Stock market update: Futures for the Dow, S&P 500, and Nasdaq climb following an intensified tech sell-off on Wall Street

US Stock Futures Inch Up as Investors Weigh Earnings and Alphabet's AI Plans

Late Wednesday, US stock futures made modest gains as market participants reviewed the latest round of corporate earnings and considered new developments from Alphabet. This followed a significant downturn earlier in the day that particularly affected technology shares.

- Futures for the Dow Jones Industrial Average (YM=F) remained largely unchanged, showing slight positive movement.

- S&P 500 futures (ES=F) advanced by approximately 0.3%.

- Nasdaq 100 futures (NQ=F) climbed around 0.4%.

Shares of Alphabet (GOOG) dropped over 1% in after-hours trading after the company released its latest financial results and revealed plans for a substantial increase in artificial intelligence spending. Alphabet anticipates its expenditures could reach up to $185 billion by 2026. Despite the dip in Alphabet's stock, this outlook boosted investor confidence in other technology firms involved in AI infrastructure, such as Nvidia (NVDA) and Broadcom (AVGO).

Meanwhile, Qualcomm (QCOM) saw its shares plunge nearly 9% after issuing a weaker-than-expected outlook, attributing the challenges to a worldwide shortage of memory chips.

Software companies experienced notable declines, fueled by concerns that Anthropic's AI tools could disrupt established business models. In the cryptocurrency sector, markets were unsettled after Treasury Secretary Scott Bessent stated that the government would not intervene to support bitcoin (BTC-USD). Bitcoin has fallen more than 13% over the past five days, bringing its value down to about $73,000.

Looking ahead, corporate earnings will remain a central focus, with Amazon (AMZN) set to report on Thursday. Investors are also anticipating the release of weekly jobless claims data, which could provide further insight into the state of the labor market.

Live Market Coverage Coming Soon

Live updates on the stock market will begin Thursday, February 5, 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Poland’s central bank continues to adopt a cautious approach; we anticipate an upcoming rate reduction soon

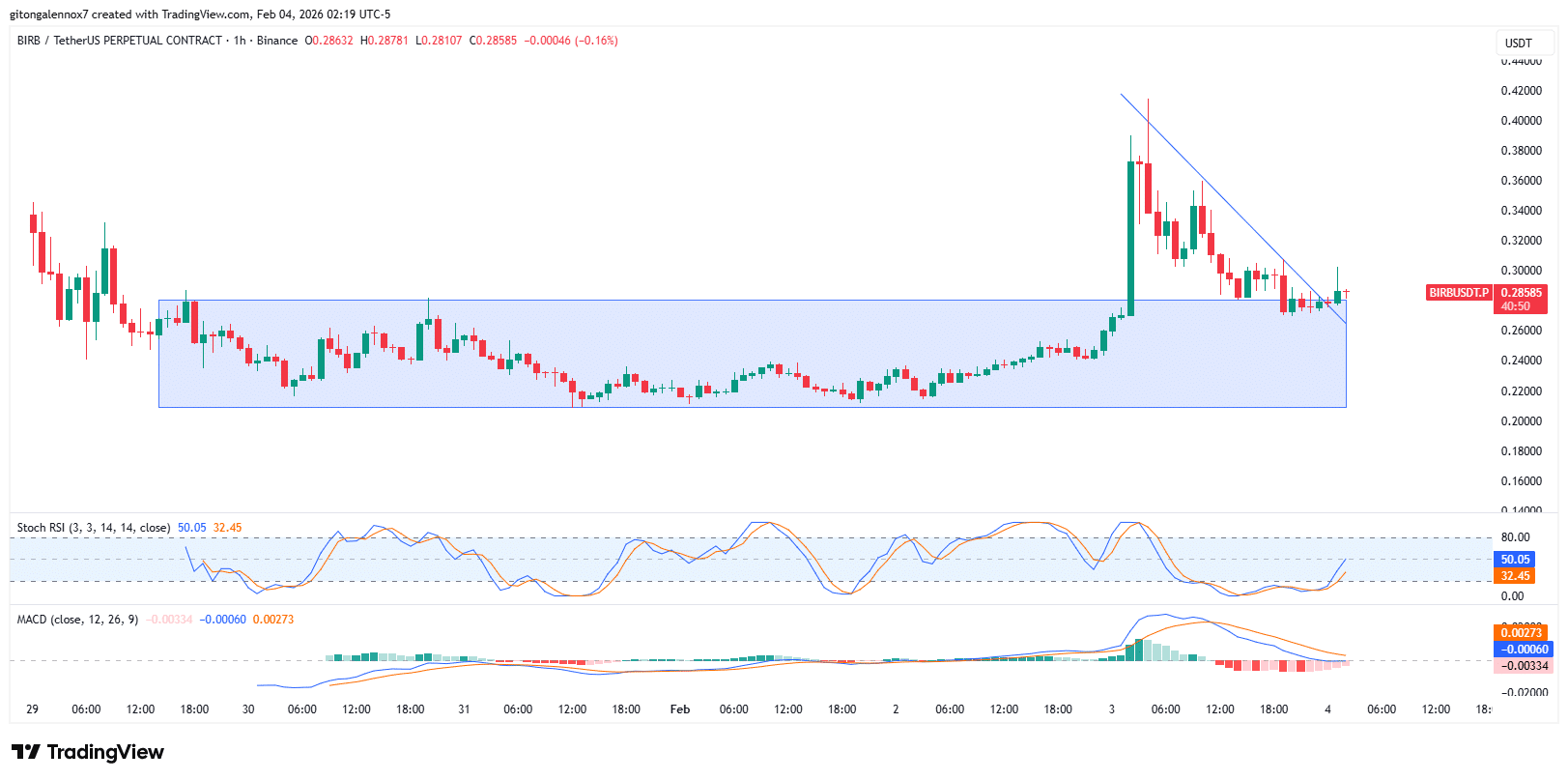

Moonbirds jumps 94% in 2 days – Can BIRB replicate PENGU’s $1B run?

Análise do Bitcoin hoje: alerta de Peter Brandt indica possível queda para US$ 63 mil