Connection (NASDAQ:CNXN) Falls Short of Q4 CY2025 Revenue Projections

Connection (CNXN) Q4 CY2025 Earnings Overview

Connection (NASDAQ:CNXN), a provider of IT solutions, reported fourth-quarter 2025 results that did not meet market revenue expectations. The company posted sales of $702.9 million, which remained unchanged compared to the same period last year. However, its adjusted earnings per share reached $0.91, surpassing analyst forecasts by 5.8%.

Curious if Connection is a smart investment right now?

Highlights from Q4 CY2025

- Revenue: $702.9 million, falling short of the $735.5 million analyst estimate (no year-over-year growth, 4.4% below expectations)

- Adjusted EPS: $0.91, exceeding the $0.86 consensus (5.8% above forecast)

- Adjusted EBITDA: $31.77 million, ahead of the $28.5 million estimate (4.5% margin, 11.5% beat)

- Operating Margin: 3.4%, consistent with the same quarter last year

- Free Cash Flow Margin: 3.6%, similar to the prior year

- Market Cap: $1.48 billion

About Connection

Founded in 1982 as a small computer retailer, Connection has grown into a Fortune 1000 company. Today, it delivers technology solutions to businesses and government organizations, assisting them in designing, purchasing, deploying, and managing IT systems and infrastructure.

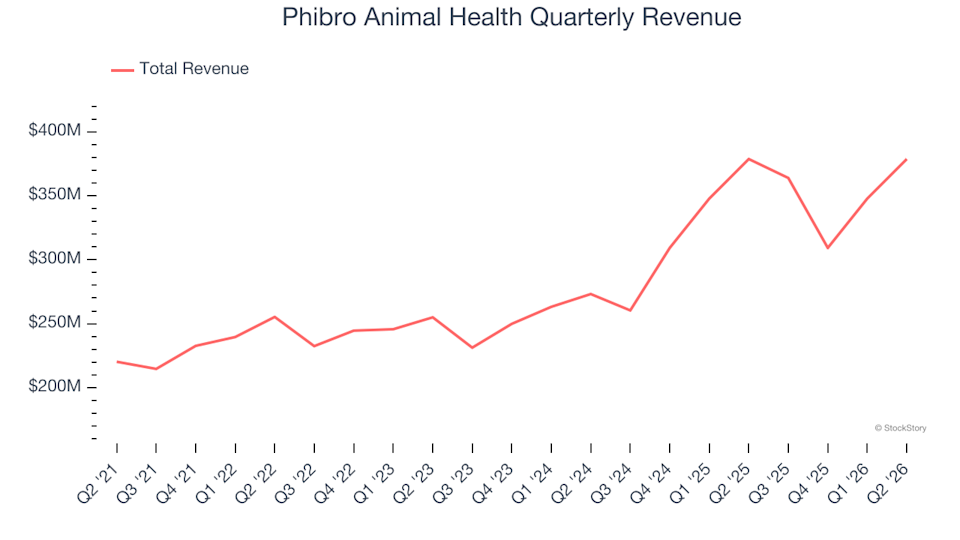

Revenue Trends

Evaluating a company's long-term sales trajectory can reveal much about its underlying strength. While any business can have a strong quarter, sustained growth over several years is more telling.

With annual revenues of $2.87 billion, Connection is considered a mid-sized player in the business services sector. This size can sometimes be a disadvantage compared to larger rivals that benefit from greater economies of scale.

Over the past five years, Connection's revenue has grown at a modest 2.1% compound annual rate, indicating limited expansion and tepid demand during this period.

While long-term growth is important, recent industry shifts or innovations can also impact performance. In Connection’s case, revenue has stagnated over the last two years, reflecting a slowdown in demand.

This quarter, the company reported a 0.8% year-over-year decline in revenue, totaling $702.9 million and missing Wall Street’s expectations.

Looking forward, analysts predict a 5.7% increase in revenue over the next year, which would outpace the sector average and suggests that new offerings could drive improved results.

Many major companies, such as Microsoft and Alphabet, began as lesser-known growth stories. We believe the next big opportunity may lie in the AI semiconductor space.

Operating Margin Analysis

Connection’s operating margin has hovered around 3.6% on average over the past five years, showing little improvement. This relatively low profitability points to a less efficient cost structure compared to peers in the business services industry.

Despite some minor fluctuations, the operating margin has remained stable, raising questions about whether the company is effectively leveraging its fixed costs as revenue grows.

In the latest quarter, Connection achieved an operating margin of 3.4%, matching the result from the same period last year, which suggests its cost base has not changed significantly.

Earnings Per Share Performance

Tracking long-term changes in earnings per share (EPS) helps assess whether a company’s growth is translating into profitability.

Over the last five years, Connection’s EPS has increased at a 10% compound annual rate, outpacing its revenue growth. However, the lack of improvement in operating margin tempers this positive trend.

Examining more recent performance, the company’s EPS growth over the past two years averaged 3.3% annually, which is slower than its five-year average. There is hope that this growth rate will accelerate going forward.

For Q4, Connection reported an adjusted EPS of $0.91, up from $0.78 a year earlier and 5.8% above analyst expectations. Wall Street anticipates full-year EPS will reach $3.45 in the next 12 months, representing a projected 10% increase.

Summary of Q4 Results

Connection delivered better-than-expected EPS this quarter, but its revenue fell short of forecasts, resulting in a mixed performance. The share price remained steady at $60.24 immediately after the announcement.

Is now the right time to invest in Connection? To make an informed decision, it’s important to consider the company’s valuation, business fundamentals, and recent results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google’s Gemini application now boasts over 750 million users who are active each month

Barclays sees rising risk premium weighing on US dollar

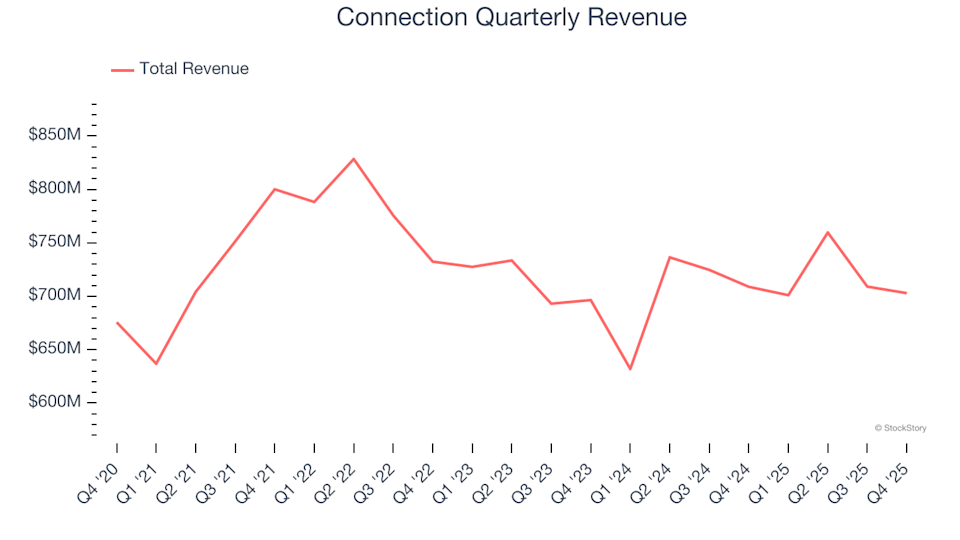

Phibro Animal Health (NASDAQ:PAHC) Falls Short of Q2 CY2026 Revenue Projections, Yet Shares Jump 5.5%