Blue Bird (NASDAQ:BLBD) Surpasses Q4 CY2025 Projections

Blue Bird (BLBD) Q4 CY2025 Earnings Overview

Blue Bird, a leading school bus manufacturer listed on NASDAQ (BLBD), released its fourth-quarter results for calendar year 2025, surpassing analysts’ revenue forecasts. The company posted sales of $333.1 million, marking a 6.1% increase compared to the same period last year. However, its projected full-year revenue of $1.5 billion (midpoint) was 1.5% below what Wall Street anticipated. Adjusted earnings per share (non-GAAP) reached $1, which was 24.8% higher than consensus estimates.

Should You Consider Investing in Blue Bird?

Curious if now is the right time to buy Blue Bird shares?

Highlights from Blue Bird’s Q4 CY2025 Results

- Revenue: $333.1 million, exceeding analyst expectations of $330 million (6.1% year-over-year growth, 0.9% above forecast)

- Adjusted EPS: $1, beating the $0.80 estimate by 24.8%

- Adjusted EBITDA: $50.06 million, topping the $43.21 million estimate (15% margin, 15.8% above forecast)

- Full-Year Revenue Guidance: Maintained at $1.5 billion (midpoint)

- Full-Year EBITDA Guidance: $225 million (midpoint), ahead of the $219.9 million analyst estimate

- Operating Margin: 11.3%, consistent with the prior year’s quarter

- Free Cash Flow Margin: 9.3%, up from 7% a year ago

- Sales Volumes: Unchanged year over year

- Market Cap: $1.66 billion

John Wyskiel, President and CEO of Blue Bird, commented, “I am incredibly proud of our team in delivering another outstanding quarterly result.”

About Blue Bird

With nearly 100 years in the industry, Blue Bird (NASDAQ:BLBD) specializes in manufacturing school buses and related components.

Examining Revenue Growth

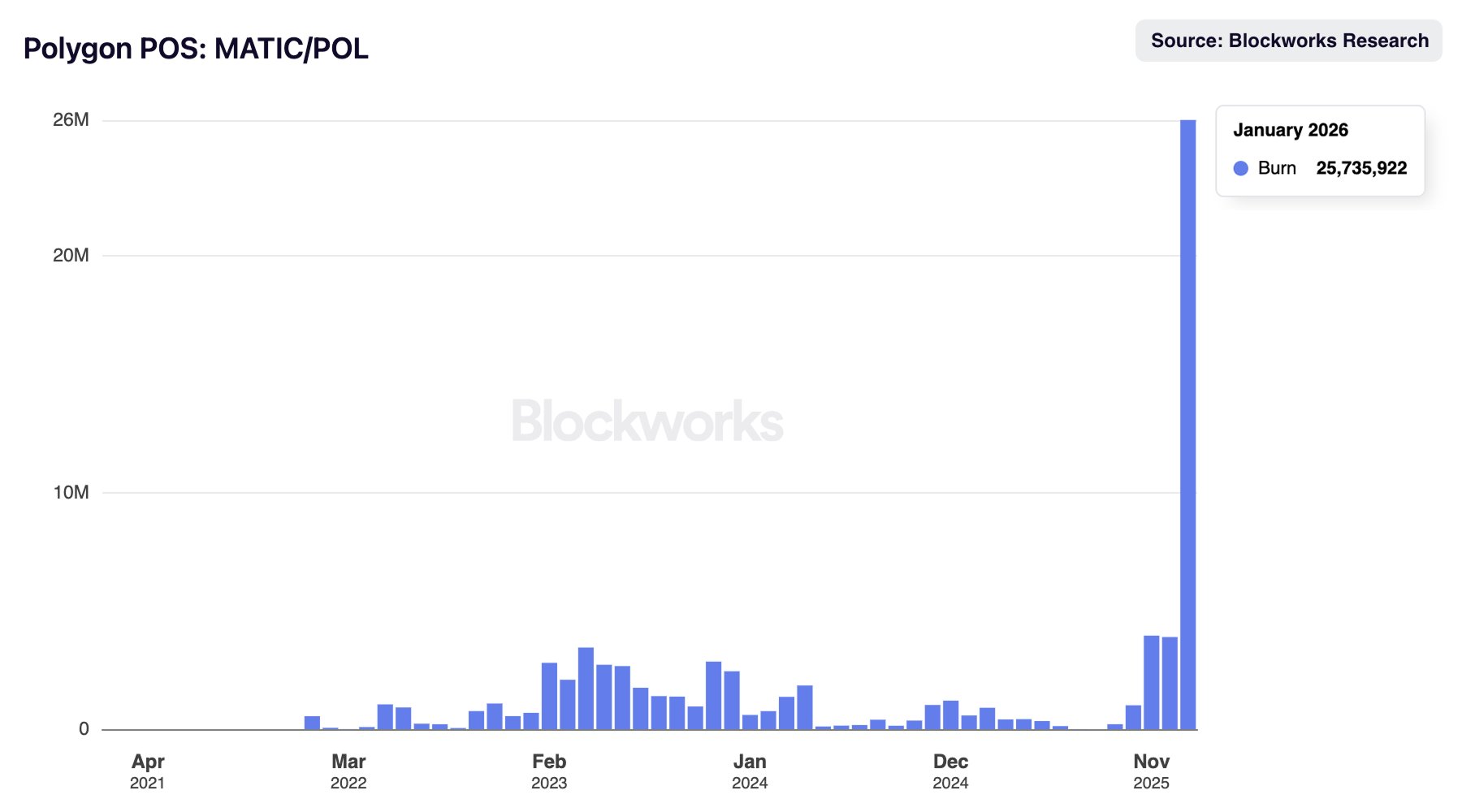

Assessing a company’s long-term growth is key to understanding its overall quality. While short-term gains can be fleeting, sustained expansion is a sign of a strong business. Over the past five years, Blue Bird achieved an impressive compound annual sales growth rate of 11.9%, outperforming the average for industrial companies and indicating strong customer demand.

Although we focus on long-term trends, it’s important to recognize that five-year data may not capture industry cycles or one-off events. Blue Bird’s two-year annualized revenue growth of 11.1% is in line with its five-year average, suggesting steady demand even as many competitors in heavy transportation equipment faced declining sales.

In the latest quarter, Blue Bird sold 2,135 units. Over the past two years, unit sales have grown by an average of 4.2% annually. Since this is lower than revenue growth, it suggests that price increases contributed to the company’s top-line expansion.

Recent Performance and Outlook

This quarter, Blue Bird’s revenue rose 6.1% year over year, with the $333.1 million figure beating Wall Street’s expectations by 0.9%.

Looking forward, analysts predict revenue will grow by 3% over the next year, a slower pace than recent years. This forecast points to potential challenges in demand, though the company continues to perform well in other financial areas.

Many major companies started as lesser-known growth stories. We’ve identified a promising AI semiconductor opportunity that’s still under Wall Street’s radar.

Profitability and Margins

While Blue Bird has remained profitable over the past five years, its average operating margin of 6.4% is relatively modest for the industrial sector, largely due to a high cost base and low gross margins.

On a positive note, the company’s operating margin has improved by 10.8 percentage points over five years, reflecting the benefits of increased sales and operational leverage.

In Q4, Blue Bird’s operating margin was 11.3%, matching the result from the same quarter last year, indicating stable cost management.

Earnings Per Share (EPS) Trends

While revenue growth shows how a company expands, changes in earnings per share (EPS) reveal how profitable that growth is. Blue Bird’s EPS has grown at a remarkable 42.9% compound annual rate over the past five years, far outpacing its revenue growth and demonstrating improved profitability per share.

Digging deeper, the main driver of this EPS growth has been the significant improvement in operating margins, with other factors like interest and taxes playing a lesser role.

Looking at a shorter timeframe, Blue Bird’s two-year annual EPS growth was 40%, slightly below its five-year trend but still strong. In Q4, adjusted EPS reached $1, up from $0.92 a year earlier, easily surpassing analyst expectations. Wall Street projects that full-year EPS will remain steady at $4.47 over the next 12 months.

Summary of Blue Bird’s Q4 Performance

Blue Bird delivered a strong quarter, notably exceeding EBITDA and EPS forecasts, though its full-year revenue guidance fell short of expectations. Overall, the results were solid, with several key metrics outperforming. Following the announcement, the stock price rose 2.7% to $51.21.

While the recent quarter was positive, investors should consider the company’s long-term fundamentals and valuation before making investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin Price Prediction 2026-2030: The Realistic Path to $1 Revealed

Quant Price Prediction 2026-2030: Unveiling the Realistic Potential for QNT’s Next Decade

BNP Paribas Raises Mid-term Performance Targets

Polygon – What should traders expect from its price after 25.9M POL burn?