of Q2 CY2026 Revenue Projections, Yet Shares Jump 5.5%